Create PDF forms with pdfFiller’s Financial Application Form Creator

How to create PDF forms using pdfFiller

Leveraging pdfFiller’s Financial Application Form Creator enables users to effortlessly design, edit, and manage comprehensive PDF forms tailored to suit various financial needs. This tool allows users to build customizable forms that are both interactive and data-driven.

-

Access pdfFiller platform.

-

Select 'Create New Form' from the dashboard.

-

Use the drag-and-drop interface to add fields.

-

Set validation rules and data types for fields.

-

Save and share your form.

What is a Financial Application Form Creator?

A Financial Application Form Creator is a specialized tool designed to help users build and customize financial documents such as loan applications, account openings, and funding requests. With pdfFiller, this tool operates fully within the cloud, allowing instant access from anywhere. The primary function is to facilitate quick modifications using ready-made templates or blank documents, easily generating compliance-ready PDF forms.

How does Financial Application Form Creator change document preparation?

The Financial Application Form Creator revolutionizes the way financial documents are prepared by simplifying the process of form creation and reducing errors. Users can rapidly design forms tailored for different financial applications, incorporate validation checks, and collect necessary data seamlessly. This shift not only saves time but also enhances accuracy in data entry.

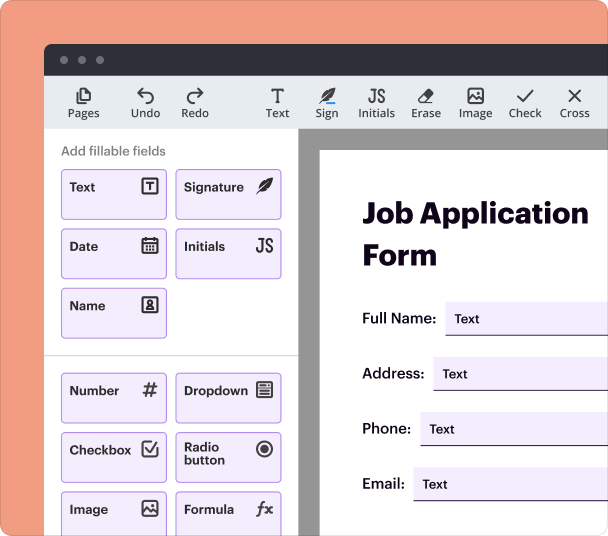

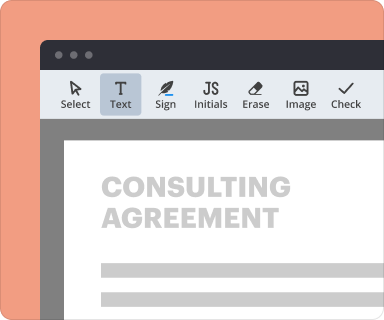

Steps to add interactive fields when using the Financial Application Form Creator

Adding interactive fields enhances user engagement and data collection capability in your financial forms. pdfFiller enables users to include various field types such as text boxes, radio buttons, checkboxes, and dropdowns, making the forms user-friendly.

-

Open your form in the editor.

-

Access the 'Add Fields' panel.

-

Drag the desired field type to the form.

-

Customize the field settings, including labels and properties.

-

Save your changes.

Setting validation and data rules within the Financial Application Form Creator

Validation and data rules ensure that users provide accurate and relevant information when filling out forms. With pdfFiller, you can establish rules that enhance the quality and integrity of data collected, decreasing the risk of errors that could affect financial decisions.

-

Select the field for which you want to add validation.

-

Access the validation settings.

-

Set rules like 'required field' or format checks (e.g., numeric fields only).

-

Test your form to ensure validations work as intended.

-

Finalize and save the updated form.

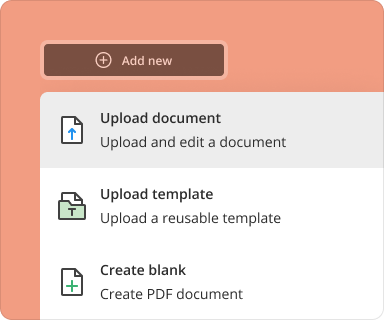

How to go from blank page to finished form with the Financial Application Form Creator

Creating a financial application form from scratch might seem daunting, but pdfFiller simplifies this with its intuitive interface. Users can start with a fresh template and systematically build out each needed component to reflect their specific requirements.

-

Start a new document and choose 'Blank Form'.

-

Add a title and introduction for clarity.

-

Incorporate required fields for applicant data.

-

Implement any necessary validation rules.

-

Review and publish the form.

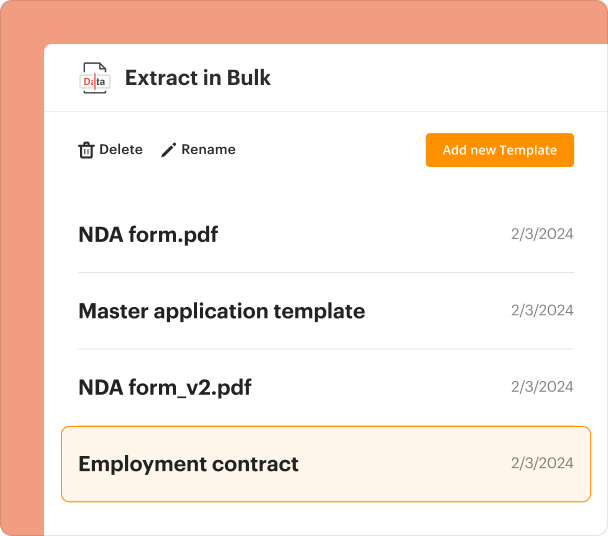

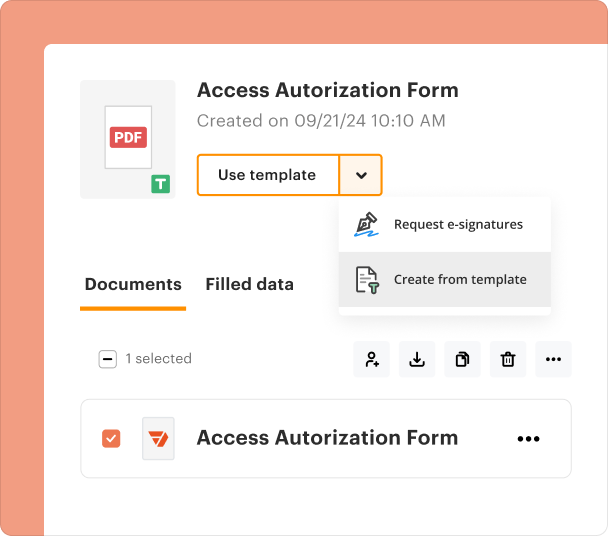

How to manage and revise templates when using the Financial Application Form Creator

Managing and revising templates is crucial as financial regulations and requirements change over time. pdfFiller allows users to easily update existing forms, ensuring compliance and accuracy across all documents without starting from scratch.

-

Locate the archived template in your account.

-

Open the template in edit mode.

-

Make necessary adjustments to fields and validation rules.

-

Save the revised template for future use.

-

Test the functionality of the revised template before sharing.

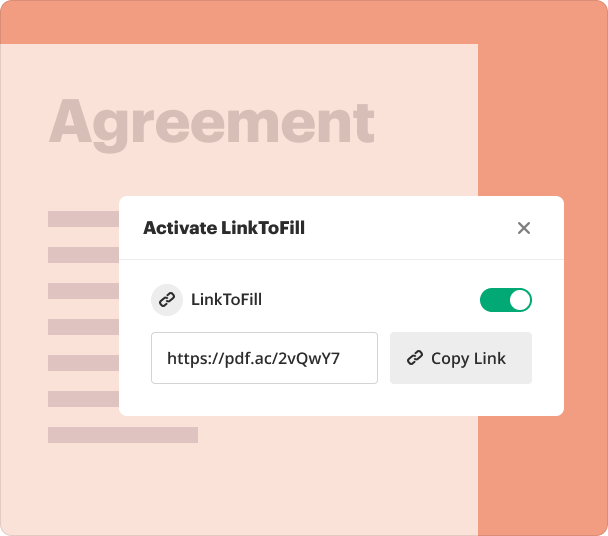

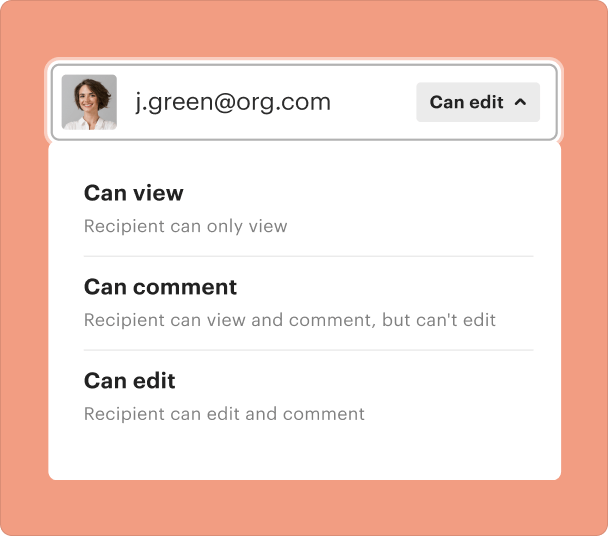

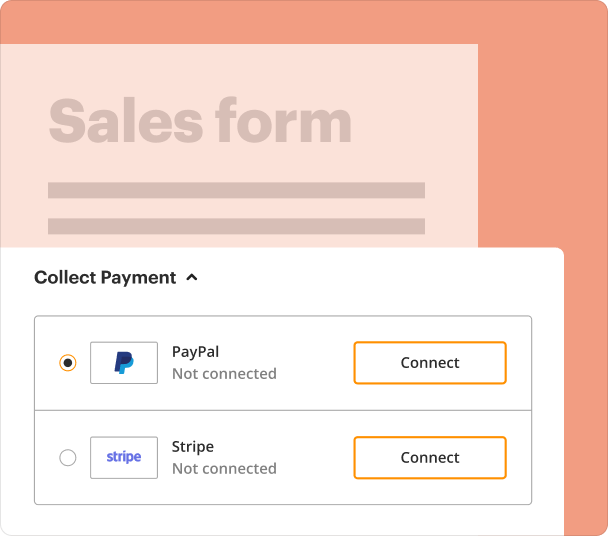

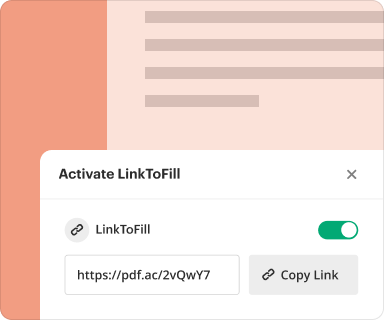

How to share results and monitor responses after creating your Financial Application Form

Sharing forms and tracking responses is essential for effective data collection. pdfFiller simplifies this process through its secure sharing options and comprehensive analytics, allowing users to gain insights into submissions.

-

Click 'Share' on the completed form.

-

Choose your preferred sharing method (email, link, etc.).

-

Set permissions for form access.

-

Monitor response rates and view submission analytics in your dashboard.

-

Respond to any queries from applicants promptly.

How to export collected data once you’ve used the Financial Application Form

Exporting collected data is crucial for record-keeping and analysis. pdfFiller presents options to extract submitted information efficiently in multiple formats, including CSV and Excel, making it easy to import data into accounting systems or customer relationship management software.

-

Access submitted forms from your dashboard.

-

Select the forms whose data you want to export.

-

Choose the export format (CSV, Excel, etc.).

-

Follow the prompts to finalize the export process.

-

Securely store the exported data on your system.

Where and why do businesses typically use the Financial Application Form Creator?

Businesses across various industries utilize the Financial Application Form Creator for applications related to loans, insurance, mortgages, and more. Industries such as banking, real estate, and insurance benefit significantly from the streamlined processes offered by pdfFiller, which enhances efficiency and accuracy.

Conclusion

The Financial Application Form Creator on pdfFiller streamlines the way organizations manage financial documents. By offering a robust platform for form creation, data collection, and management, it caters to the diverse needs of businesses needing efficient solutions for paperwork. Whether you are a small business or a large enterprise, leveraging this tool can lead to improved productivity and enhanced accuracy in financial documentation.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms