Build PDF forms with pdfFiller’s Loan Repayment Form Builder

What is a Loan Repayment Form Builder?

A Loan Repayment Form Builder is a digital tool designed to create, edit, and manage PDF forms specifically for tracking loan repayment details. It allows users to structure forms that borrowers can fill out to confirm payment details, loan amounts, interest rates, and other relevant information. This functionality is essential for financial institutions, lending companies, and anyone managing loans, providing a streamlined way to handle documentation.

How does a Loan Repayment Form Builder change document preparation?

The Loan Repayment Form Builder enhances document preparation by automating and digitizing the creation process. Using pdfFiller, users can rapidly generate forms that are customizable to their needs, which reduces time spent on paperwork and errors associated with manual handling. By incorporating interactive elements, these forms can be filled out directly by users, simplifying data collection.

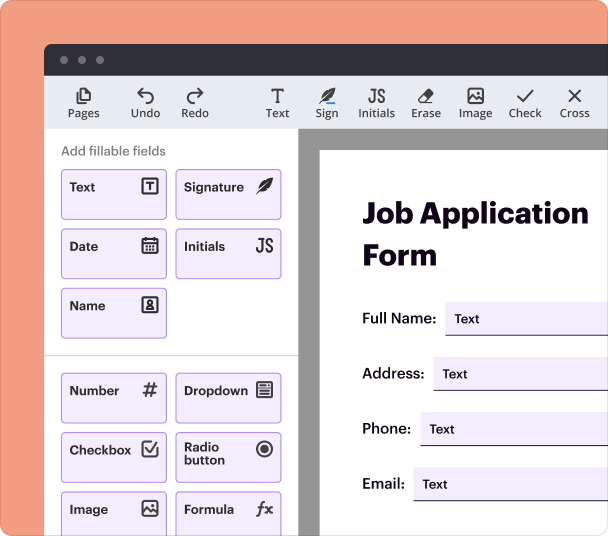

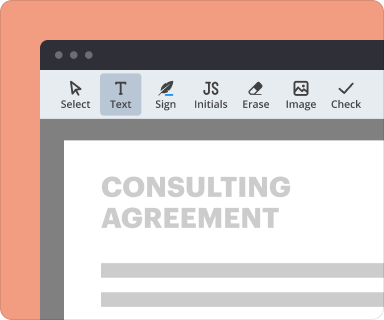

Steps to add fields when you create a loan repayment form

Adding interactive fields in your loan repayment form is straightforward with pdfFiller. You can easily drag and drop elements to tailor the form to your requirements. The process includes defining variable fields such as names, addresses, loan amounts, and payment schedules.

-

Open pdfFiller and select the option to create a new form.

-

Choose from a template or start from scratch.

-

Drag and drop text fields, checkboxes, and signatures where needed.

-

Customize properties for each field by setting validation rules.

-

Save and preview your form to ensure all fields are correctly placed.

Setting validation and data rules as you create

Setting data validation rules in your loan repayment form can help prevent errors in submissions. With pdfFiller, you can enforce certain formats and requirements, such as ensuring the loan amount is a number or that the date is in a specific format, enhancing the quality of collected data.

-

Select a field to edit in your form.

-

Navigate to the properties panel and find the validation settings.

-

Choose the type of validation required (e.g., numeric, date).

-

Save the settings to apply them to the field.

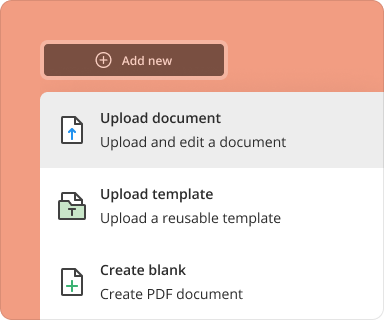

Going from a blank page to a finished form

Transforming a blank PDF into a finished loan repayment form is seamless with pdfFiller. You start by accessing the form creation tool, then gradually build your form, adding necessary fields, rules, and instructions, culminating in a professional and functional document.

-

Start with the blank form option in pdfFiller.

-

Add fields for borrower information, repayment details, and other agreements.

-

Incorporate any additional instructions about repayment terms.

-

Once all elements are added, customize the layout to fit your branding.

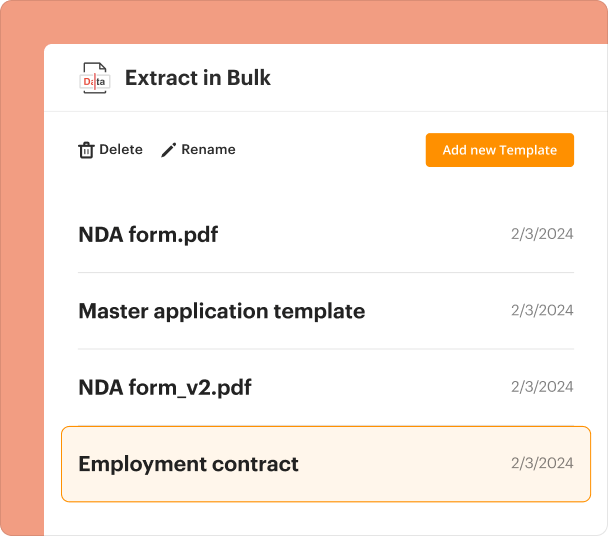

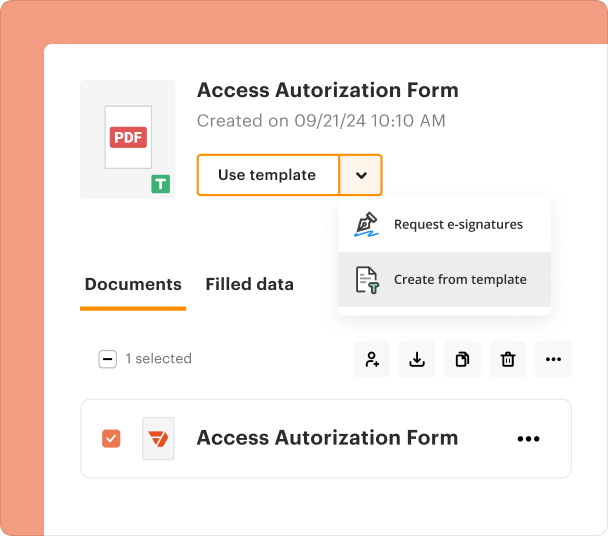

Organizing and revising templates in your Loan Repayment Form Builder

Managing your PDF form templates is crucial for efficiency. With pdfFiller, users can easily access, edit, and reorganize their existing templates. This functionality allows for quick revisions and updates to financial forms as conditions or terms change.

-

Go to the 'My Templates' section in pdfFiller.

-

Select the form you wish to edit.

-

Make necessary changes to fields, rules, or design.

-

Save the updated template for future use.

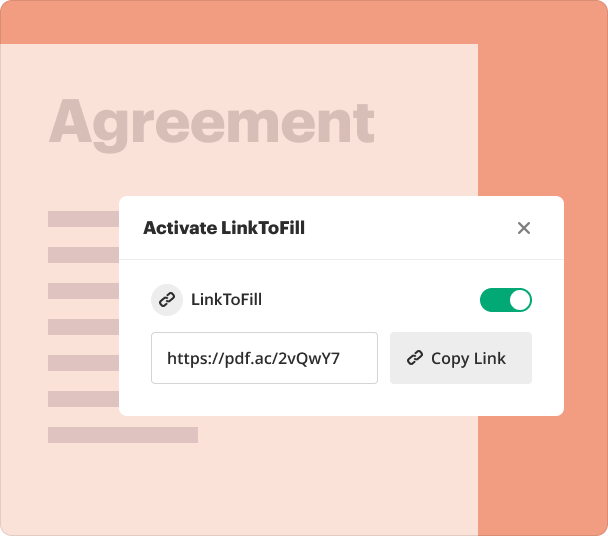

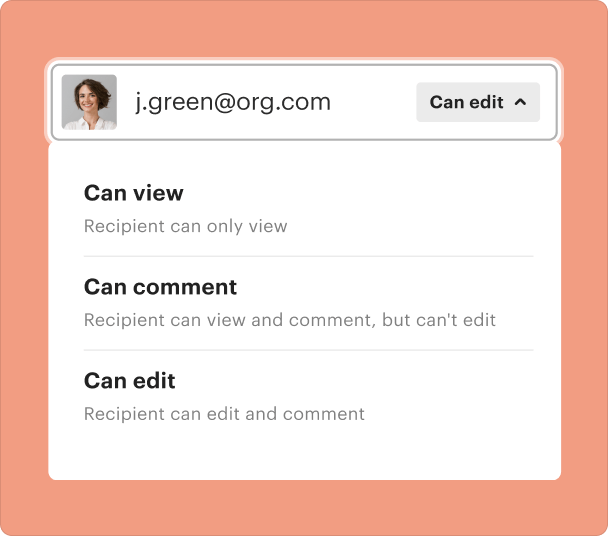

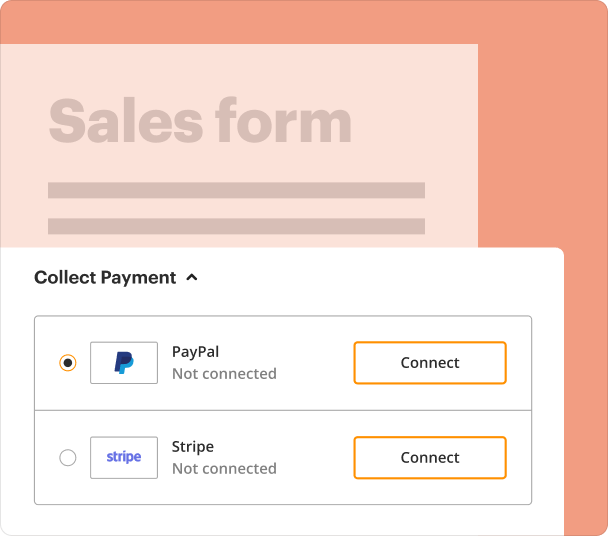

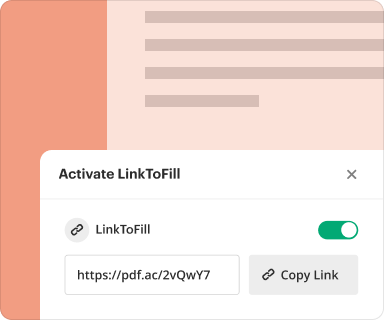

How to share results and monitor responses

Sharing your loan repayment form and tracking responses is made simple with pdfFiller. When forms are distributed electronically to borrowers, pdfFiller provides tools to monitor who has filled them out and any responses collected.

-

Click on 'Share' to distribute the form via email or link.

-

Specify if recipients should edit or merely view the documents.

-

Access the response tracking feature to see status updates.

-

Export the data from responses for record-keeping.

Exporting collected data once you finalize

After collecting responses from the completed loan repayment forms, exporting this data is essential for analysis and record-keeping. pdfFiller allows you to easily export the filled forms into different formats for flexible use.

-

Select the filled forms you want to export.

-

Click on the 'Export' button.

-

Choose the preferred file format (e.g., CSV, Excel, PDF).

-

Download the exported file for your records.

Where and why businesses use a Loan Repayment Form Builder

Many businesses, particularly in financing, rely on loan repayment form builders to ensure accurate and efficient handling of loan documentation. Industries such as banking, credit unions, automotive financing, and real estate benefit significantly from having electronic forms that are easy to disseminate, fill out, and process.

Conclusion

The Loan Repayment Form Builder within pdfFiller empowers users to create, manage, and track loan repayment documents effortlessly. By providing a centralized platform for document processing, pdfFiller saves time and enhances accuracy, allowing users to focus more on their core activities rather than paperwork.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms