Create a Loan Request Form with pdfFiller’s Loan Request Form Creator

How to create a loan request form easily

Creating a loan request form using pdfFiller is simple and efficient. With just a few clicks, you can generate a professional PDF form tailored to your requirements. Start by logging into your pdfFiller account, and follow the guided steps to design your form with interactive fields, apply necessary checks, and export the results seamlessly.

-

Log in to your pdfFiller account.

-

Select 'Create New' to start your form.

-

Add interactive fields suitable for your loan request.

-

Set data rules to ensure accuracy.

-

Share the form and track submissions.

What is a loan request form creator?

A loan request form creator is a tool that allows individuals and organizations to design, customize, and manage loan application forms in PDF format. Users can add questions, interactive fields, and apply data validation rules to ensure that the submitted information is accurate and complete.

How does the loan request form creator change document preparation?

The loan request form creator simplifies document preparation by providing an intuitive interface to build forms without any coding knowledge. This empowers users to efficiently handle applications, streamline workflow, and reduce paperwork, which enhances overall productivity.

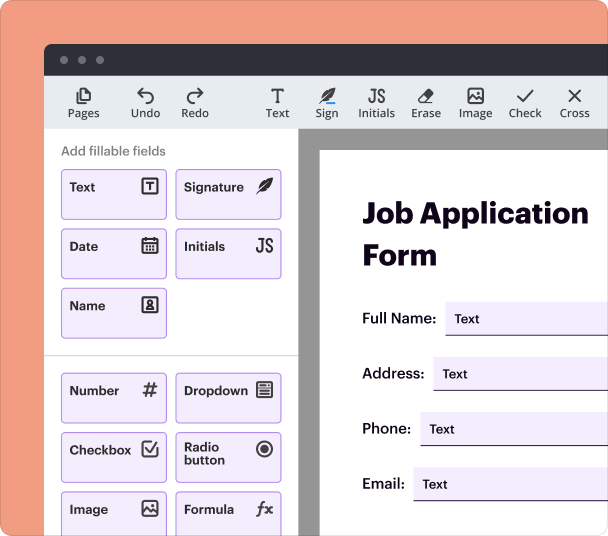

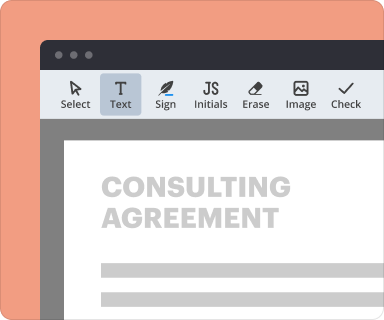

Steps to add interactive fields in the loan request form creator

To make your loan request form interactive, you can add various fields such as text boxes, drop-down lists, radio buttons, and checkboxes. These fields ensure that users can easily fill out the form with the required information.

-

Click on the 'Add Field' option in the toolbar.

-

Select the type of field you need.

-

Position the field on the form as required.

-

Adjust properties like field size and label.

Setting validation and data rules as you create

Ensuring the integrity of submitted data is crucial. While creating your form, you can set up validation rules, such as mandatory fields, specific formats (like email or phone numbers), or conditional fields that appear based on previous responses.

-

Select the field to apply validation.

-

Go to the 'Properties' panel.

-

Enable validation and define the rules.

-

Test the validation by previewing the form.

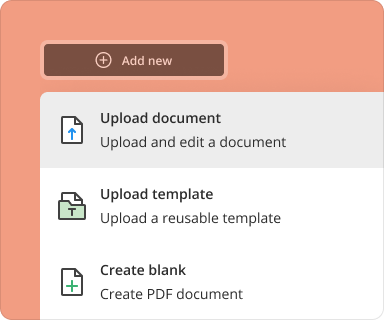

Going from a blank page to a finished form

Starting from a blank page allows you full creative control. You can choose from templates or create a form entirely from scratch. To design your form, just follow the steps to add fields, set rules, and review your design until it meets your needs.

-

Choose 'Start from Blank' or 'Use Template.'

-

Add your logo or branding elements.

-

Include relevant sections like personal information, loan details, and signature fields.

-

Finalize and save your form.

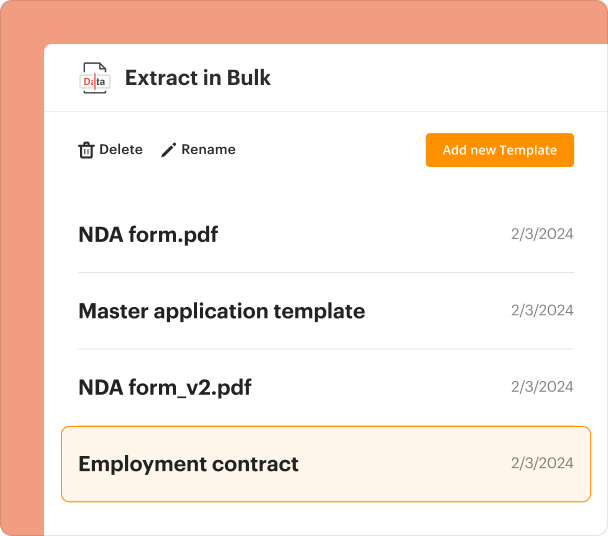

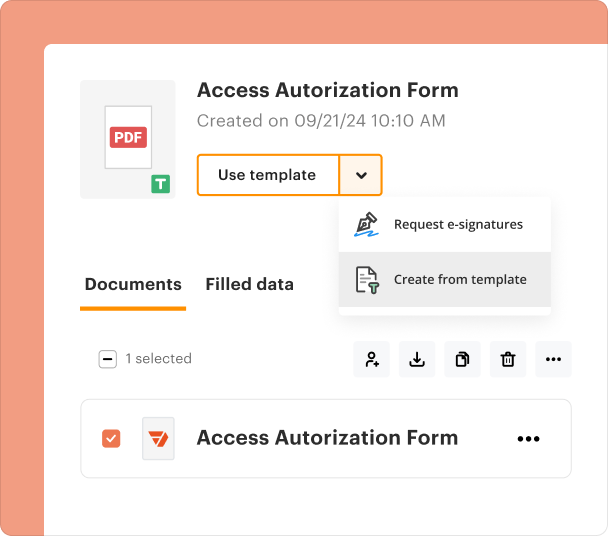

Organizing and revising templates

With pdfFiller, managing multiple loan request form templates is straightforward. You can easily categorize, edit, and delete forms to keep everything organized. Regular reviews and updates ensure that your forms remain relevant and effective.

-

Go to 'My Templates' section in your account.

-

Select a template for editing.

-

Make necessary changes and save the updated version.

-

Delete any outdated forms when needed.

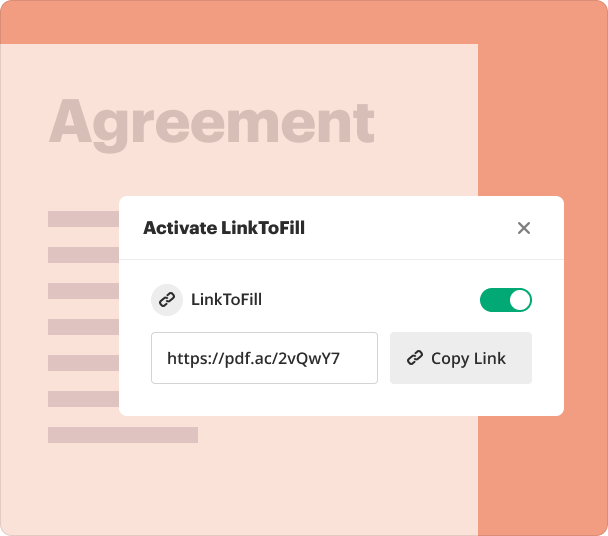

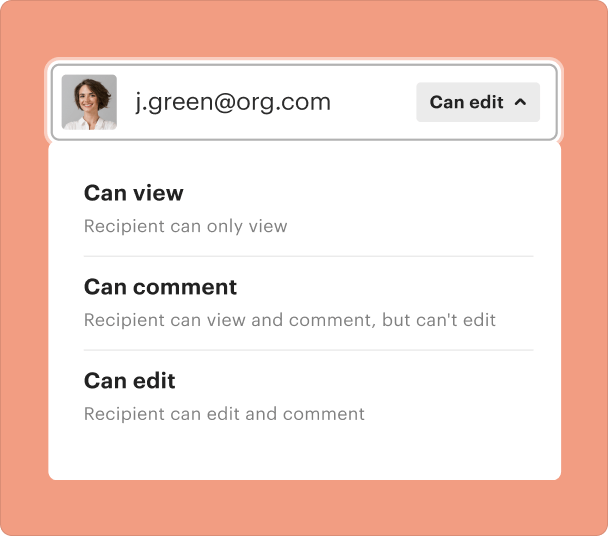

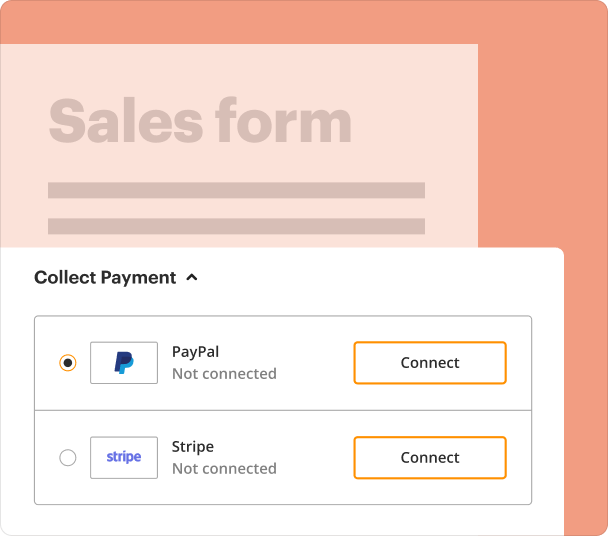

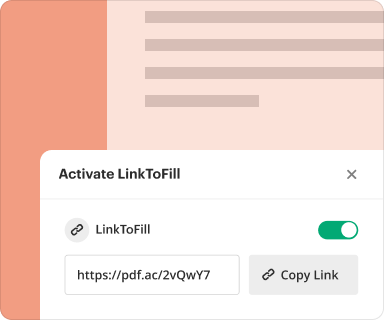

Sharing results and monitoring responses after creating forms

pdfFiller allows you to share your loan request form easily. Once distributed, you can track all responses, which provides valuable insights into submission rates and user engagement, ensuring you have all necessary data at your fingertips.

-

Click 'Share' and choose your sharing option (email, link, etc.).

-

Monitor submissions in real-time within the dashboard.

-

Analyze response data to improve your forms.

Exporting collected data once forms are submitted

After submission, exporting collected data is essential for processing loan requests. With pdfFiller, you can easily extract data into Excel, CSV, or PDF formats, making it convenient to analyze and maintain records.

-

Select 'Export' from the submissions view.

-

Choose your preferred file format.

-

Download the file to your device.

-

Integrate the data into your existing systems if necessary.

Where and why businesses use loan request forms

Loan request forms are essential in various industries, including finance, real estate, and education. They serve to standardize the application process, collect necessary information, and expedite approvals, significantly improving customer experience and operational efficiency.

Conclusion

Using pdfFiller’s loan request form creator enhances the process of designing, managing, and tracking loan applications. By integrating this tool into your workflow, you can create effective forms, enforce data accuracy, and streamline your business operations, making it a smart choice for any organization looking to optimize its paperwork handling.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms