Build PDF forms with pdfFiller’s Mortgage Payment Form Builder

How to create a mortgage payment form using pdfFiller

To create a mortgage payment form using pdfFiller, start by selecting the PDF form builder tool from your dashboard, choose a template or a blank document, add interactive fields like text boxes and drop-down options, apply necessary data validation rules, and finally save and share your form for use.

What is the Mortgage Payment Form Builder?

The Mortgage Payment Form Builder is an advanced feature of pdfFiller that allows users to design and customize PDF forms specifically for mortgage payments. This tool is effective in managing client information, payment schedules, and eligibility criteria. With pdfFiller, users can streamline their document workflows, making the form creation process easier and more efficient.

How does the Mortgage Payment Form Builder change document preparation?

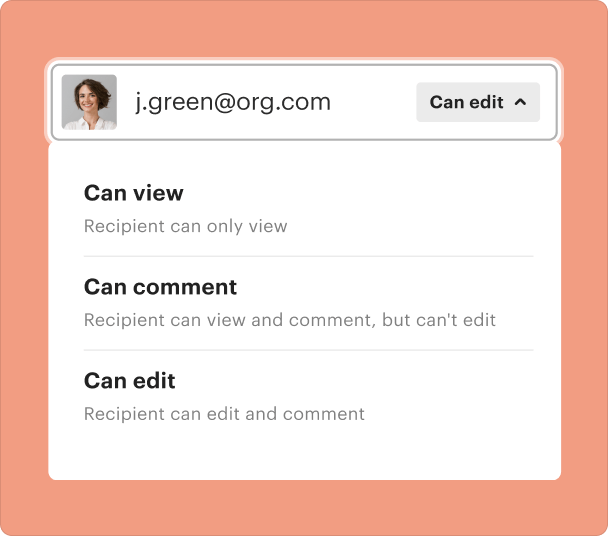

The Mortgage Payment Form Builder transforms document preparation by simplifying the creation of complex forms, enhancing collaboration among users, and ensuring quick access for all team members. Users can build forms digitally rather than relying on traditional methods like paper forms or email attachments, which improves efficiency.

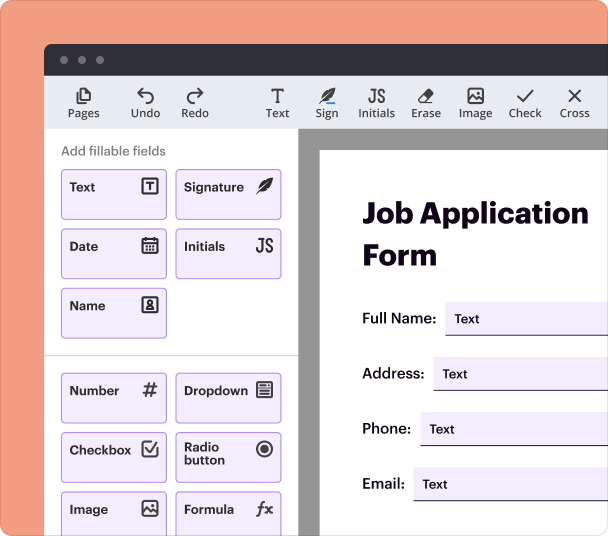

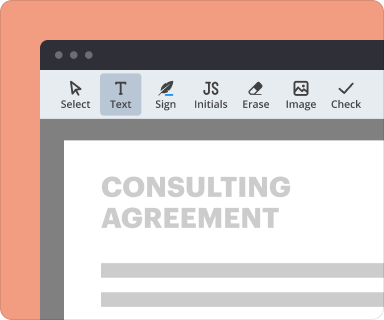

Steps to add interactive fields in the Mortgage Payment Form Builder

Adding interactive fields to your mortgage payment form is straightforward. Here’s a concise breakdown of the process:

-

Select the 'Add Fields' option from the sidebar.

-

Drag and drop the required fields such as text boxes, checkboxes, or signature lines onto the form.

-

Configure each field’s properties, specifying the type of input expected.

-

Repeat for all desired fields until the form meets your requirements.

Setting validation and data rules as you use the Mortgage Payment Form Builder

To enhance data integrity in your mortgage payment forms, applying validation rules is essential. Users can set rules to ensure that entries meet specific criteria, thereby preventing errors.

-

Choose the field you want to validate.

-

Access the properties menu to set validation rules.

-

Define the acceptable input type, such as numerical limits for payment amounts.

-

Save the changes and test the form to ensure validation functions as intended.

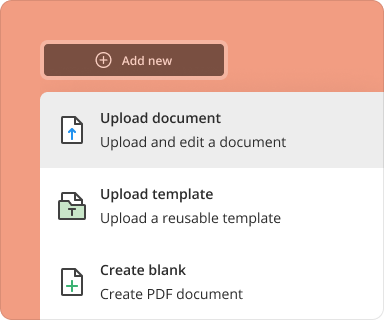

Going from blank page to finished form while using the Mortgage Payment Form Builder

Creating a complete form from scratch is a vital aspect of pdfFiller. The flexibility allows any user to design forms tailored to specific mortgage needs.

-

Begin with a blank page and choose your layout.

-

Add titles, instructions, and branding elements as needed.

-

Insert interactive fields, validating them as you go.

-

Review your document and finalize by saving it as a PDF.

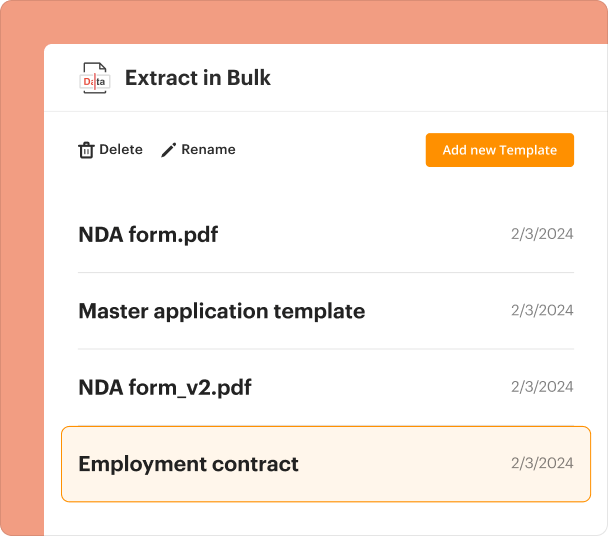

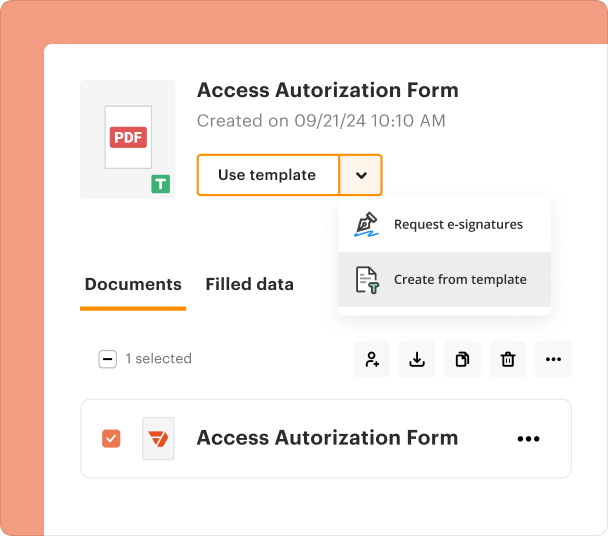

Organizing and revising templates when you use the Mortgage Payment Form Builder

Once forms are created, managing them effectively is crucial. pdfFiller allows users to organize their templates for quick access and make revisions easily.

-

Categorize templates by type or function for easy retrieval.

-

Use version control to track updates and changes made to templates.

-

Regularly review templates for relevance and accuracy.

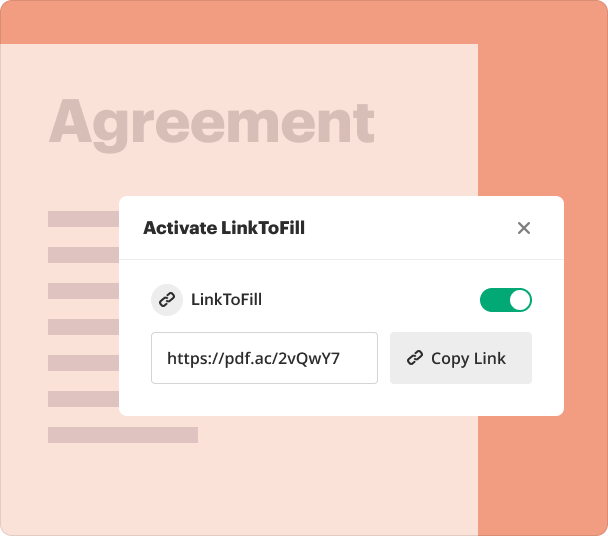

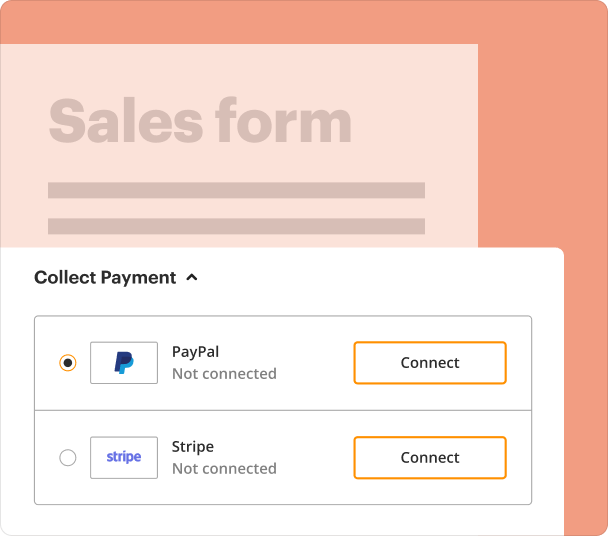

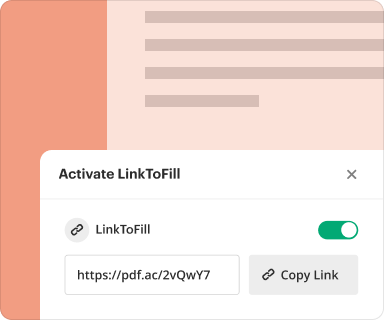

Sharing results and monitoring responses after you create a mortgage payment form

After creating a mortgage payment form, sharing is straightforward. Users can distribute forms via email or through a direct link, allowing for easy access.

-

Share the form link with clients or team members.

-

Track completion statuses and responses in real-time.

-

Use analytics to understand user engagement and response rates.

Exporting collected data once you finish your mortgage payment form

Once users collect data through the mortgage payment form, exporting this information for analysis or record-keeping is easy and efficient.

-

Access the responses section in your pdfFiller dashboard.

-

Select the dataExport function for desired formats (CSV, Excel, etc.).

-

Download the data for usage in reports or direct input into other systems.

Where and why businesses use the Mortgage Payment Form Builder

Various industries benefit from the Mortgage Payment Form Builder, particularly in finance, real estate, and legal fields. By adopting digital solutions, businesses improve service delivery and reduce response times.

-

Real estate agencies to streamline client onboarding.

-

Mortgage lenders managing application forms.

-

Legal firms handling payment agreements or contracts.

Conclusion

The Mortgage Payment Form Builder from pdfFiller is a powerful tool for creating and managing PDF forms effectively. By leveraging its features, users can enhance productivity, ensure accuracy, and save time in document transactions. Adopting this solution not only simplifies form management but also leads to better client relationships through improved response processes.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms

I love transforming all of my PDF files into editable documents . I also enjoy the digital signature feature for authentication and business purposes.

What do you dislike?

There is nothing that I dislike about this product.

What problems are you solving with the product? What benefits have you realized?

Able to transform difficult to edit documents into usable forms on a frequent basis. Love the compatibility with all platforms including social media!