Build PDF forms with pdfFiller’s Pdf Form Builder For Auto Insurance Companies

How to build PDF forms using pdfFiller

To build PDF forms for auto insurance companies using pdfFiller, start by accessing the platform and selecting a template or a blank form. Next, add interactive fields such as text boxes or checkboxes to meet your specific requirements. Customize the form according to your branding, set data validation rules, and finally share the form with your team or clients.

What is a PDF form builder for auto insurance companies?

A PDF form builder for auto insurance companies is a specialized tool that allows users to create, edit, and manage PDF forms tailored for insurance purposes. These forms can include policy applications, claims submissions, and customer information sheets. pdfFiller provides a user-friendly platform that aids insurance companies in streamlining their documentation process.

How does a PDF form builder change document preparation?

Using a PDF form builder revolutionizes document preparation by automating repetitive tasks, reducing the need for physical paperwork, and enhancing accuracy. Automating data collection minimizes human error and expedites the processing of applications and claims. With pdfFiller, insurance companies can enjoy faster turnaround times and better compliance.

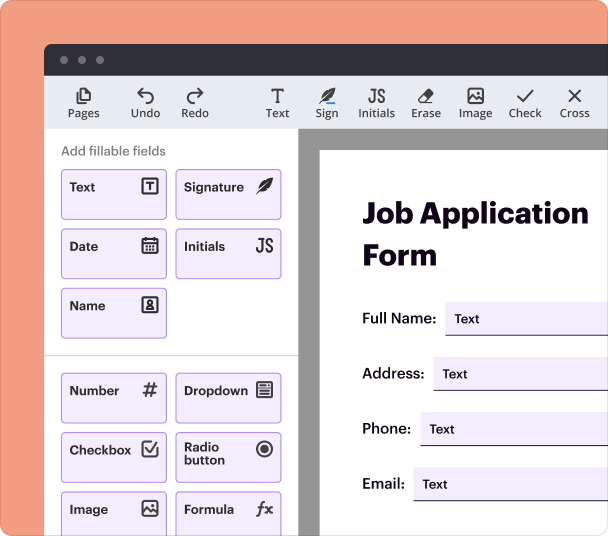

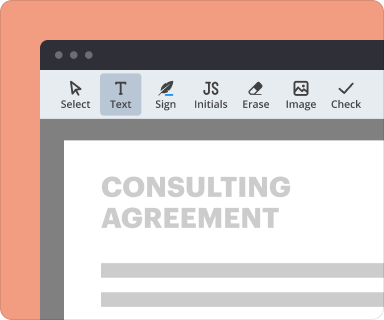

Steps to add interactive fields when you build PDF forms

Adding interactive fields is crucial for ensuring that users can input their data. To do this in pdfFiller, follow these simple steps:

-

Open your PDF form template or create a new one.

-

Select the 'Add Fields' option from the toolbar.

-

Choose the type of field you want to add (e.g., text box, checkbox, dropdown).

-

Place the field in the desired location on the form.

-

Customize the field properties, such as label and validation rules.

Setting validation and data rules as you build PDF forms

Setting data rules ensures that users fill out forms correctly. Validation rules can include mandatory fields, specific formats for phone numbers, and email validation. To do this in pdfFiller, simply select a field and define its rules in the properties panel.

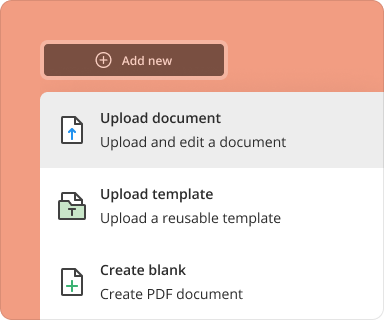

Going from a blank page to a finished form while you build PDF forms

Starting from scratch can be daunting, but pdfFiller simplifies this process. Begin with a blank PDF, then:

-

Define the purpose of your form (e.g., quote request, claims form).

-

Add essential fields as discussed earlier.

-

Customize your form's appearance using branding elements.

-

Include any necessary instructions for users.

-

Review and test the form before sharing.

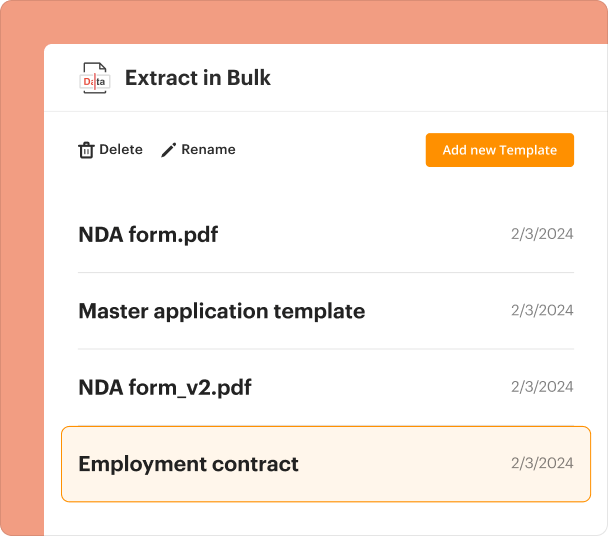

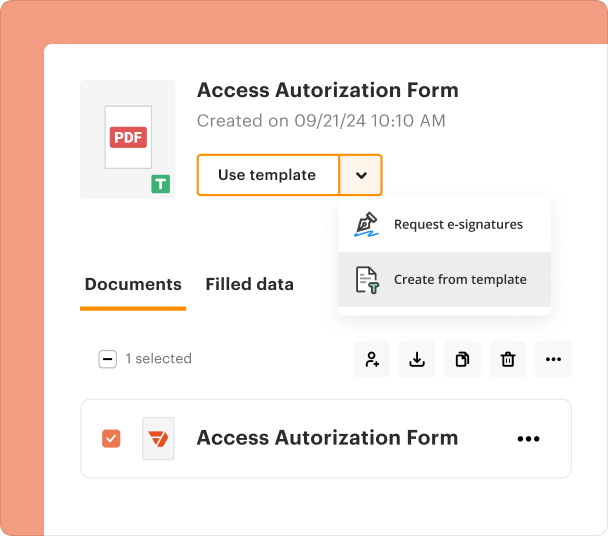

Organizing and revising templates when you build PDF forms

Effective organization of form templates is vital in maintaining efficiency. pdfFiller offers a template management system where you can categorize forms based on usage, update existing templates, and ensure consistency across all documents.

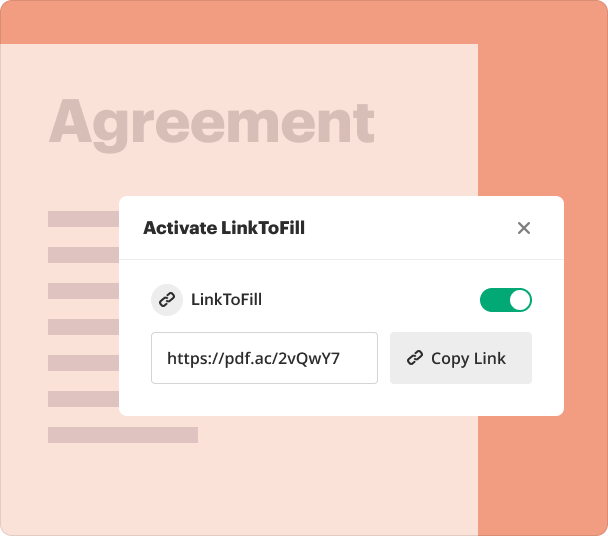

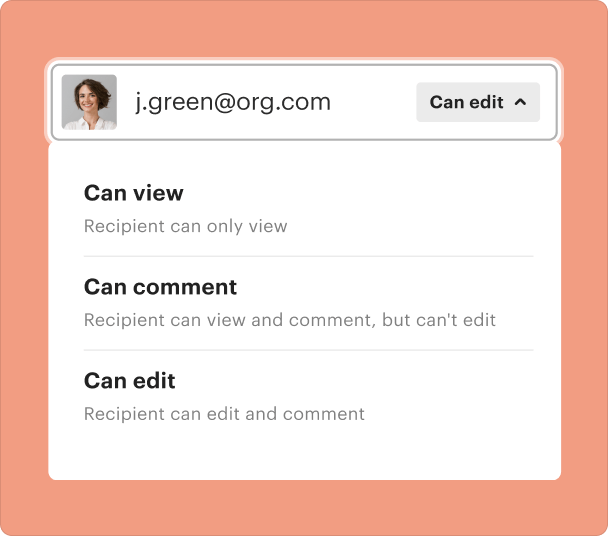

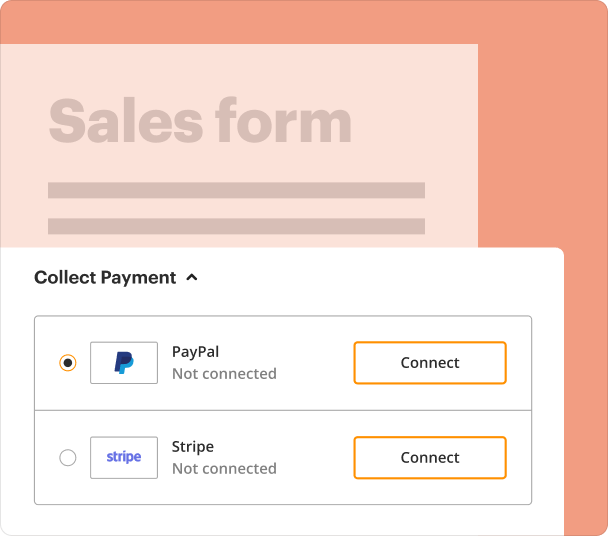

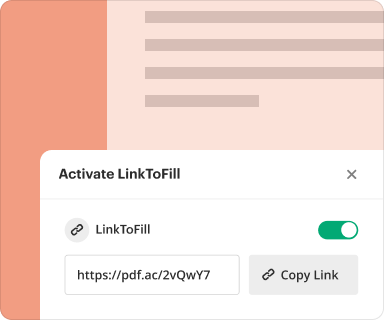

Sharing results and monitoring responses after you build PDF forms

Once your PDF forms are ready, sharing them is easy. You can send forms directly through email or generate shareable links. Additionally, pdfFiller allows you to monitor responses in real-time, providing insights into how quickly forms are being completed and submitted.

Exporting collected data once you build PDF forms

After receiving completed forms, exporting the data is straightforward. pdfFiller supports various file formats, allowing seamless integration with other tools used in your organization. You can download data in CSV format for further analysis or directly upload it to your CRM.

Where and why businesses build PDF forms

Auto insurance companies utilize PDF forms for policy applications, claims processes, and customer communication. By transitioning to digital forms, these businesses increase efficiency and improve customer satisfaction. The ease of modifying and sharing forms on pdfFiller empowers organizations to adapt swiftly to changing regulations.

Conclusion

In conclusion, the pdfFiller Pdf Form Builder For Auto Insurance Companies provides a robust solution for managing documentation needs. From creating interactive forms to exporting data, the capabilities offered simplify processes and enhance accuracy. Transitioning to a digital form system is not just a trend, it's a necessity for staying competitive in the insurance sector.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms