Build PDF forms with pdfFiller’s Pdf Form Builder For Chief Accountants

How to build PDF forms using pdfFiller

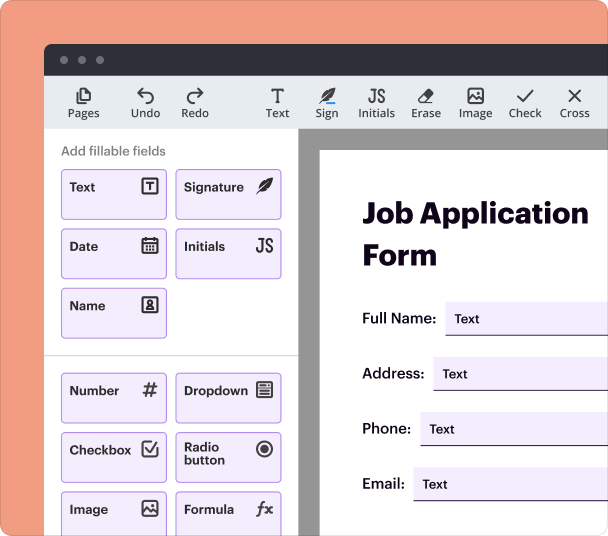

To build PDF forms with pdfFiller, start by accessing the platform and selecting the template option. Use the drag-and-drop interface to add interactive fields, customize the design, and set up data validation rules. Once your form is complete, share it with your team and track responses easily.

-

Access pdfFiller and select a template or start from scratch.

-

Add interactive fields using the drag-and-drop tool.

-

Customize the form layout and apply validation rules.

-

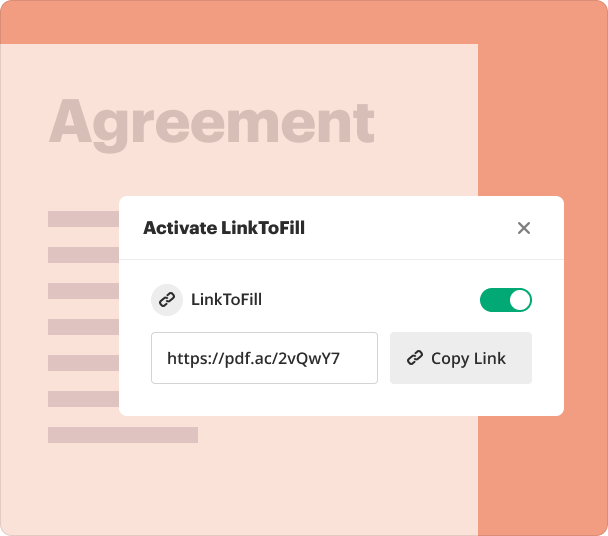

Save and share your form for immediate use.

What is a PDF form builder?

A PDF form builder is software designed to create and manage interactive PDF documents that users can fill out electronically. It simplifies the process of document preparation for diverse needs, allowing users to add text fields, checkboxes, signatures, and other interactive elements.

How does a PDF form builder change document preparation?

Traditionally, document preparation involved physical paper, which could lead to inefficiencies and higher costs. With a PDF form builder, accountants and teams can prepare, distribute, and collect data electronically, streamlining processes and ensuring accuracy. This transition not only saves time but reduces environmental impact.

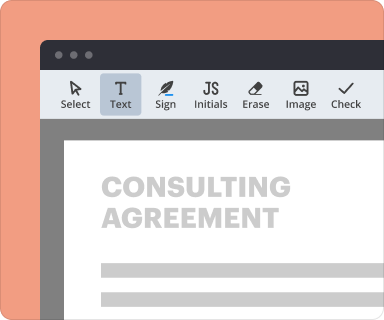

Steps to add fields when you build PDF forms

Adding fields in pdfFiller is straightforward. Once you open your document, follow these steps: Select the ‘Add Field’ option, choose the type of field you want (text box, checkbox, dropdown, etc.), and drag it to your desired location on the form.

-

Open your PDF in pdfFiller.

-

Click on 'Add Field'.

-

Select the field type (text, checkbox, etc.).

-

Drag and place the field on the document.

-

Adjust size and position as needed.

Setting validation and data rules as you build PDF forms

Applying validation rules ensures that users provide the correct information when filling out forms. With pdfFiller, you can set rules for specific fields, such as number ranges, mandatory fields, and data formats, reducing the risk of errors.

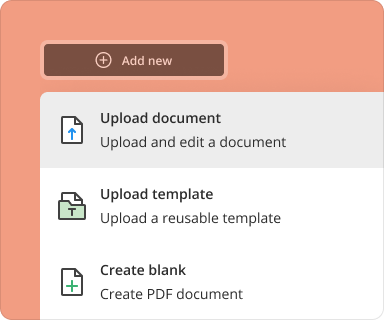

Going from blank page to finished form while you build PDF forms

Starting from a blank page can be daunting, but pdfFiller simplifies the process with templates and intuitive tools. Focus on the essential components you wish to include, like logos, headings, and footers, before layering in the functional fields.

-

Decide on the information needed in the form.

-

Select a template or start with a blank document.

-

Organize your components — logos, headers, etc.

-

Layer interactive fields over the layout.

-

Save your progress and review for completeness.

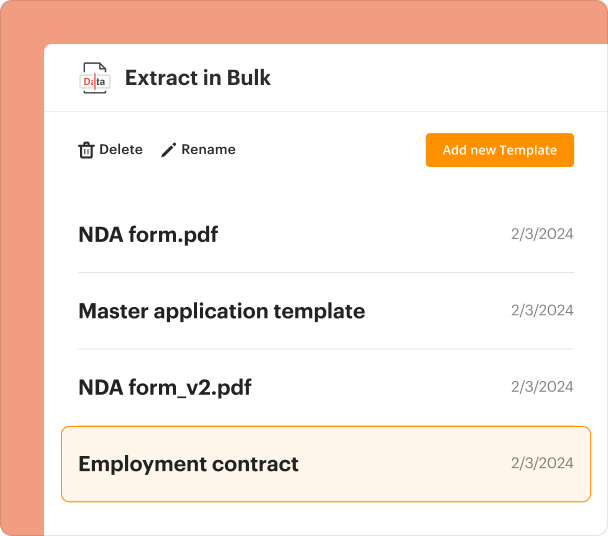

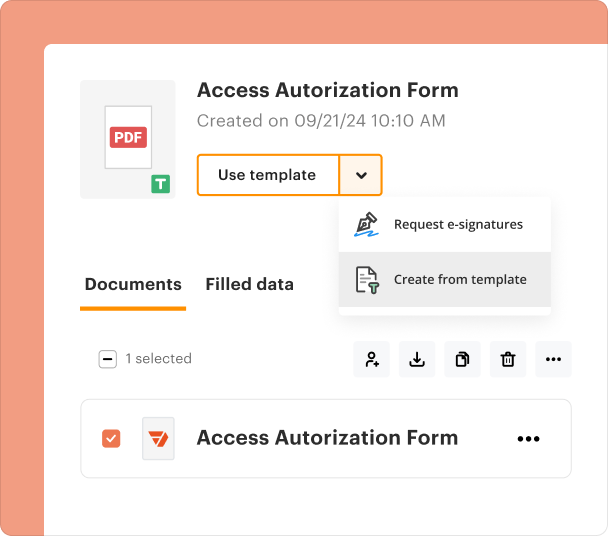

Organizing and revising templates when you build PDF forms

Once a form template is created, it can be organized and revised within pdfFiller. Use the platform's management features to categorize templates by type or project, ensuring quick access for future use or revision.

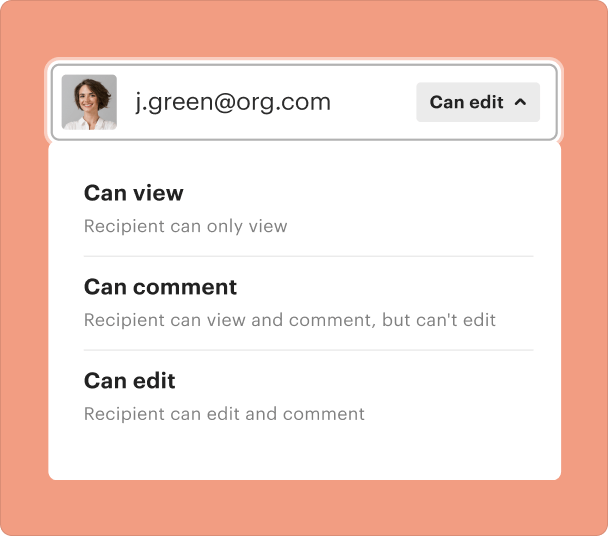

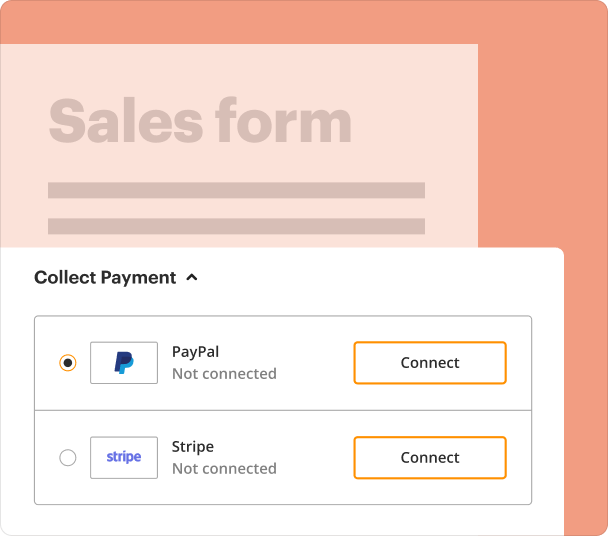

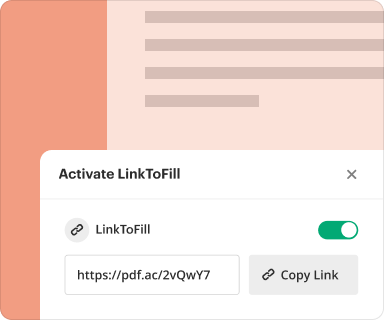

Sharing results and monitoring responses after you build PDF forms

After sending out forms, pdfFiller allows for tracking submissions and responses in real time. Utilize the analytics and reporting features to grasp how forms are being interacted with, which helps in making informed decisions.

Exporting collected data once you build PDF forms

Exporting data collected from your PDF forms is seamless with pdfFiller. You can download responses in various formats, such as CSV or Excel, for easy integration into accounting software or further data analysis.

Where and why businesses utilize PDF form builders

PDF form builders are particularly valuable in industries like finance, healthcare, and education, where accurate data collection and streamlined processes are critical. Chief accountants especially benefit from reduced turnaround times and increased compliance.

Conclusion

With pdfFiller’s PDF form builder, chief accountants gain an essential tool that transforms document creation and management. This solution not only enhances efficiency but also facilitates seamless collaboration and data collection, underscoring its value for modern accounting practices.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms