Build PDF forms with pdfFiller’s Pdf Form Builder For Insurance Consultants

How to Pdf Form Builder For Insurance Consultants

To effectively create and manage PDF forms tailored for insurance consultancy, pdfFiller provides an intuitive platform where you can design forms, add interactive fields, and automate data collection seamlessly.

What is a PDF form builder for insurance consultants?

A PDF form builder for insurance consultants is a specialized tool that allows users to create, edit, and manage PDF forms specifically designed for gathering data related to insurance policies, claims, and other services. It empowers consultants to streamline their paperwork and enhance client interactions with dynamic, fillable forms.

How does a PDF form builder change document preparation?

Using a PDF form builder transforms the tedious process of document preparation into a more efficient and organized workflow. It allows insurance consultants to create interactive forms that capture client information accurately while minimizing errors and reducing the turnaround time for document processing.

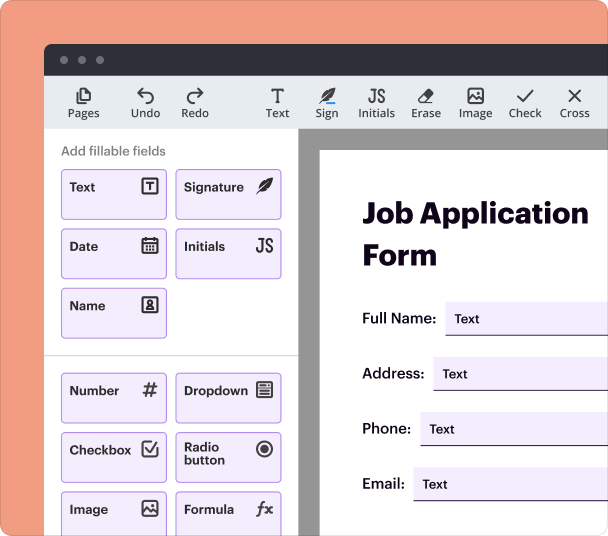

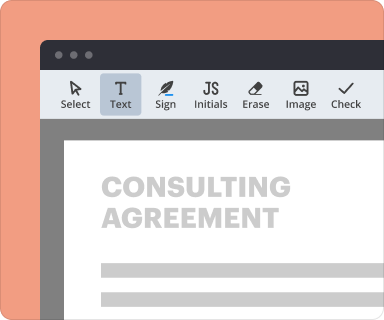

Steps to add interactive fields in a PDF form builder

Adding interactive fields in your PDF forms is critical for data collection. Here’s how to achieve this using pdfFiller:

-

Open your document in pdfFiller.

-

Use the ‘Add Fields’ option to select field types (like text fields, checkboxes, or dropdowns).

-

Drag and drop the selected field onto your PDF.

-

Configure properties for the fields, such as required fields or validation rules.

-

Save your form to preserve changes.

Setting validation and data rules in a PDF form builder

Validation and data rules are essential for ensuring the integrity of information collected through your forms. With pdfFiller, you can easily set rules to restrict field entries. This step can help avoid errors, ensuring that submitted data complies with specific formats or requirements.

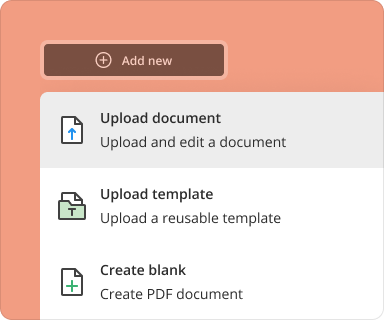

Going from a blank page to a finished form while using a PDF form builder

To create a complete PDF form from scratch, follow these steps:

-

Start with a blank PDF or import an existing document that needs form fields.

-

Design the form layout by adding text and imagery where necessary.

-

Insert interactive fields as discussed previously.

-

Set any field rules or instructions to guide users.

-

Review the form for functionality before finalizing.

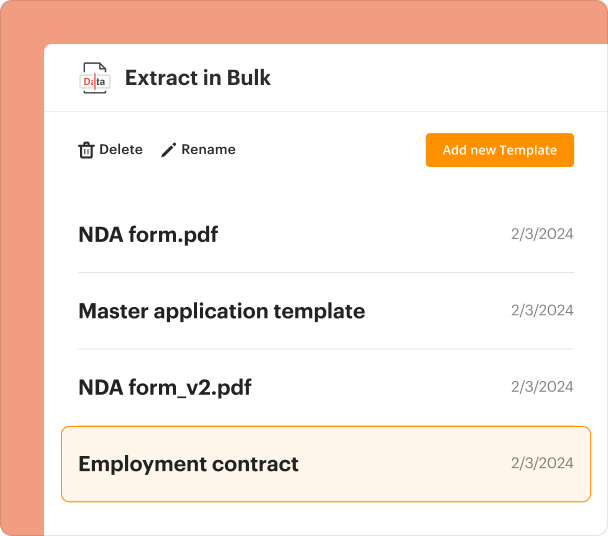

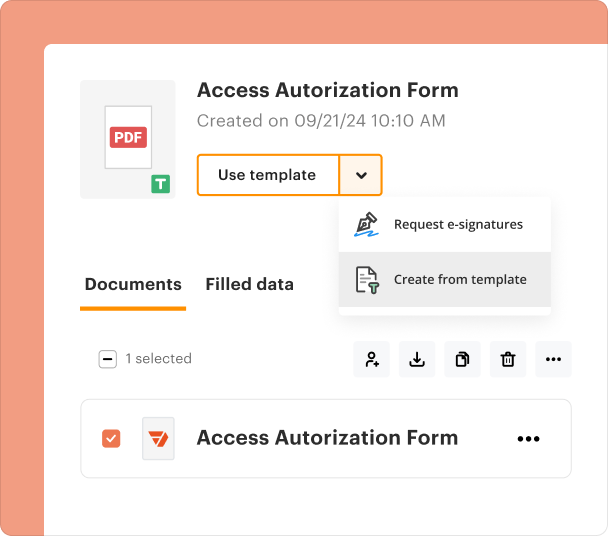

Organizing and revising templates when using a PDF form builder

Staying organized with your PDF form templates is vital for efficient workflow. pdfFiller enables you to categorize your templates and revise them when necessary based on changing needs or regulations in the insurance industry.

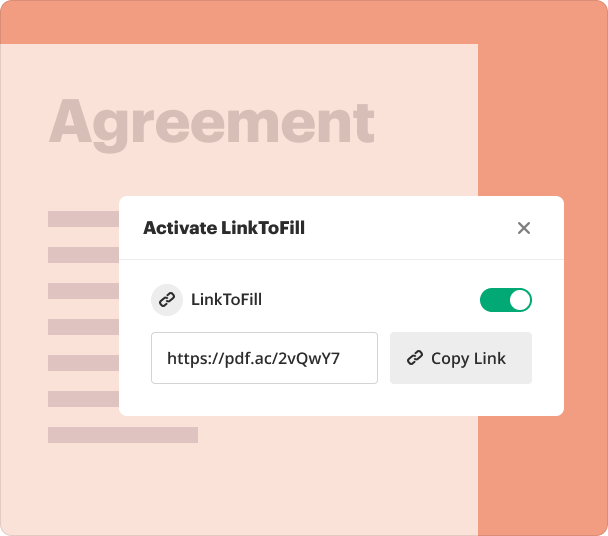

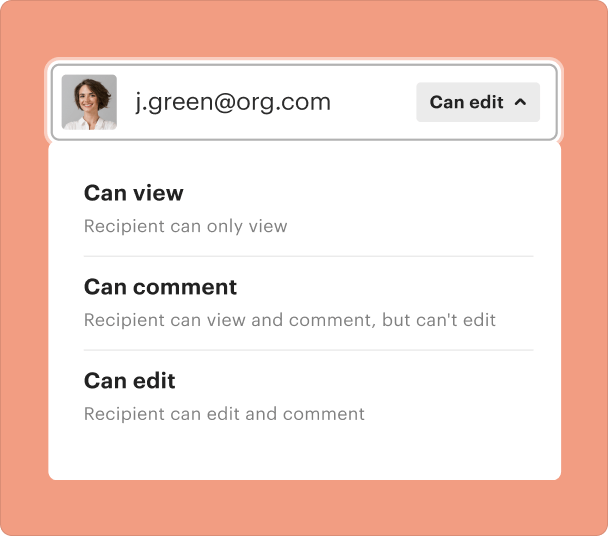

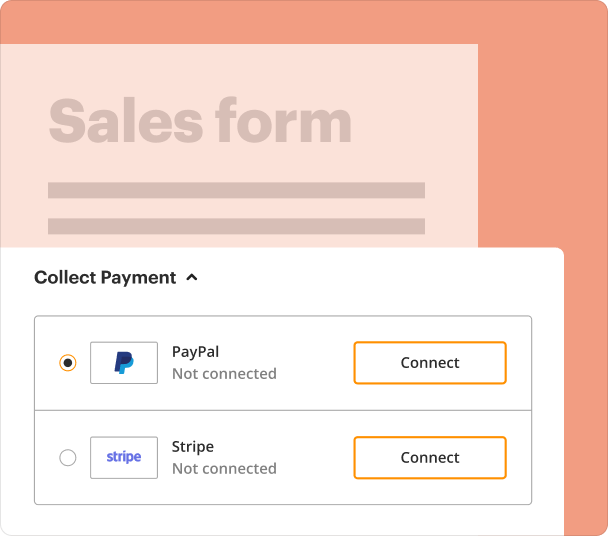

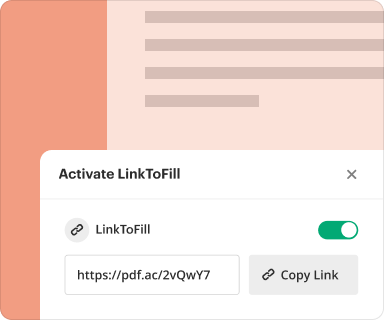

Sharing results and monitoring responses after utilizing a PDF form builder

Once forms are completed, sharing and tracking responses helps you manage client interactions effectively. pdfFiller allows seamless sharing of forms with clients and offers tracking functionalities to monitor who has completed and submitted forms.

Exporting collected data once you create forms with a PDF form builder

After collecting responses, exporting the data is crucial for analysis and reporting. pdfFiller facilitates easy data export in various formats, making it convenient to integrate with other systems for further processing.

Where and why businesses use a PDF form builder for insurance consultants

Businesses in the insurance industry leverage PDF form builders to improve client data collection processes, enhance compliance with legal standards, and reduce response times. This improved efficiency translates directly into better client service and quicker turnaround times on policy processing, making it an invaluable tool for insurance consultants.

Conclusion

The pdfForm Builder For Insurance Consultants empowers users with the ability to create, manage, and optimize their document workflows. Embracing this technology not only streamlines tasks but also improves client engagement and data accuracy. By utilizing pdfFiller, insurance consultants can enhance their operational efficiency and provide a better experience for their clients.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms