Build PDF forms with pdfFiller’s PDF Form Builder for Invoice Factoring Companies

How to create PDF forms using pdfFiller

To create PDF forms for invoice factoring companies using pdfFiller, start by signing in to your pdfFiller account. Use the form editor to add text fields, checkboxes, and signatures. Customize the form layout to meet your specific business needs. Finally, save and share the PDF form with your team or clients.

What is a PDF form builder for invoice factoring companies?

A PDF form builder for invoice factoring companies is a specialized tool that allows users to create and manage interactive PDF forms tailored for invoicing and financial documentation. Users can easily incorporate various fields, such as client information, payment terms, and signatures, facilitating more efficient and organized financial transactions.

How does a PDF form builder improve document preparation?

A PDF form builder enhances document preparation by streamlining the creation and editing processes. Users can automate repetitive tasks, ensure consistency across forms, and reduce the time spent on manual entries. This efficiency not only saves time but also minimizes errors, making it especially valuable for invoice factoring companies handling numerous clients.

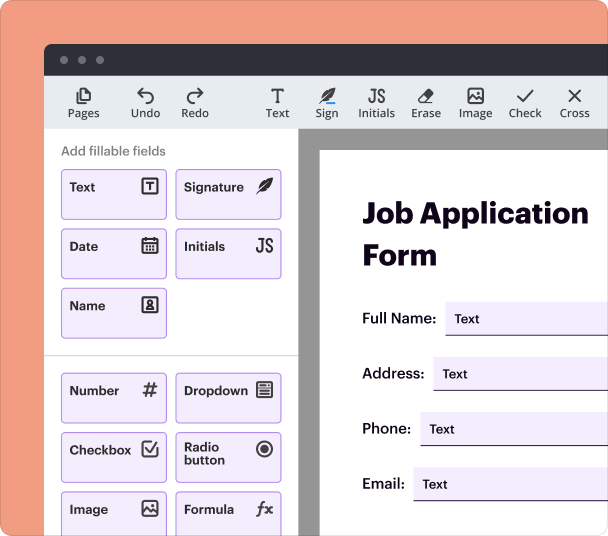

Steps to add interactive fields when using a PDF form builder

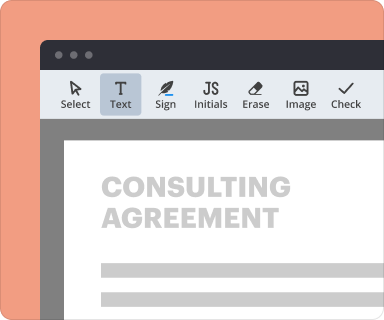

Adding interactive fields in pdfFiller is an intuitive process. Here’s how to do it:

-

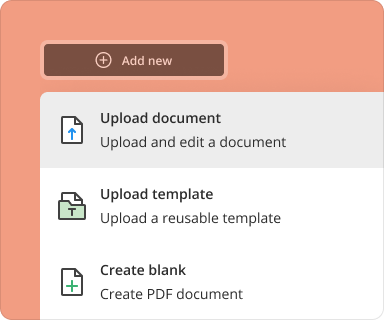

Open your template or create a new PDF document.

-

Select the 'Add Fields' option from the toolbar.

-

Drag and drop desired fields (text boxes, checkboxes, etc.) onto the PDF.

-

Adjust the properties for each field to specify validation rules or data types.

-

Save your document after final adjustments.

Setting validation and data rules in your PDF forms

Implementing validation and data rules helps ensure the accuracy of the information collected through your forms. You can configure fields to accept only specific data types (e.g., numbers for monetary values) or establish mandatory fields that must be filled out before submission.

Going from a blank page to a finished form

Creating a complete form from scratch involves several phases. Start with a blank document, outline the necessary sections for invoicing, and utilize pdfFiller's extensive library of fields and templates. This guided approach simplifies the creation process.

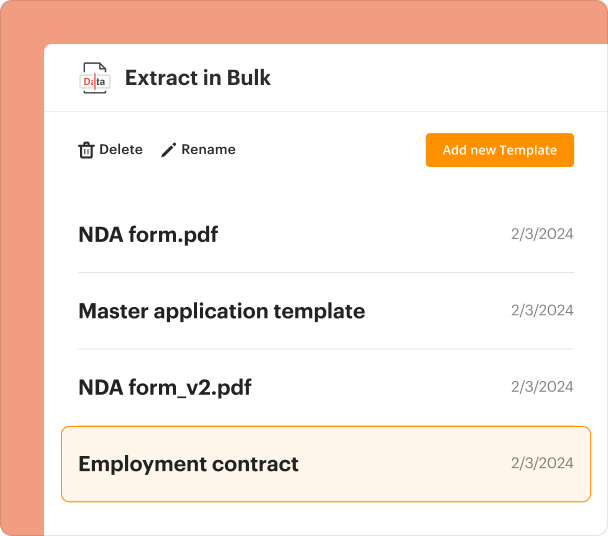

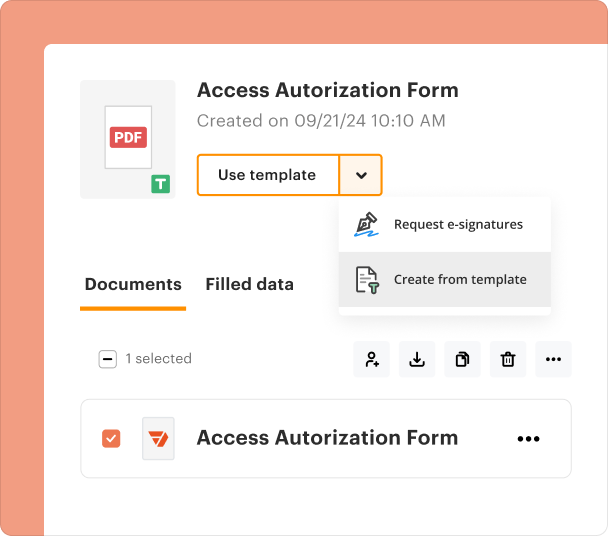

Organizing and revising templates in your PDF form builder

Managing your PDF form templates effectively ensures quick access to frequently used documents. Users can categorize templates by type, client, or project, and make revisions as necessary to accommodate changes in invoicing or regulatory requirements.

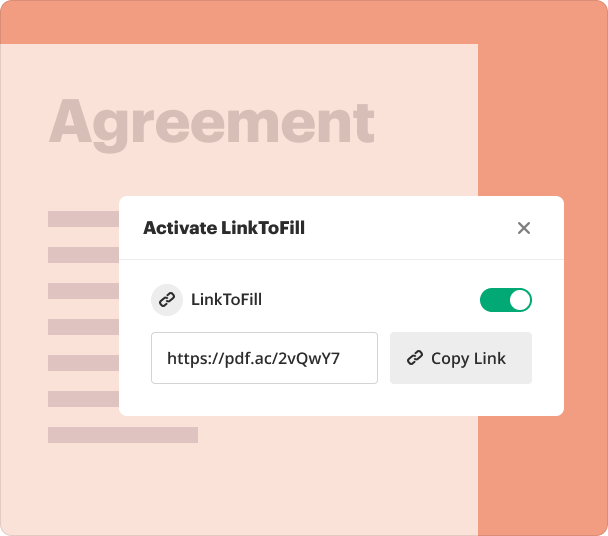

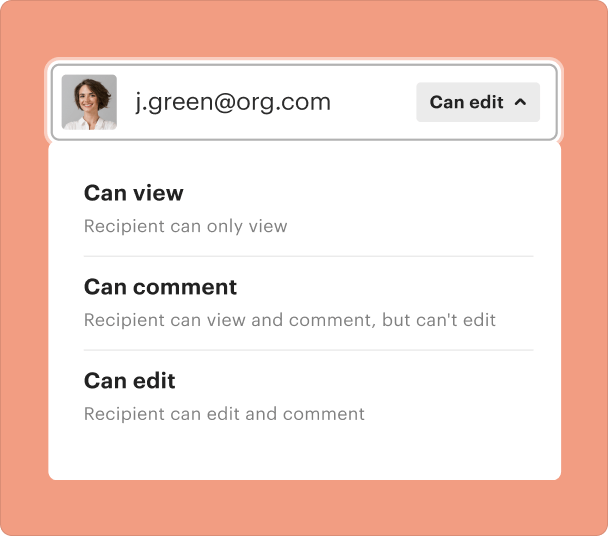

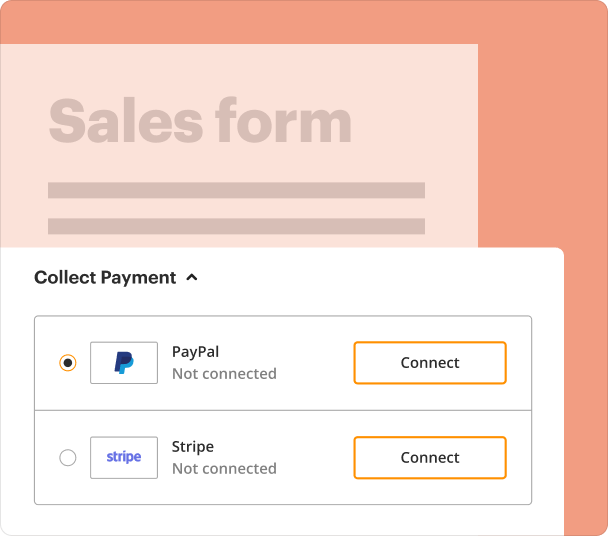

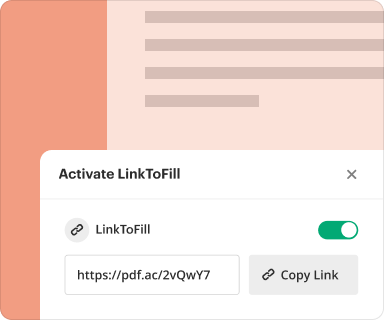

How to share forms and track responses

After your forms are ready, sharing them becomes a straightforward task with pdfFiller. You can send forms via email or share links directly. Additionally, tracking responses is facilitated by robust features that show when forms are opened, completed, and returned.

Exporting collected data from your PDF forms

Once your forms have been filled out, you can export the submitted data in multiple formats, including CSV and Excel. This allows for further analysis or integration with other accounting software, supporting effective management of financial records.

Where and why businesses use PDF form builders?

Invoice factoring companies, financial institutions, and consultancy firms often rely on PDF form builders for their customizable and user-friendly interfaces. These tools streamline the invoicing and contract generation processes, resulting in better workflow efficiency and improved client engagement.

Conclusion

In conclusion, pdfFiller’s PDF Form Builder for Invoice Factoring Companies not only enhances document creation but also ensures accuracy and efficiency in handling financial forms. By leveraging its features, businesses can optimize their workflows and maintain a professional standard in their documentation processes.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms