Build PDF forms with pdfFiller’s Pdf Form Builder For Lenders

How to Pdf Form Builder For Lenders

To effectively utilize a Pdf Form Builder for Lenders, begin by selecting the template you wish to modify. Use the intuitive interface to add interactive fields, apply necessary rules, and complete your form. Once finalized, share and track responses securely. This process simplifies document management for lenders and enhances efficiency.

What is a Pdf Form Builder for Lenders?

A Pdf Form Builder allows lenders to create, manage, and distribute PDF forms easily. It provides tools to design forms that can be filled out online, facilitating smoother client interactions and data collection. This builder eliminates the need for paper forms, streamlining the process for both lenders and clients.

How does a Pdf Form Builder for Lenders change document preparation?

Using a Pdf Form Builder revolutionizes document preparation by enabling immediate digital form creation. Lenders no longer need to rely on physical documents, thus speeding up the signing process and reducing errors associated with manual entry. The ability to customize forms enhances data collection accuracy and client experience.

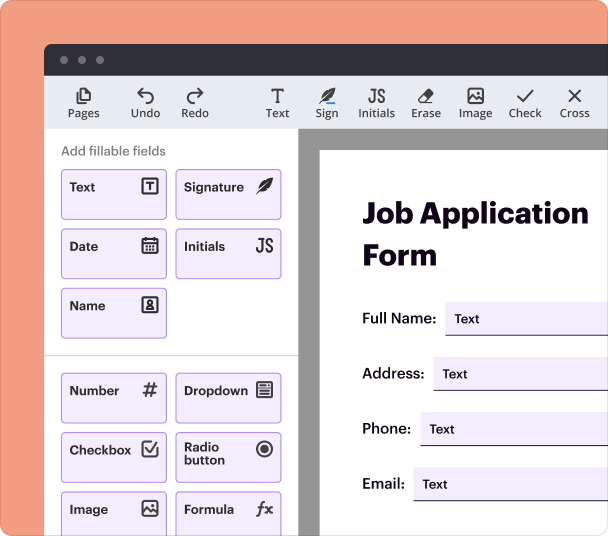

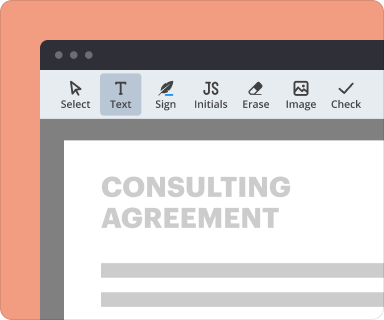

Steps to add interactive fields when you use pdfFiller

Adding interactive fields in pdfFiller is a straightforward process. Lenders can drag and drop fields, such as text boxes, checkboxes, and signature areas, to create tailored documents. This functionality enhances the user's experience by facilitating smooth data entry.

-

Select the form template from the library or create a new one.

-

Drag and drop the desired interactive fields onto your form.

-

Adjust the properties of each field as needed, including size and alignment.

-

Save your form and preview it to ensure functionality.

Setting validation and data rules as you create a form

Configuring data validation in your PDF form ensures accuracy and compliance. Lenders can set specific criteria for data entry, which eliminates common errors. This includes mandating fields or setting formats for phone numbers and email addresses, thus improving the quality of collected data.

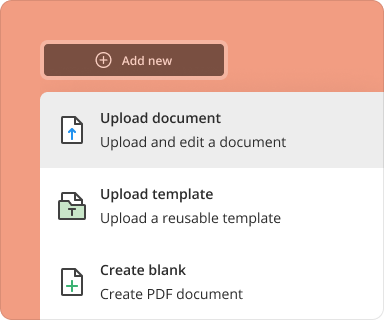

Going from a blank page to a finished form while using pdfFiller

Creating a complete form from scratch begins with assessing the information required. By utilizing pdfFiller’s intuitive interface, lenders can build complex documents tailored to their specific needs efficiently. This process maximizes versatility and allows for the incorporation of branding elements.

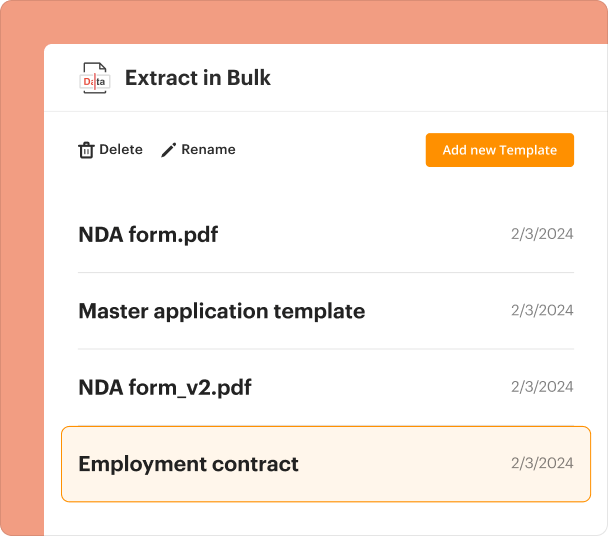

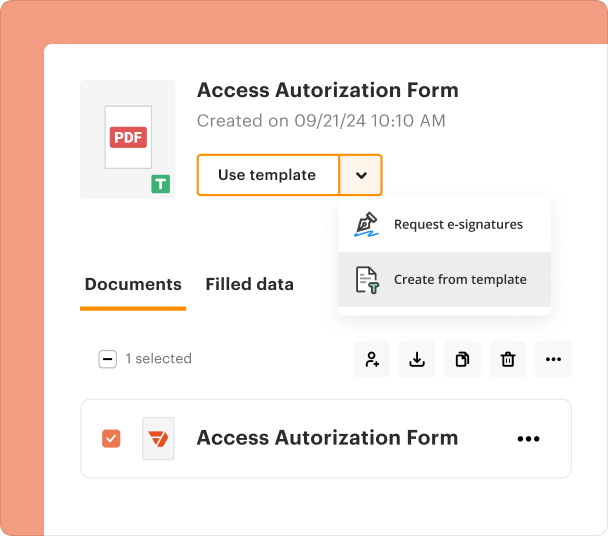

Organizing and revising templates when you generate PDF forms

Maintenance of form templates is essential for ensuring accuracy and relevance. Lenders can easily organize, rename, and revise their templates within pdfFiller, ensuring that they always utilize the most current version. This built-in version control is especially beneficial in a fast-paced lending environment.

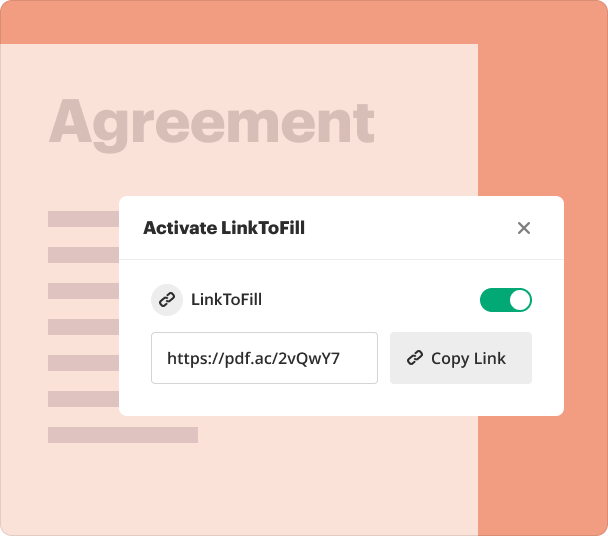

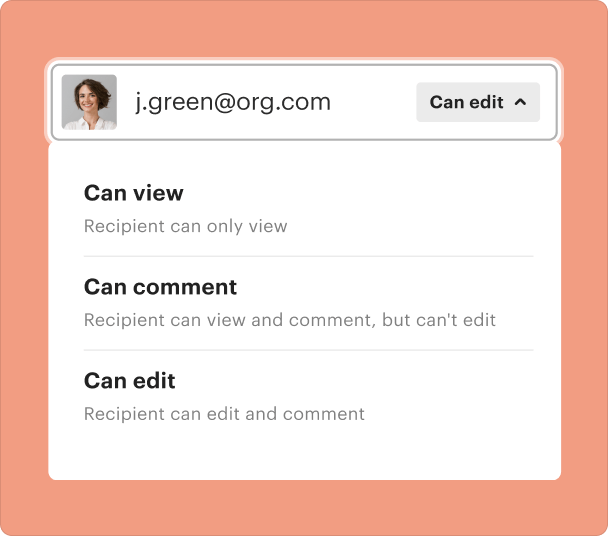

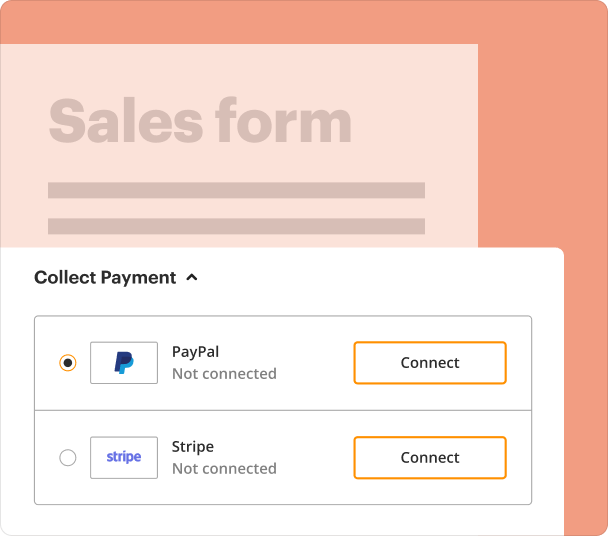

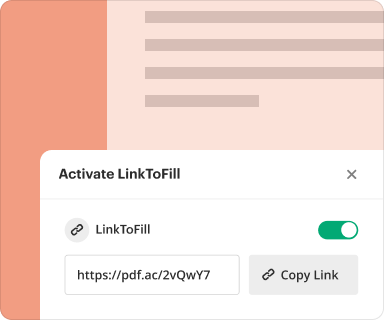

Sharing results and monitoring responses after you create a PDF form

Once a form is shared, pdfFiller provides tools to track responses in real-time. Lenders can monitor who has completed forms and manage follow-ups accordingly. This feature enhances communication and ensures timely processing of applications.

Exporting collected data once you generate a PDF form

After collecting data, pdfFiller allows users to export information into various formats, such as Excel or CSV. This flexibility is crucial for lenders who need to analyze data or integrate with customer relationship management (CRM) systems.

Where and why do businesses typically use a Pdf Form Builder for Lenders?

Businesses in the finance and lending sectors leverage PDF form builders to enhance efficiency and accuracy in documentation. From loan applications to credit assessments, these tools are invaluable in ensuring compliance with industry regulations while improving the customer experience.

Conclusion

Employing a Pdf Form Builder for Lenders significantly optimizes the document workflow. With features tailored to enhance efficiency, accuracy, and data management, pdfFiller stands out as an essential tool for modern lenders. Transitioning to digital forms not only simplifies processes but also improves client interactions, setting businesses up for success.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms