Build PDF forms with pdfFiller’s Pdf Form Builder For Life Insurance Agents

How to Pdf Form Builder For Life Insurance Agents

To create effective PDF forms for life insurance agents using pdfFiller, you can easily add interactive fields, set validation rules, and manage your templates online. Start by accessing the pdfFiller platform, where you can design and customize forms suitable for your business needs.

What is Pdf Form Builder For Life Insurance Agents?

The Pdf Form Builder for Life Insurance Agents is a specialized tool by pdfFiller that allows insurance professionals to create and manage PDF forms tailored to their operational needs. This tool combines intuitive design features with robust functionality to streamline the process of document preparation, ensuring agents can efficiently capture client information and process applications.

How does Pdf Form Builder For Life Insurance Agents improve handling paperwork?

This form builder enhances paperwork management by digitizing traditionally cumbersome processes. It minimizes errors and accelerates client onboarding by allowing agents to create dynamic forms that can be easily completed online. This efficiency leads to better customer satisfaction and faster processing times.

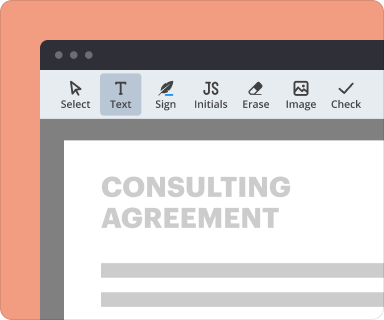

Steps to add fields when you use Pdf Form Builder For Life Insurance Agents

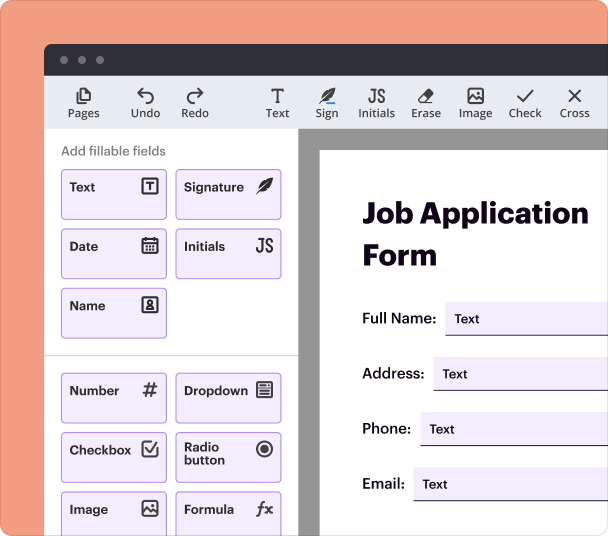

Adding fields in the Pdf Form Builder is straightforward. Users can select from various field types such as text boxes, checkboxes, and dropdown menus to gather comprehensive data from clients. Here are the steps:

-

Open your PDF template in pdfFiller.

-

Select the 'Add Fields' option from the toolbar.

-

Drag and drop your desired field types onto the document.

-

Customize the properties of each field, including labels and required settings.

-

Save your template.

Setting validation and data rules as you use Pdf Form Builder For Life Insurance Agents

Implementing validation rules is crucial for ensuring that the data collected through your forms is accurate and complete. With pdfFiller, you can set specific criteria for responses, such as requiring certain fields to be filled out or validating email formats.

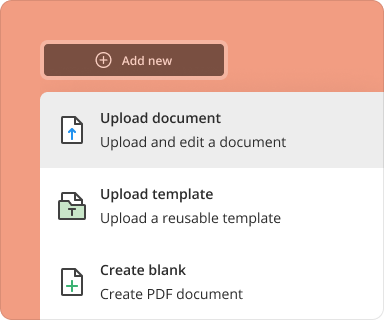

Going from blank page to finished form while you use Pdf Form Builder For Life Insurance Agents

Creating a complete form from scratch is easy with the pdfFiller platform. You can start with a blank document or transform existing PDFs into interactive forms by adding the necessary fields and validation rules. This capability ensures agents can quickly generate forms tailored to specific client needs.

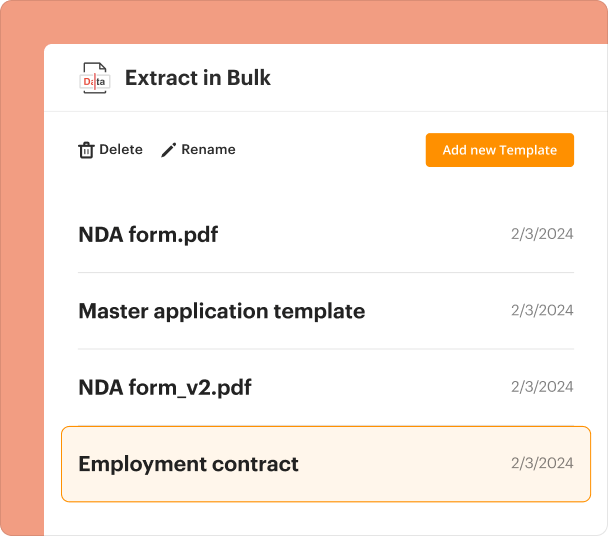

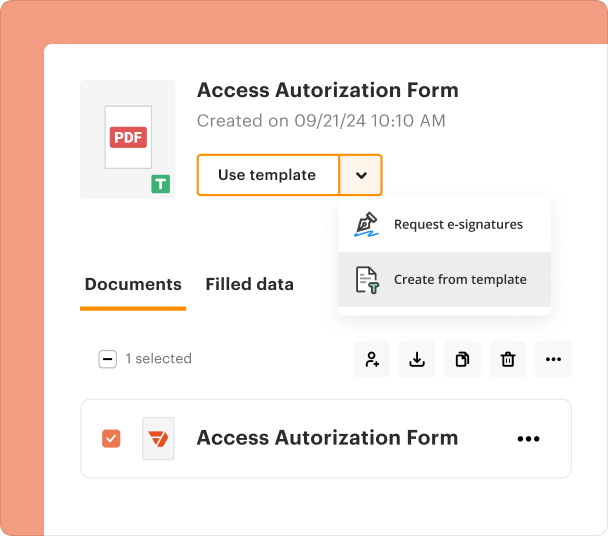

Organizing and revising templates when you use Pdf Form Builder For Life Insurance Agents

PdfFiller allows for easy management of your PDF templates. You can categorize forms based on their purposes, such as sales applications or client follow-ups, making it easier to locate and update them as requirements change.

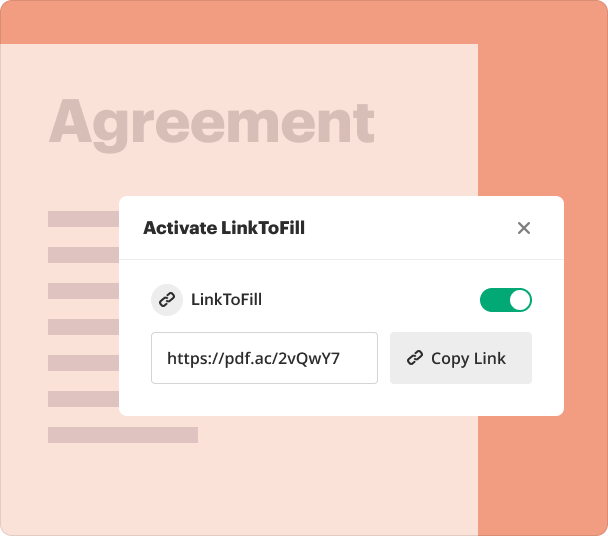

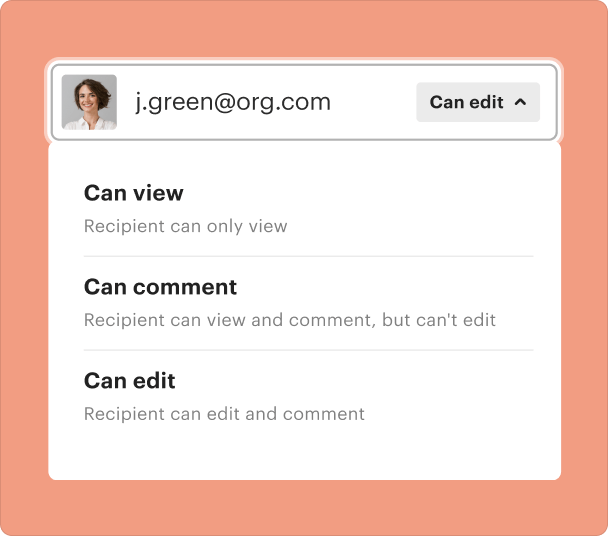

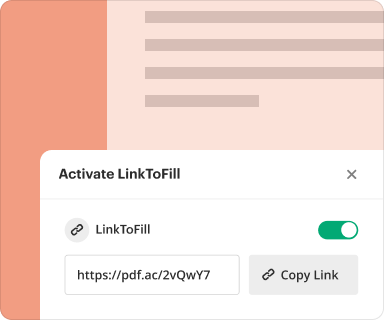

Sharing results and monitoring responses after you use Pdf Form Builder For Life Insurance Agents

Once forms are filled out, agents can share them with relevant departments or clients seamlessly. PdfFiller provides tracking tools that allow you to monitor who has completed the forms, thus enhancing the follow-up process.

Exporting collected data once you use Pdf Form Builder For Life Insurance Agents

After your forms have been completed, exporting data is just as easy. PdfFiller allows users to export submissions directly into spreadsheet formats such as CSV or Excel, facilitating easier analysis and record-keeping.

Where and why do businesses use Pdf Form Builder For Life Insurance Agents?

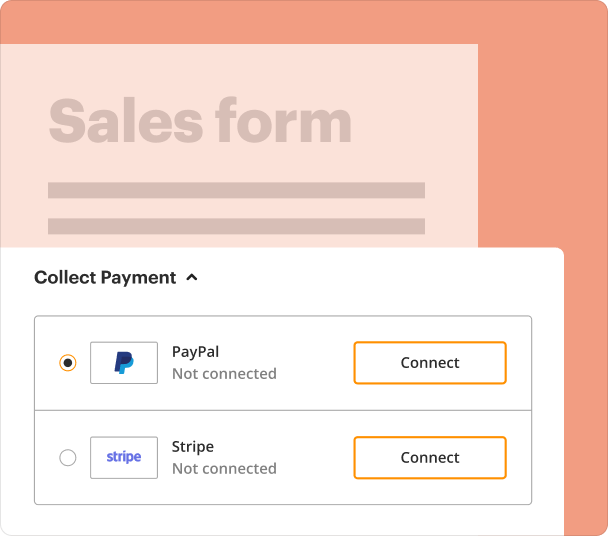

Life insurance agencies and financial services firms benefit significantly from this form builder. It streamlines user interactions and transforms lead capturing into a digital and efficient process. Businesses choose to employ pdfFiller for their comprehensive solution, easy accessibility, and collaborative features.

Conclusion

The Pdf Form Builder For Life Insurance Agents from pdfFiller is an essential tool for modernizing the way insurance professionals handle documentation. Its ability to digitize and streamline form creation significantly enhances efficiency and improves client interactions. By utilizing this tool, life insurance agents can ensure they stay ahead in a competitive industry.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms