Build PDF forms with pdfFiller’s Pdf Form Builder For Loan Specialists

How to Pdf Form Builder For Loan Specialists

To effectively use a PDF form builder for loan specialists, begin by accessing the pdfFiller platform. Select the template or create a new form, add necessary fields for data collection, apply validations as needed, and finalize your document.

What is a PDF form builder for loan specialists?

A PDF form builder designed for loan specialists allows users to create, edit, and manage form templates tailored for the financial industry. It simplifies the process of gathering information from clients through interactive forms, facilitating smoother loan applications and approvals.

How does a PDF form builder improve handling paperwork?

Using a PDF form builder streamlines the preparation of important documents. It enhances efficiency by enabling quick edits, e-signatures, and real-time collaboration, which reduces the time spent on traditional paperwork, ultimately leading to quicker loan processing.

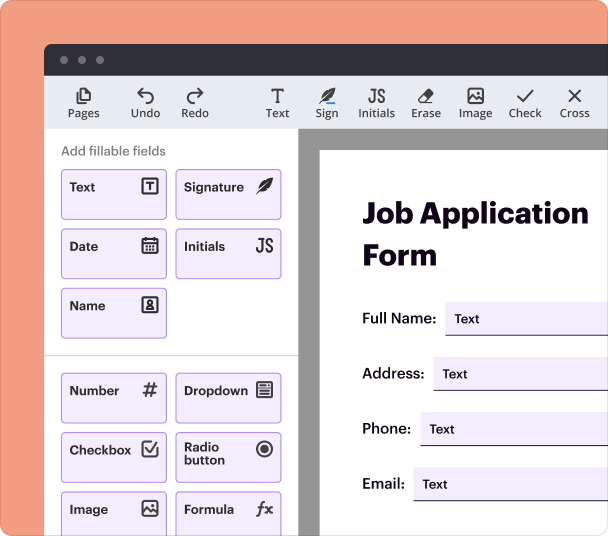

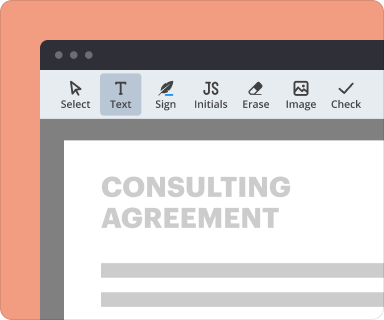

Steps to add fields when you create PDF forms

To add fields in pdfFiller, users can follow these steps: 1) Open your document in pdfFiller. 2) Select 'Add Fields' from the menu. 3) Choose from various interactive field types such as text boxes, radio buttons, and dropdowns. 4) Drag the selected fields to the desired locations on your form. 5) Customize field properties as needed.

Setting validation and data rules as you create forms

When creating forms, setting validation rules ensures data accuracy. This can be done by configuring field requirements, such as specifying if a field must be filled or if it should only accept certain formats (e.g., numerics for loan amounts). Doing this minimizes errors during data entry and enhances the overall efficiency of the form.

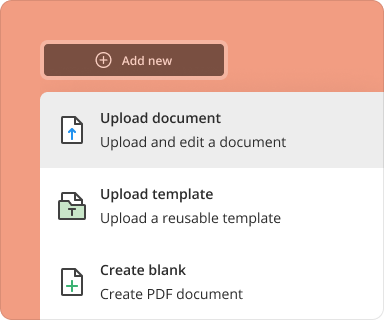

Going from blank page to finished form

Transforming a blank page into a complete form is simple using pdfFiller. Start by selecting a template or a blank canvas. Add fields for client information, loan specifics, and any necessary legal disclaimers. Review the form for completeness, making sure all interactive elements work seamlessly before saving or distributing.

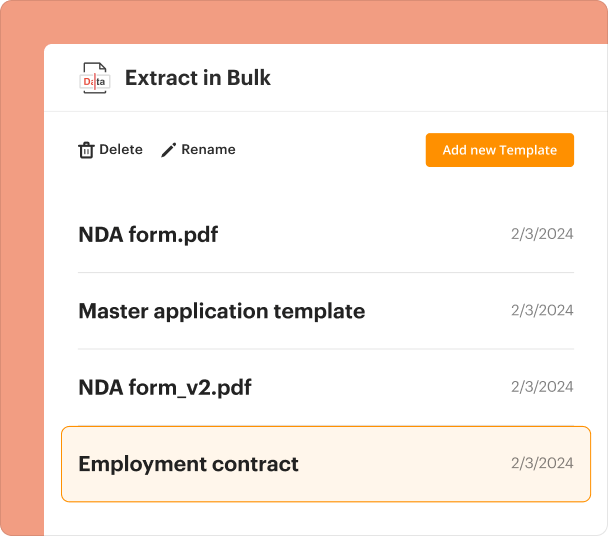

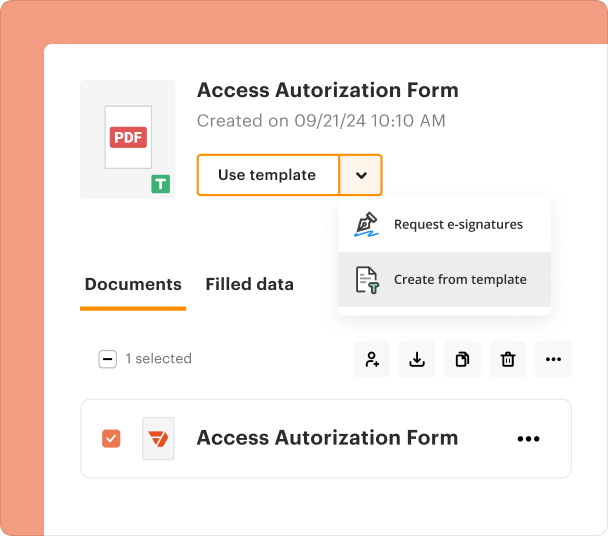

Organizing and revising templates

Managing templates in pdfFiller allows for easy updates and standardization across forms. Users can revisit previous documents, make necessary adjustments to reflect any changes in loan policies, and duplicate templates to streamline the creation of similar forms across different loan products.

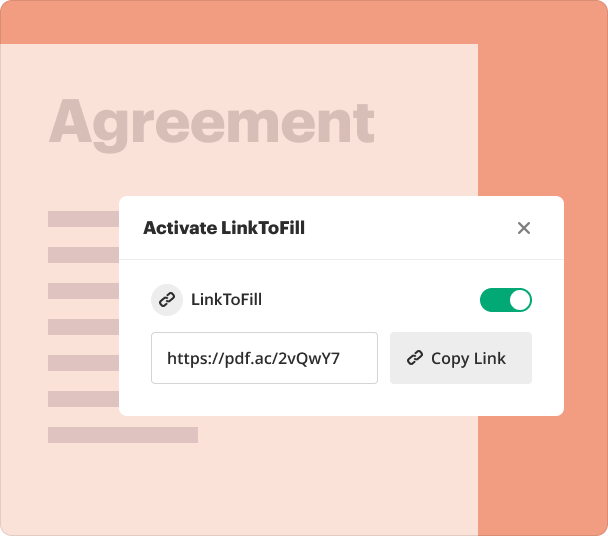

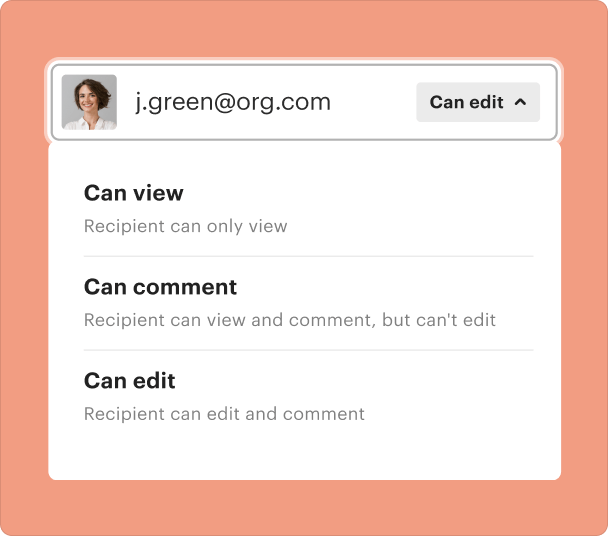

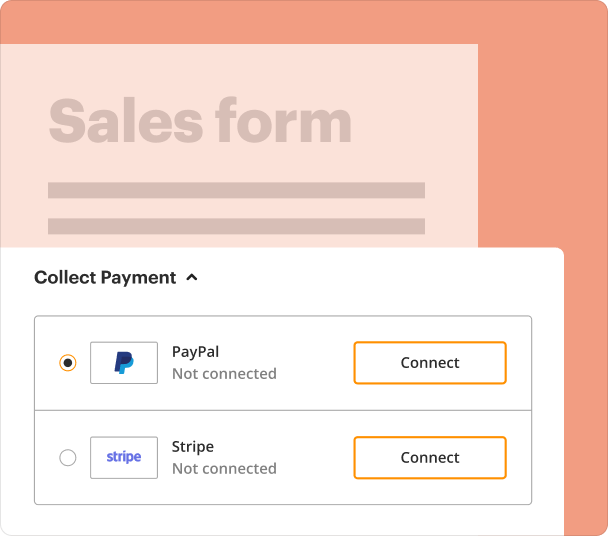

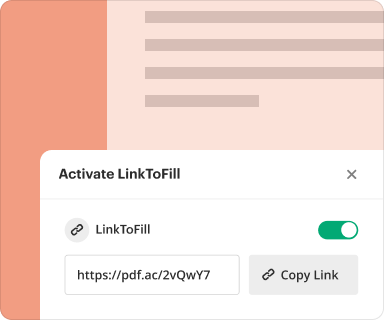

Sharing results and monitoring responses

After distributing forms, it’s crucial to track how they perform. pdfFiller allows you to share forms via email or link. Users can monitor which clients have opened and completed the forms, providing insights on engagement and prompting follow-ups for outstanding submissions.

Exporting collected data after form submissions

Collecting and managing data effectively involves exporting submitted forms. pdfFiller supports exporting data in various formats such as CSV or directly into your CRM. This feature guarantees that you can analyze and utilize client data efficiently for decision-making and record-keeping.

Where and why businesses use PDF form builders

PDF form builders are increasingly being adopted across industries, especially in finance, healthcare, and education, due to their ability to simplify documentation processes. Loan specialists can harness these tools to improve customer service and support compliance with regulatory requirements by ensuring documentation is accurate and accessible.

Conclusion

Utilizing a PDF form builder for loan specialists, like the one provided by pdfFiller, significantly enhances the loan application process. By enabling easy document creation, management, and tracking, pdfFiller positions itself as an invaluable tool in the financial sector, paving the way for better client interactions and streamlined operations.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms