Build PDF forms with pdfFiller’s Pdf Form Builder For Mortgage Finance Officers

What is a PDF form builder for mortgage finance officers?

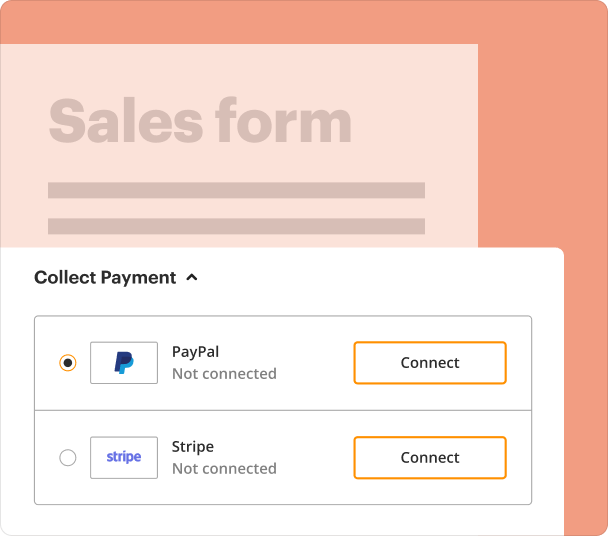

A PDF form builder for mortgage finance officers is a tool that allows users to create, edit, and manage interactive PDF forms specifically designed for the mortgage finance industry. This capability ensures that mortgage professionals can streamline their document processes, enhancing efficiency in information collection and compliance. With features like data validation and eSignature integration, these tools facilitate smoother transaction workflows.

-

Quick creation of mortgage-related documents

-

Integration of interactive elements for better data collection

-

Cloud storage for easy access and collaboration

How does a PDF form builder change document preparation?

Utilizing a PDF form builder significantly transforms the document preparation landscape for mortgage finance officers. It minimizes dependency on paper forms by enabling the digital creation, distribution, and signing of documents. This shift leads to reduced processing time, improved client satisfaction, and lower operational costs. The seamless transition from traditional methods to digital solutions represents a critical enhancement for businesses aiming to modernize their operations.

-

Eliminates the need for physical documents

-

Facilitates faster processing and increased productivity

-

Enhances security and compliance with electronic records

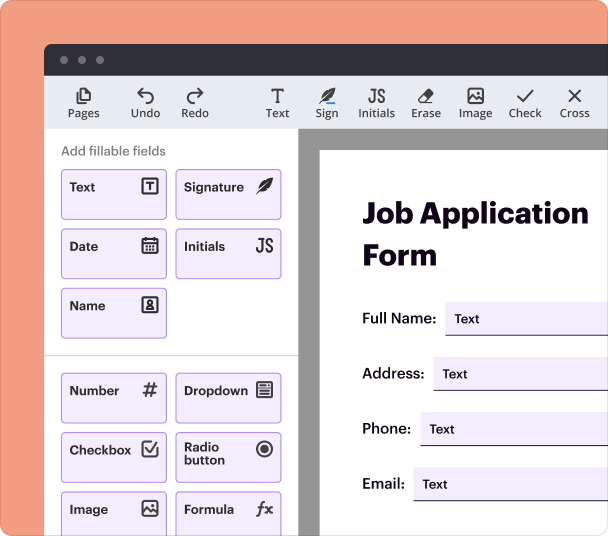

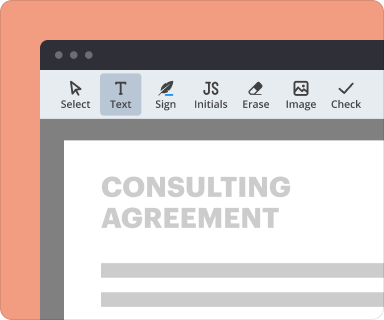

Steps to add interactive fields when using a PDF form builder

Adding interactive fields to your PDF forms can significantly enhance user experience by allowing clients to fill out necessary information directly. Using pdfFiller, the process to add interactive fields is straightforward.

-

Open your PDF document in pdfFiller.

-

Choose the 'Add Fields' option from the toolbar.

-

Select the type of field (e.g., text box, checkbox, dropdown) that you want to add.

-

Drag the selected field onto your form and position it appropriately.

-

Save your changes to create an interactive PDF form.

Setting validation and data rules as you create PDF forms

Setting validation and data rules is crucial when creating forms, especially in mortgage finance, where accuracy is paramount. This feature ensures that the information collected meets the necessary guidelines and assists in minimizing errors.

-

Select the field you want to apply validation rules to.

-

Choose from various validation options like required fields or data type checks (e.g., numbers, dates).

-

Specify any custom messages that should appear if validation fails.

-

Save the settings and test the form to ensure rules function as intended.

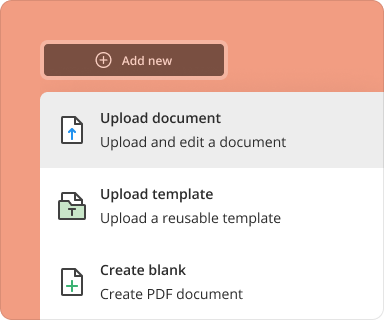

Going from blank page to finished form while using a PDF form builder

Transitioning from a blank page to a completed PDF form is straightforward with pdfFiller. The platform provides intuitive tools to design your documents efficiently.

-

Start with a blank template or upload an existing document.

-

Use tools to add text, images, or logos where necessary.

-

Incorporate interactive form fields for data input.

-

Check your layout and settings before finalizing.

-

Download or share the form electronically.

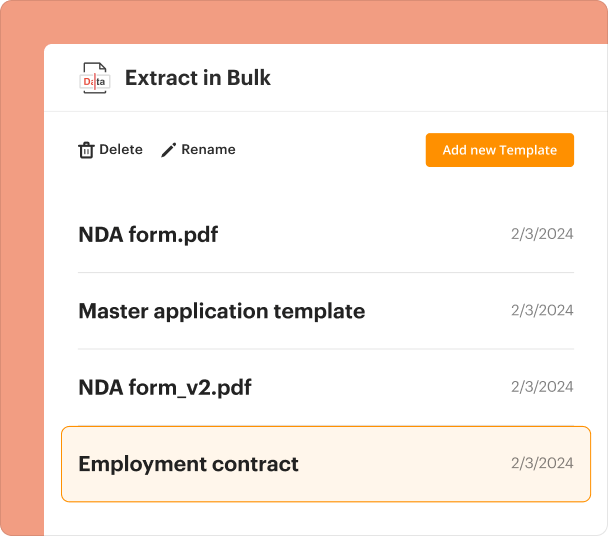

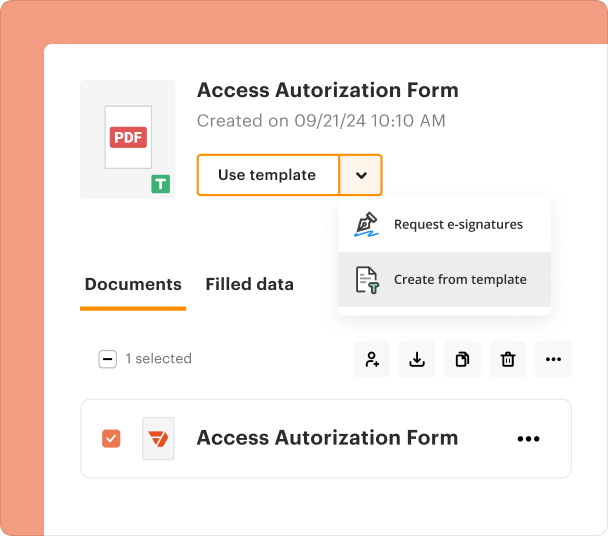

Organizing and revising templates when using a PDF form builder

Organizing and revising templates is vital for maintaining efficiency in form usage. pdfFiller makes it easy to manage multiple versions of documents as your needs change over time.

-

Ensure all templates are stored in designated folders for easy access.

-

Regularly review templates to identify updates needed based on industry changes.

-

Use version control features to keep track of revisions.

-

Delete outdated versions to avoid confusion and maintain clarity.

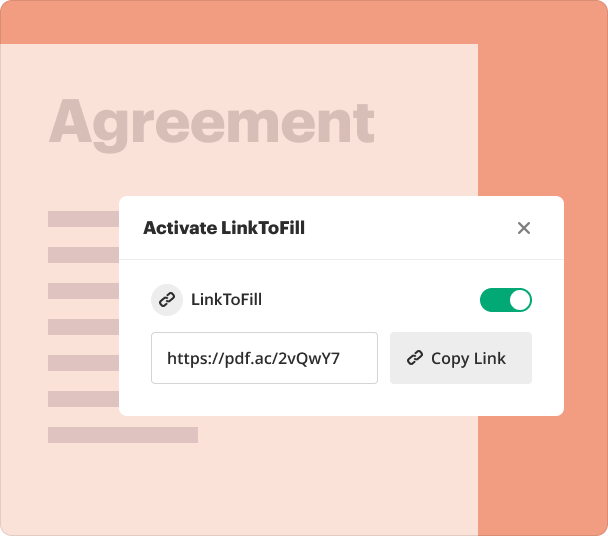

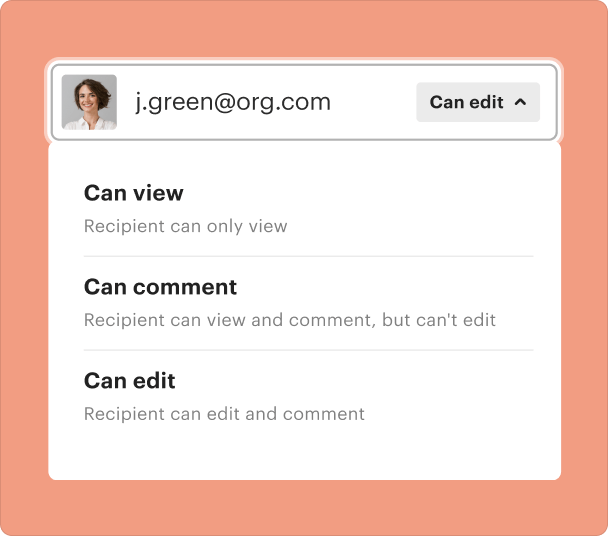

Sharing results and monitoring responses after creating PDF forms

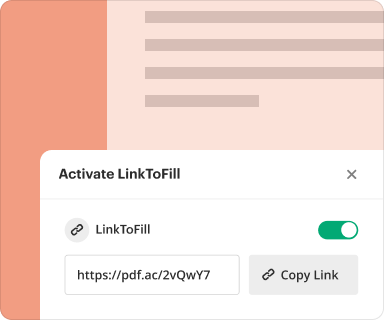

Sharing forms and tracking submissions are crucial for effective workflow. pdfFiller offers options for sharing forms easily while allowing users to monitor responses efficiently.

-

Select the 'Share' function after saving your form.

-

Choose between emailing the form or generating a shareable link.

-

Set permissions for form access where necessary.

-

Use analytics tools available within pdfFiller to view submission data.

-

Respond to submissions based on collected data effectively.

Exporting collected data once you create a PDF form

Exporting data collected from PDF forms is essential for analysis and record-keeping. pdfFiller makes it simple to extract this information in various formats.

-

Navigate to the 'Response' section for your form.

-

Select 'Export' to choose your desired format (e.g., CSV, Excel).

-

Set the parameters for exported data, such as date ranges or specific fields.

-

Download the file or send it directly to another platform.

Where and why do businesses use PDF form builders in mortgage finance?

Businesses in the mortgage finance sector employ PDF form builders to streamline their application and documentation processes. Locations range from banks and credit unions to mortgage brokerages, all leveraging these forms to enhance client experience and ensure compliance.

-

Accelerates loan application processing time.

-

Facilitates clear communication of required information to clients.

-

Promotes better record-keeping and retrieval of documents.

Conclusion

In conclusion, utilizing a PDF form builder is essential for mortgage finance officers aiming to optimize their document workflows. The capabilities offered by pdfFiller not only elevate document creation processes but also enhance collaboration and data management capabilities. By adopting comprehensive tools like pdfFiller, professionals ensure that they remain competitive while improving their operational efficiencies.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms