Build PDF forms with pdfFiller’s Pdf Form Builder For Mortgage Loan Officers

How to use a PDF form builder for mortgage loan officers

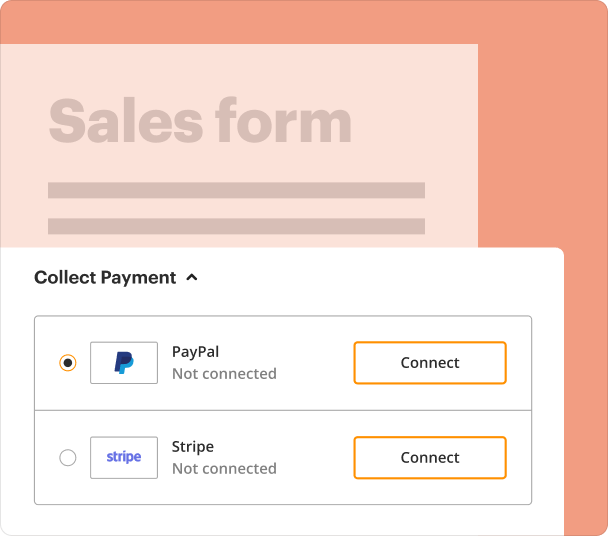

Using pdfFiller’s Pdf Form Builder For Mortgage Loan Officers allows users to create, edit, and manage PDF forms to streamline the mortgage documentation process. This tool enables loan officers to efficiently collect borrower information, obtain electronic signatures, and manage document workflows from anywhere.

What is a PDF form builder for mortgage loan officers?

A PDF form builder for mortgage loan officers is a digital tool that enables the creation of interactive, fillable PDF forms tailored for mortgage applications, disclosures, and compliance documents. With features to customize fields, specify conditional logic, and integrate with data management systems, this tool enhances the efficiency of document preparation.

How does a PDF form builder change document preparation?

A PDF form builder transforms document preparation for mortgage loan officers by automating repetitive tasks, ensuring accuracy, and providing a centralized platform for form management. It eliminates the need for paper forms, reducing errors and enhancing collaboration among teams.

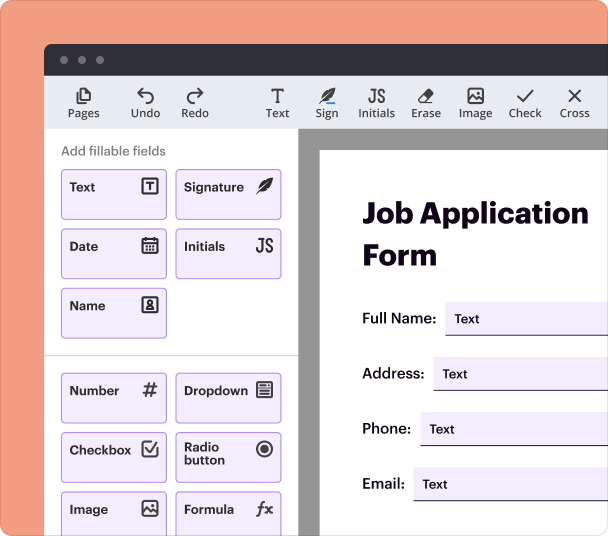

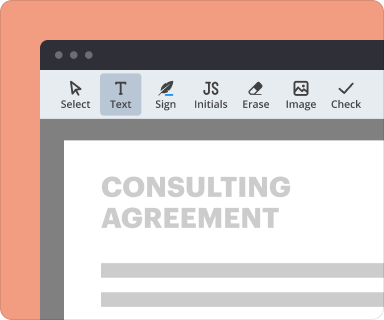

Steps to add interactive fields in a PDF form builder

Adding interactive fields in pdfFiller is straightforward. The drag-and-drop interface allows users to select various field types, including text boxes, radio buttons, and checkboxes, making forms more user-friendly.

-

Open your PDF template within pdfFiller.

-

Select 'Add Fields' and choose the type of field you need.

-

Drag the selected field to your desired location in the PDF.

-

Customize the field properties, such as size and font.

-

Save your changes and preview the PDF.

Setting validation and data rules as you build a PDF form

By setting data validation rules, you ensure that the information entered into the PDF form is correct and complete. This enhances the quality of data collected and ensures compliance with industry standards.

-

Select a field to apply validation.

-

Choose from options such as required fields, input types, or size limits.

-

Set error messages to guide users when entering data.

-

Test the validation by filling the form in preview mode.

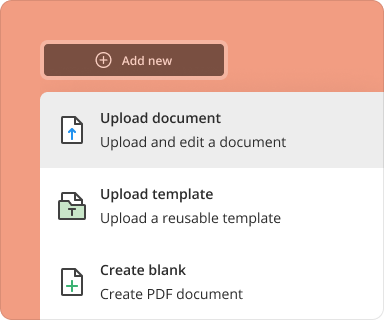

Going from a blank page to a finished form while using a PDF form builder

Creating a complete form in pdfFiller involves more than adding fields; it requires structuring the document for clarity and completeness. Loan officers can build from scratch by starting with standard templates or creating new forms from the ground up.

-

Select 'Create New Form' and choose your starting option.

-

Utilize pdfFiller’s templates or start with a blank page.

-

Add necessary sections for borrower information, loan details, and disclosures.

-

Incorporate interactive fields and validations as discussed earlier.

-

Review and save your completed form to the cloud.

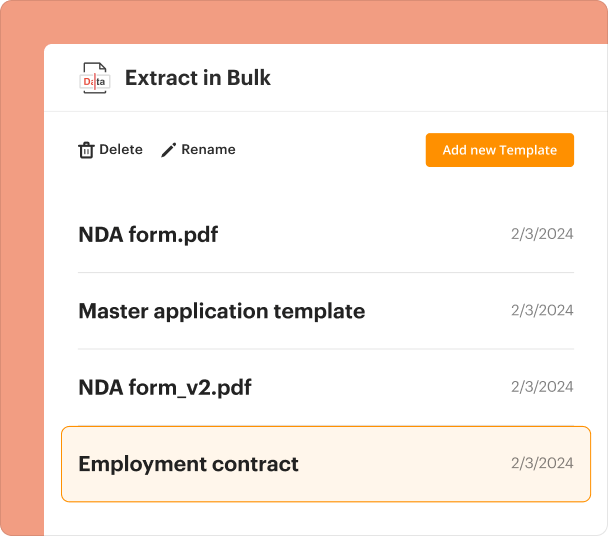

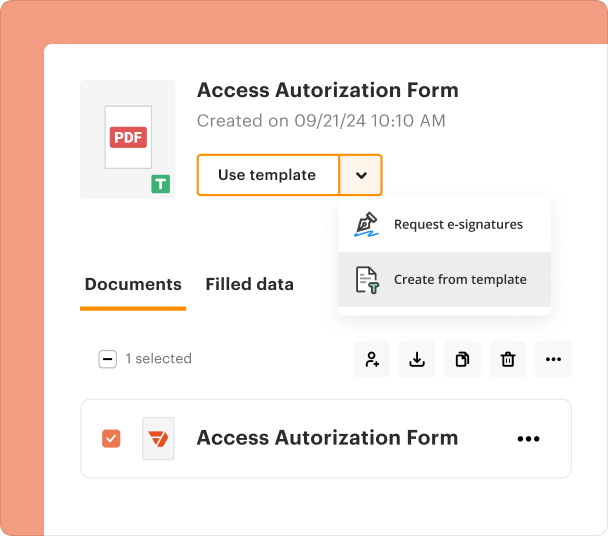

How to organize and revise templates when using a PDF form builder

Managing and updating PDF form templates is crucial for maintaining compliance and relevance. pdfFiller allows users to organize templates efficiently for quick access and modification.

-

Create folders for different types of forms.

-

Regularly review templates to ensure they meet current regulations.

-

Track changes with version control features.

-

Share updated templates with team members for feedback.

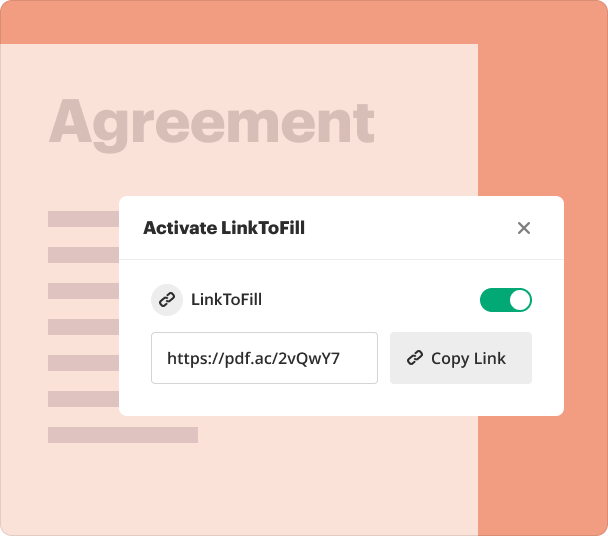

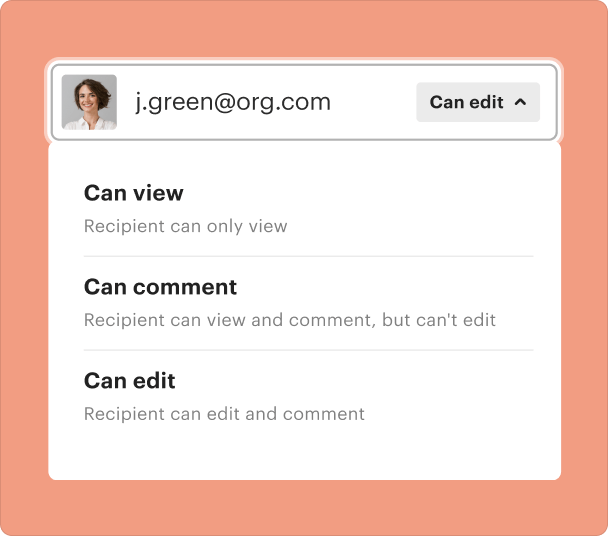

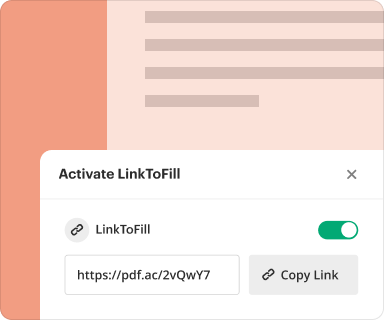

Sharing results and monitoring responses after creating a PDF form

Sharing forms created with pdfFiller is easy and allows for real-time collaboration. Loan officers can send forms directly to clients for completion, and track responses efficiently.

-

Use the 'Share' function to send forms via email or a unique link.

-

Enable response tracking to see when and how clients interact with the form.

-

Collect feedback to improve future forms.

Exporting collected data from a PDF form builder for mortgage loan officers

Once the data is collected, pdfFiller offers various export options, allowing loan officers to efficiently manage information pulled from submitted forms. This can integrate smoothly with other data management tools.

-

Access the submission dashboard to view collected responses.

-

Select the export format – CSV, Excel, or PDF.

-

Download the exported data or send it directly to a third-party tool.

Where and why businesses use a PDF form builder for mortgage loan officers

PDF form builders are widely adopted across various sectors, particularly in financial services. Mortgage loan officers benefit from enhanced efficiency, reduced errors, and improved customer satisfaction by using this digital solution.

Conclusion

The Pdf Form Builder For Mortgage Loan Officers provided by pdfFiller is an essential tool for streamlining document creation and management. By leveraging its features, mortgage professionals can enhance their workflows, improve accuracy, and focus on providing exceptional service to their clients.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms

On line storage and file forms for easy access, easy to operate

What do you dislike?

Wish I could add signature to documents...never given direction for how.

Recommendations to others considering the product:

fairly user friendly...they do not verify before charging annual subscription

What problems are you solving with the product? What benefits have you realized?

Completing misc forms for all uses