Build PDF forms with pdfFiller’s Pdf Form Builder For Tax Preparation Companies

What is a Pdf Form Builder for Tax Preparation Companies?

A PDF Form Builder for Tax Preparation Companies is a specialized tool that enables businesses in the tax sector to design, edit, and manage PDF forms tailored to their needs. With this solution, organizations can streamline the documentation process, making it easier for clients to submit vital information securely and efficiently.

-

User-friendly interface designed for all skill levels.

-

Customizable templates specific to tax documentation.

-

Interactive fields that allow users to easily fill out forms.

-

Integration capabilities with other software used by tax professionals.

-

Secure storage and sharing options to protect sensitive information.

How does a Pdf Form Builder change document preparation?

The Pdf Form Builder revolutionizes document preparation by automating tedious tasks and enhancing collaboration between tax professionals and their clients. It enables a digital approach that minimizes paper usage, promotes quicker turnarounds, and enhances overall communication.

-

Reduces time spent managing physical documents.

-

Allows real-time collaboration and edits.

-

Streamlines the submission and approval workflows.

-

Facilitates easy tracking of document status.

-

Enhances compliance with regulatory standards.

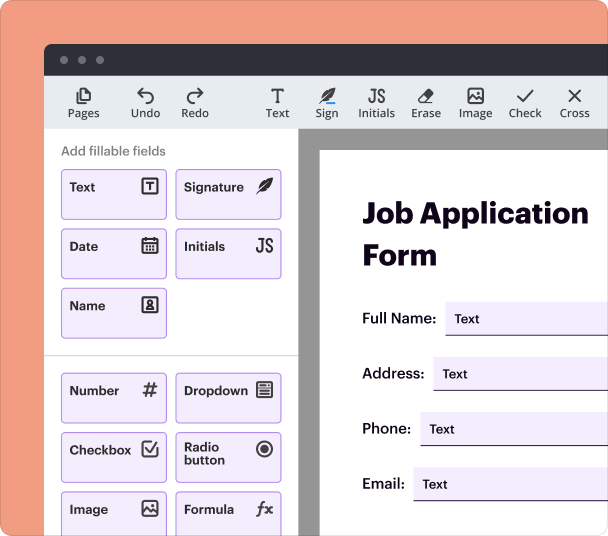

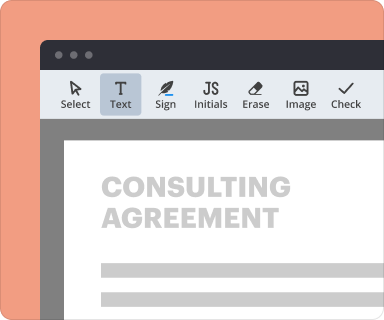

What are the steps to add interactive fields in the Pdf Form Builder?

Adding interactive fields in your PDF form is straightforward with pdfFiller. This process allows you to create forms that are user-friendly and intuitive for your clients.

-

Open your PDF in the pdfFiller platform.

-

Select the 'Add Fields' option from the editing toolbar.

-

Choose the type of field (text, checkbox, dropdown) you want to insert.

-

Drag and drop the field to your desired location in the document.

-

Adjust the properties of the field, such as size and validation rules.

How do you set validation and data rules while creating PDF forms?

Implementing validation and data rules helps ensure the accuracy of the information collected through your PDF forms. This feature is crucial for tax preparation, where precision is vital.

-

Select the field you want to validate.

-

Open the 'Properties' menu for that field.

-

Enable validation options, such as required fields or specific formats (e.g., date or number).

-

Set any additional rules, like character limits for text inputs.

-

Save your changes and test the validation by filling out the form.

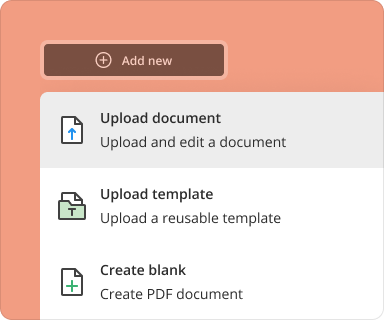

How can you go from a blank page to a completed form using pdfFiller?

Creating a complete form from scratch is streamlined with pdfFiller's intuitive interface. Users can leverage pre-built templates or create one from the ground up.

-

Log into your pdfFiller account.

-

Select 'Create New Document' and choose to start from blank or template.

-

Use the 'Add Fields' feature to include necessary interactive elements.

-

Format text, add branding elements, and adjust layouts.

-

Preview your document and make final adjustments before saving.

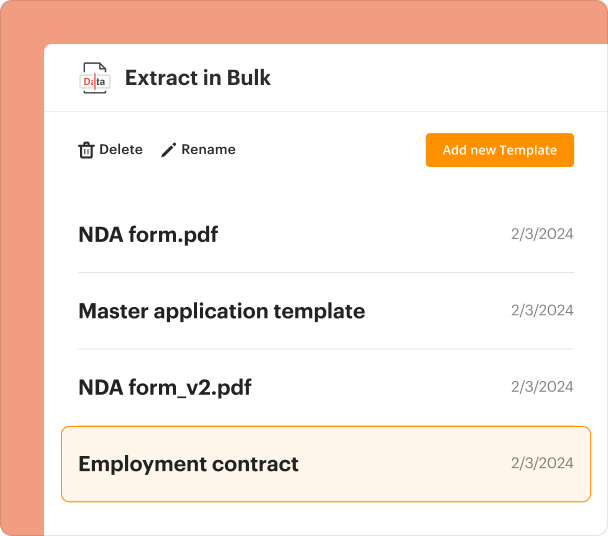

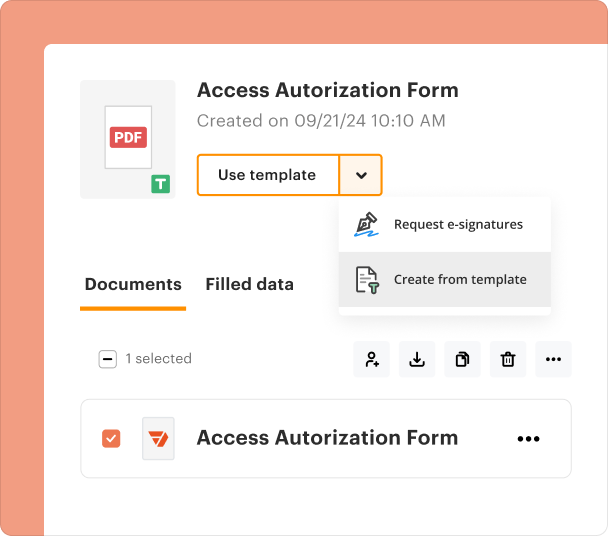

What are the best practices for managing and updating PDF form templates?

Effectively managing and updating your templates is essential for maintaining consistency and compliance in tax preparation. Regular reviews help ensure that forms remain relevant and effective.

-

Regularly review forms for accuracy and compliance with current regulations.

-

Use version control features to track changes made to templates.

-

Incorporate feedback from users to improve form usability.

-

Archive outdated templates for reference or compliance audits.

-

Schedule periodic updates to ensure forms reflect current organizational needs.

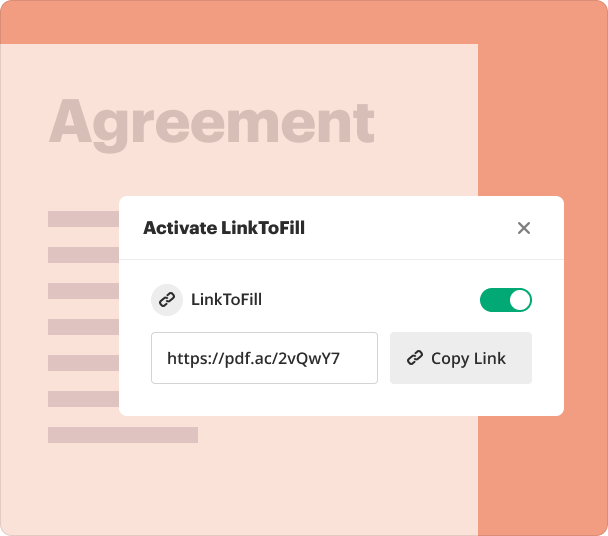

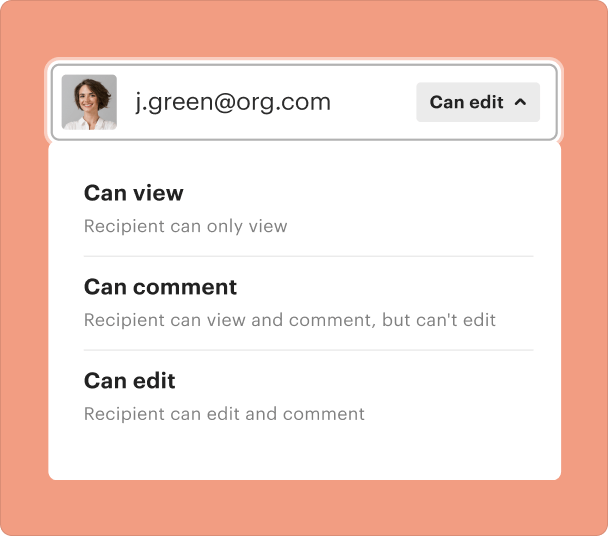

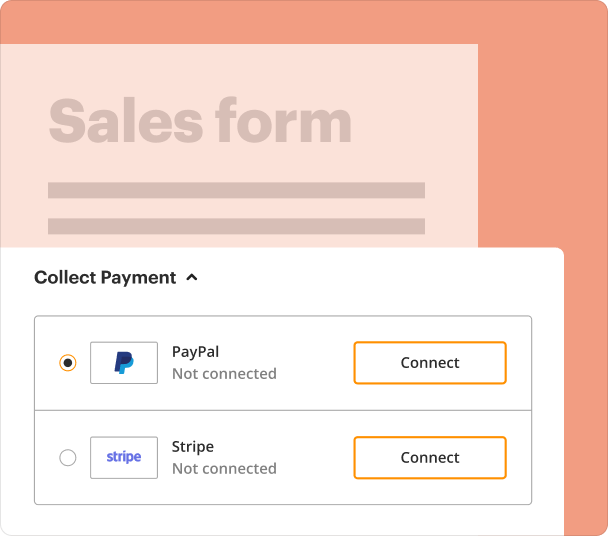

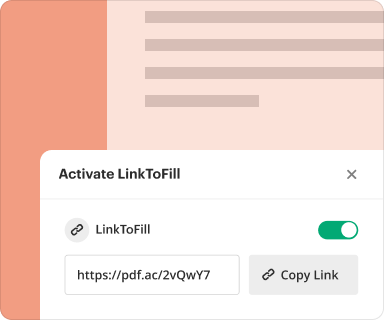

How can you share forms and track activity through pdfFiller?

Sharing forms securely and tracking user interactions helps tax companies manage the completion of necessary documents efficiently. pdfFiller provides robust tools for sharing and monitoring.

-

Select the 'Share' option in your completed document.

-

Choose your preferred sharing method: link, email, or direct invitation.

-

Set permissions on document access and editing options.

-

Track form status and completion through the 'Activity' dashboard.

-

Receive notifications when a form is viewed or filled out.

What are the steps to export and use submitted data from PDF forms?

Exporting and utilizing the data collected from your PDF forms is crucial for analytical purposes and record-keeping. pdfFiller simplifies this process.

-

Go to the 'Completed' section of your account.

-

Select the form from which you want to export data.

-

Click on the 'Export Data' option.

-

Choose your desired format (e.g., CSV, Excel) for the export.

-

Confirm and download the file to your system for further analysis.

Where and why are businesses using a Pdf Form Builder?

Businesses across various sectors utilize a Pdf Form Builder for enhanced organization, efficiency, and customer service. In the tax preparation industry, these tools are particularly beneficial.

-

Tax preparation companies streamline client information collection.

-

Real estate firms manage property disclosure forms digitally.

-

Healthcare providers handle patient intake forms online.

-

Educational institutions simplify enrollment and consent forms.

-

Non-profit organizations reduce paperwork for grant applications.

Conclusion

In conclusion, leveraging a Pdf Form Builder for Tax Preparation Companies enhances operational efficiency, accuracy, and client satisfaction. By utilizing tools like pdfFiller, tax professionals can streamline their documentation processes, ensuring that they remain productive and compliant in their work. This solution plays a significant role in improving how organizations manage paperwork, highlight their professionalism, and ultimately provide better services to their clients.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms