Build PDF forms with pdfFiller’s Pdf Form Creator For Auto Finance Companies

What is a PDF form creator for auto finance companies?

A PDF form creator for auto finance companies is a tool that enables businesses to design, edit, and distribute PDF forms specifically tailored for the finance sector. These forms can capture essential client information, streamline approval processes, and ensure regulatory compliance. By using a platform like pdfFiller, users can create customized forms that enhance operational efficiency and client engagement.

How does a PDF form creator change document preparation?

PDF form creators revolutionize document preparation by simplifying the process of collecting and managing information. Traditionally, creating forms involved laborious manual processes prone to errors. With pdfFiller’s intuitive interface, auto finance companies can quickly generate, modify, and share forms, reducing administrative overhead and minimizing turnaround times.

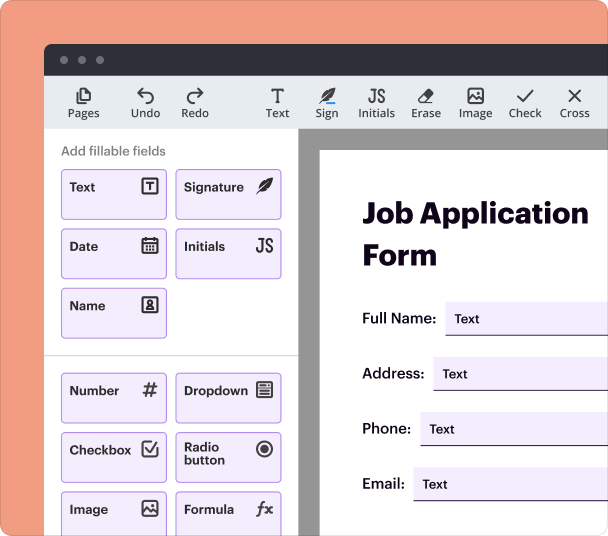

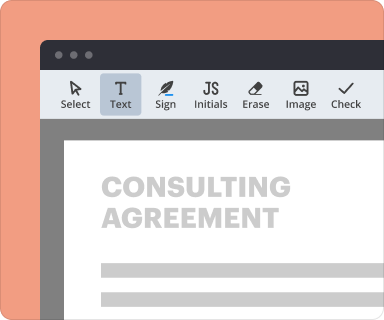

Steps to add fields when you create a PDF form

Adding fields to a PDF form is a straightforward process with pdfFiller. Users can select from a variety of field types, including text boxes, dropdowns, checkboxes, and signature fields. The following step-by-step guide illustrates how to incorporate these interactive elements into forms:

-

Log in to your pdfFiller account.

-

Choose 'Create New' and select 'PDF Form'.

-

Drag and drop the necessary field types onto your document.

-

Customize the fields by modifying properties like size, color, and placeholder text.

-

Save your changes and preview the document.

Setting validation and data rules as you create a PDF form

Incorporating data validation rules enhances the accuracy of collected information. pdfFiller allows users to set specific rules such as required fields, data types (like numeric or date formats), and custom validation messages. This ensures that only correctly filled forms are submitted, reducing follow-up time and errors.

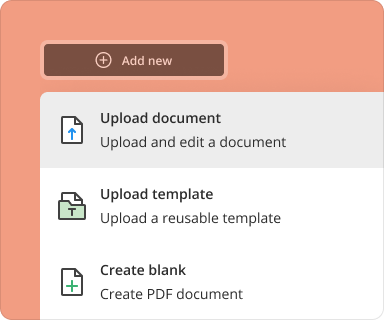

Going from blank page to finished form while you create a PDF form

The process of turning a blank page into a finished form can be achieved in just a few clicks. Begin with a template if available, or create a new document from scratch. Leverage pdfFiller’s library of pre-made templates designed for auto finance industries, or start without one and add elements as necessary.

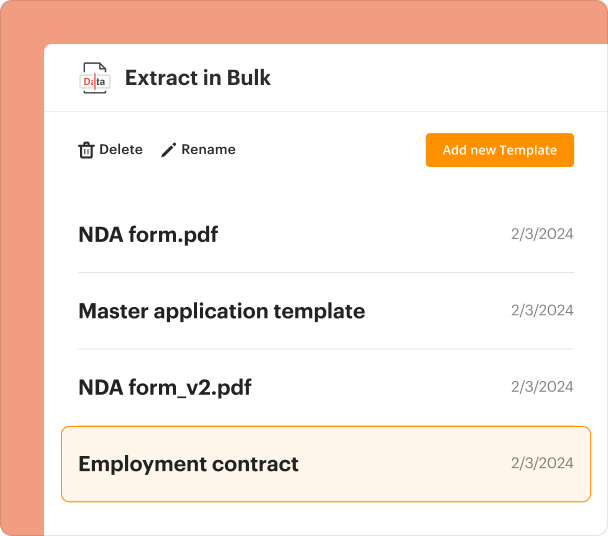

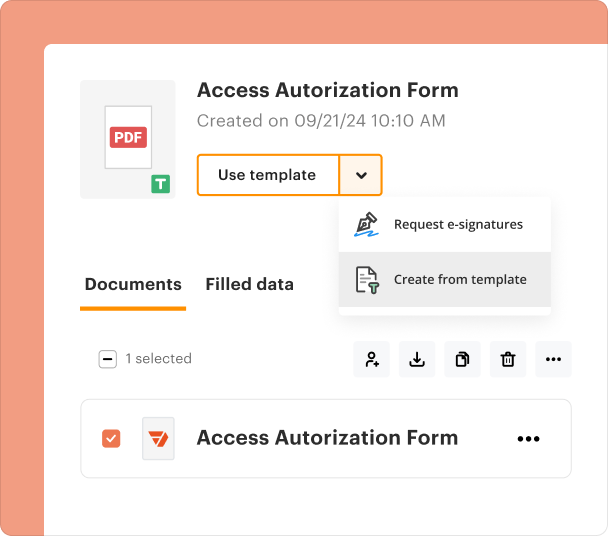

Organizing and revising templates when you create a PDF form

Managing your templates is crucial for efficiency. pdfFiller allows users to organize forms into folders and tag them for easy retrieval. Regular revisions can be made to templates to keep them current with changing regulations or business needs. Simply open your template, make the necessary changes, and save to update it automatically.

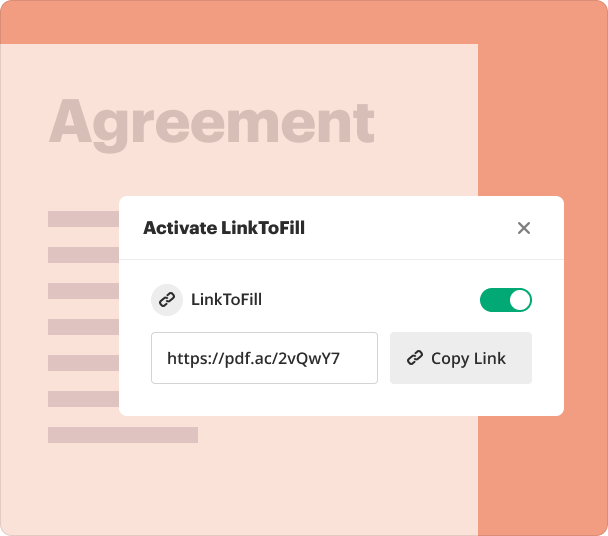

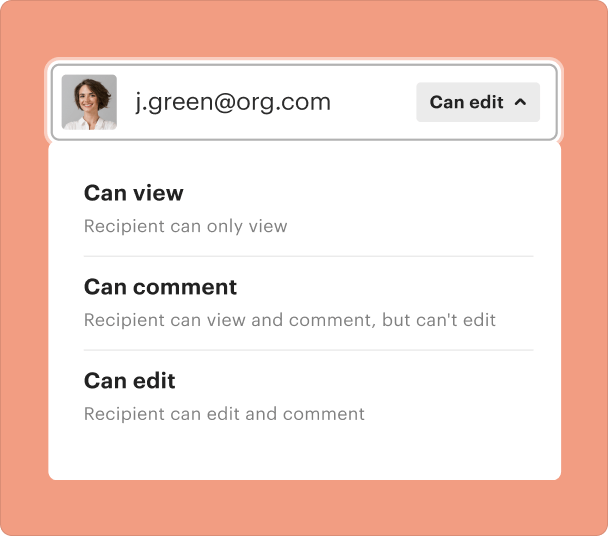

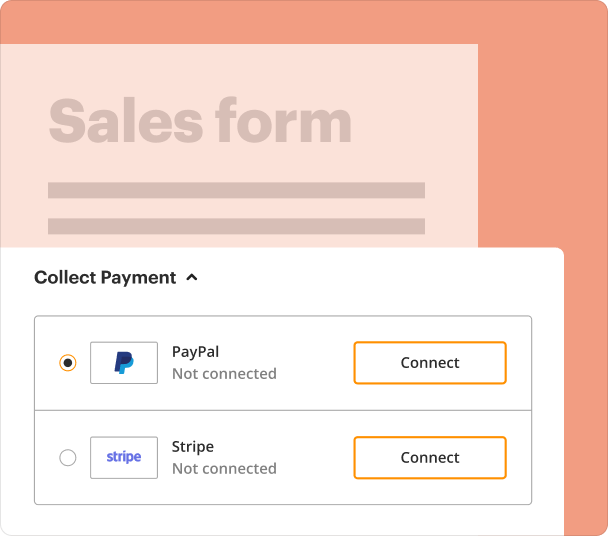

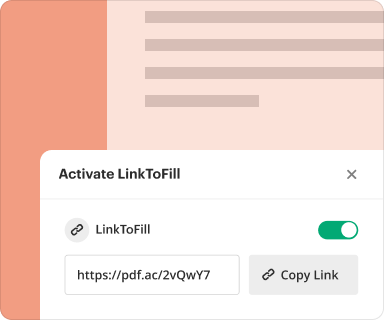

Sharing results and monitoring responses after you create a PDF form

Once forms have been created, sharing them with stakeholders is simple. pdfFiller provides options to send forms via email or share direct links. Users can monitor responses in real-time, allowing for immediate follow-up and ensuring that no submission goes unnoticed.

Exporting collected data once you create a PDF form

After receiving completed forms, exporting data for analysis or storage is seamless with pdfFiller. Data can be exported in various formats such as CSV or Excel, which is ideal for further processing. This ability to easily extract and utilize data can improve decision-making and reporting for auto finance companies.

Where and why businesses use a PDF form creator

Businesses in the auto finance sector utilize PDF form creators for various applications, including loan applications, compliance documents, and customer feedback forms. By leveraging pdfFiller, companies can enhance their efficiency, improve customer experience, and ensure regulatory compliance. These forms are also useful for internal processes, streamlining approvals and documentation management.

Conclusion

In conclusion, pdfFiller’s PDF form creator for auto finance companies leverages cloud-based technology to facilitate the seamless creation and management of essential documents. By utilizing this tool, businesses can reduce manual processes, improve accuracy, and enhance client interactions. The platform not only meets the specific needs of the auto finance industry but also provides flexibility, enabling teams to work collaboratively from anywhere.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms