Build PDF forms with pdfFiller’s Pdf Form Creator For Car Loan Companies

What is a Pdf Form Creator For Car Loan Companies?

A Pdf Form Creator For Car Loan Companies is a tool designed to streamline the creation of PDF forms specifically for the auto financing sector. This functionality allows users to build customizable forms that can be easily filled out by applicants, ensuring a smooth and efficient loan application process.

-

Customizable templates tailored to car loans

-

Interactive fields for data input

-

Cloud storage for easy access

-

eSignature capabilities for approval

How does a Pdf Form Creator For Car Loan Companies change document preparation?

Traditionally, preparing loan documents involved repetitive manual entry and the risk of errors. With a Pdf Form Creator, companies can automate much of this process, ensuring greater accuracy and speed. This allows staff to focus on customer service rather than paperwork.

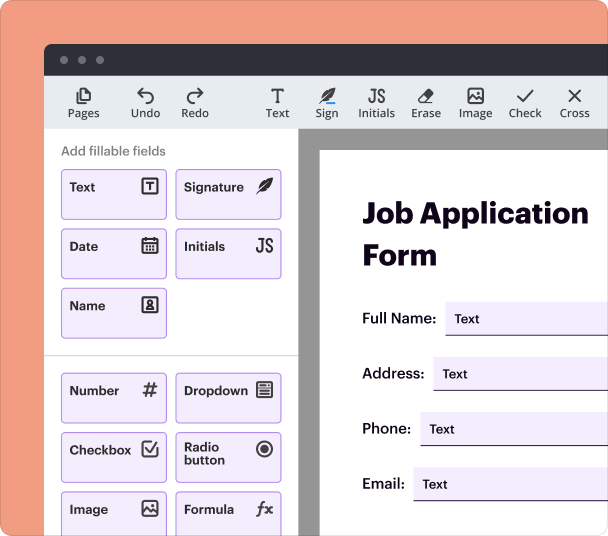

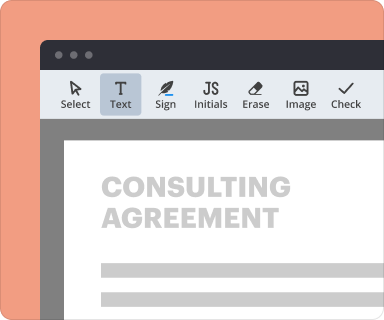

Steps to add fields when you create a PDF form

Adding interactive fields in pdfFiller is straightforward. Follow these steps to enhance your PDF forms:

-

Open your PDF document in pdfFiller.

-

Select the 'Add Field' option from the toolbar.

-

Choose the type of field you want to add (text box, checkbox, dropdown, etc.).

-

Place the field in the desired location on the PDF.

-

Adjust field properties, such as size and label.

Setting validation and data rules as you create a PDF form

Incorporating data validation ensures that users input the correct information. This feature is vital for car loan applications, where data accuracy is paramount. To set rules:

-

Select a field where validation is needed.

-

Access the properties menu for that field.

-

Set conditions for input, such as number ranges for financial figures.

-

Enable mandatory fields to ensure essential information is not omitted.

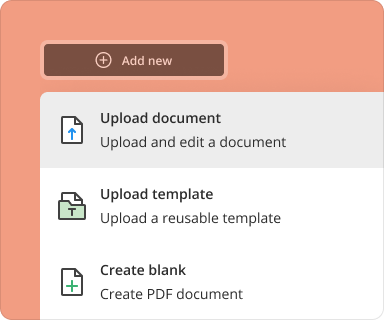

Going from a blank page to a finished form while you create a PDF form

Starting from a blank page can be daunting, but pdfFiller simplifies this with pre-built templates for auto loans. Follow these steps to create your form:

-

Choose a pre-designed template relevant to car loans.

-

Modify the sections according to your requirements.

-

Add necessary fields as outlined previously.

-

Review the form for completeness and accuracy.

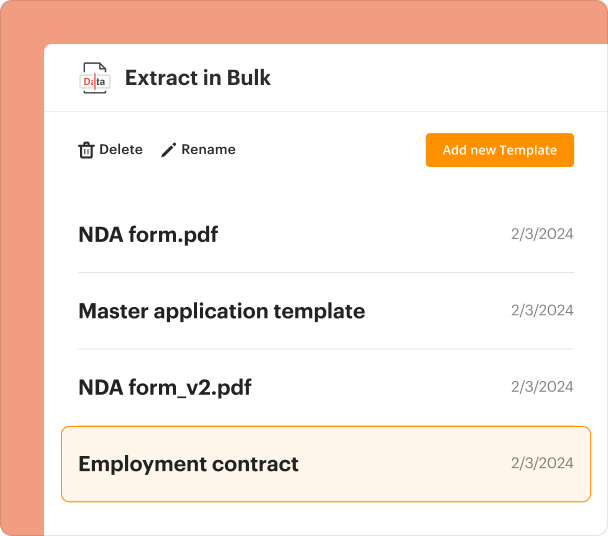

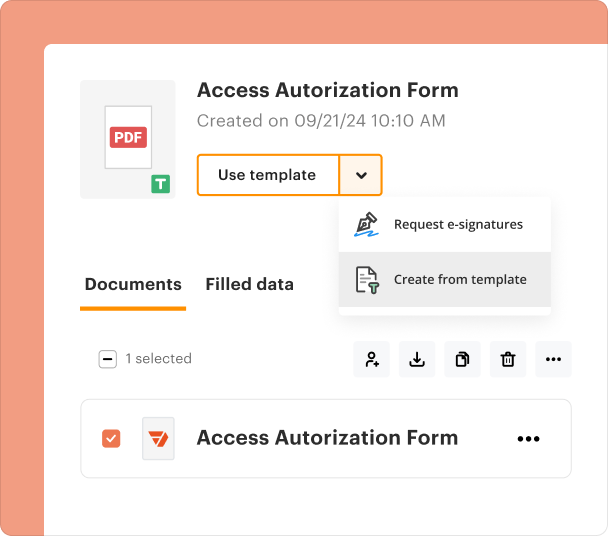

Organizing and revising templates when you create a PDF form

Maintaining a library of templates allows for quick revisions and updates. Keep these best practices in mind:

-

Create multiple versions of templates for different loan types.

-

Regularly review and update templates based on regulatory changes.

-

Catalog templates in a file structure that's easy to navigate.

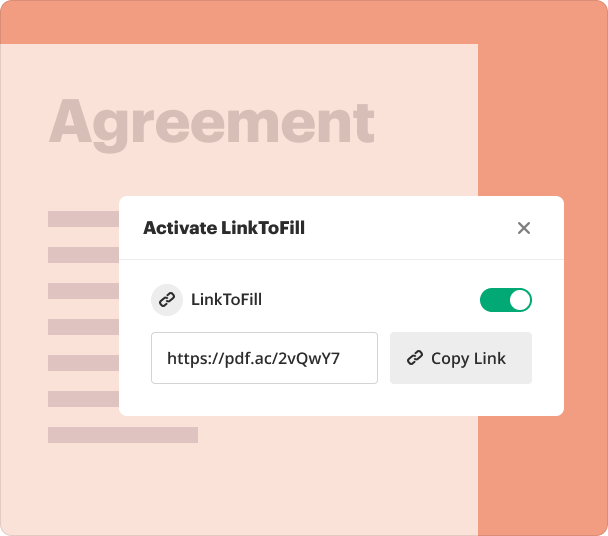

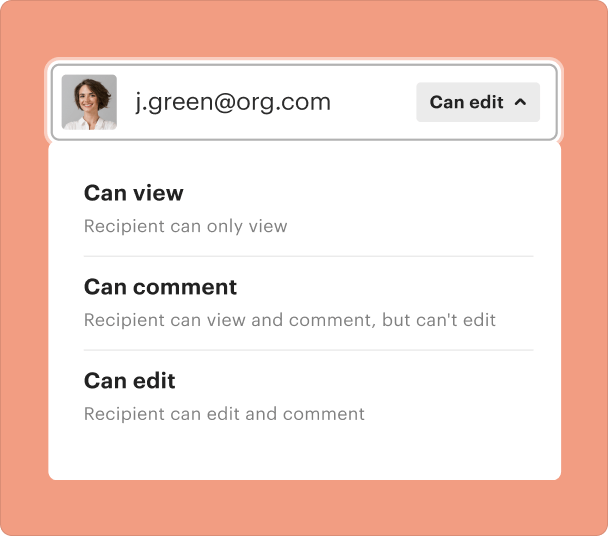

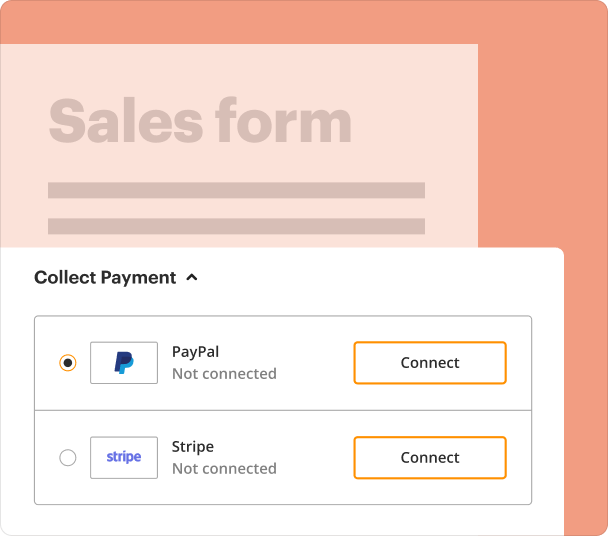

Sharing results and monitoring responses after you create a PDF form

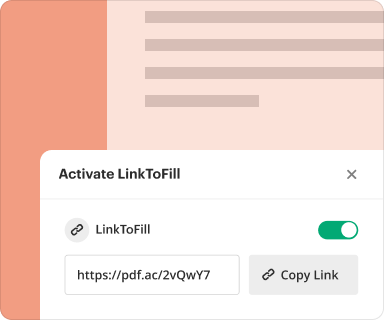

After a form is completed, you can easily share it for collaboration or processing. Here's how to effectively manage the distribution:

-

Use the sharing options within pdfFiller to send forms via email or direct link.

-

Set permissions for viewing, editing, or signing.

-

Track who has accessed the form and their activity.

Exporting collected data once you create a PDF form

Extracting the information submitted through your forms can provide valuable insights. To export data:

-

Access the completed form section in pdfFiller.

-

Select the desired submissions.

-

Choose to export as CSV, Excel, or PDF for reporting.

Where and why businesses use a Pdf Form Creator For Car Loan Companies

Car loan companies utilize PDF form creators for various reasons, including efficiency, accuracy, and data management. Common applications include:

-

Streamlining the loan application process.

-

Ensuring regulatory compliance through structured forms.

-

Collecting customer data for analytics and decision-making.

Conclusion

The Pdf Form Creator For Car Loan Companies significantly enhances the way organizations handle documentation. By automating processes, ensuring compliance, and improving overall efficiency, pdfFiller stands out as a comprehensive solution tailored for the needs of car loan providers. Start using pdfFiller today to transform your document management and streamline your business operations.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms