Build PDF forms with pdfFiller’s Pdf Form Creator For Credit Monitoring Companies

What is a pdf form creator for credit monitoring companies?

A PDF form creator for credit monitoring companies is a tool designed to facilitate the creation and management of fillable PDF documents. This software enables users to construct forms that can capture information from clients, making it invaluable in industries focused on financial data and credit assessments. With pdfFiller's functionalities, organizations can build interactive documents that not only gather user input but also enhance the overall efficiency of data handling.

How does a pdf form creator transform document preparation?

The shift from traditional paperwork to digital forms significantly streamlines document preparation. By utilizing a pdf form creator such as pdfFiller, credit monitoring companies can automate the data collection process and minimize human error. The ability to create and manage forms efficiently reduces time spent on administrative tasks, allowing teams to focus on core business activities. Furthermore, the instant access to data and organized templates enhances team collaboration.

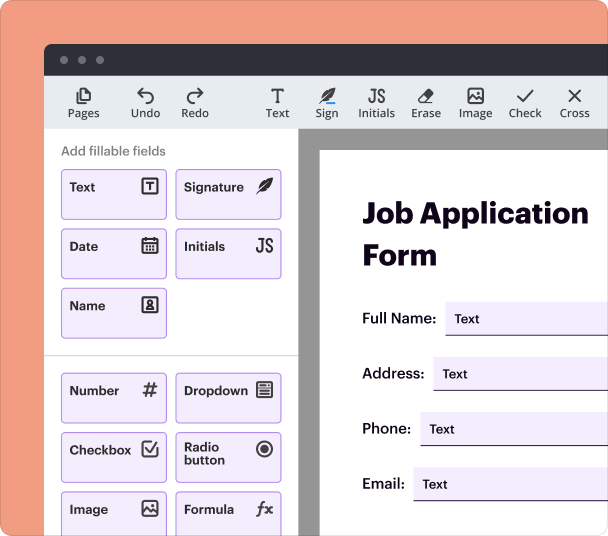

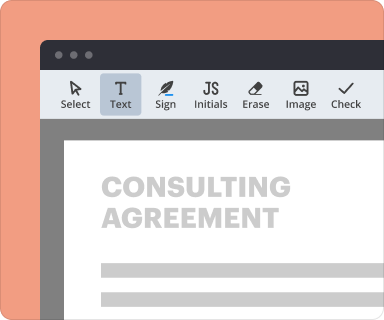

What are the steps to add interactive fields?

Adding interactive fields in your PDF form is straightforward with pdfFiller. The tool allows users to drag and drop various field types to customize their forms. This includes text boxes, checkboxes, radio buttons, and dropdown menus, catering to the diverse data entry needs of credit monitoring firms.

-

Choose your template or upload an existing PDF.

-

Access the form editor to select desired fields.

-

Drag and drop fields into required positions.

-

Configure properties for each field such as validation rules.

-

Save and publish your form.

How to set data rules and validations?

Implementing data rules and validations is essential for ensuring the integrity of the information collected. With pdfFiller, you can set criteria that need to be met before a form is submitted. This feature minimizes errors and ensures accuracy when inputting financial data.

-

Select a field that requires validation.

-

Choose the validation type (e.g., email, date).

-

Enter the validation parameters.

-

Test the validation with sample inputs.

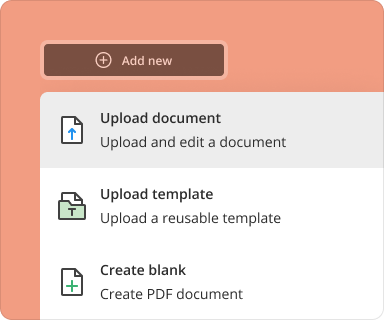

What are the steps to create a complete form from scratch?

Creating a comprehensive form entails careful planning around the information required. With pdfFiller, credit monitoring companies can start with a blank PDF or modify an existing document to fit their needs, ensuring that all necessary information for credit assessments is included.

-

Identify the purpose of the form.

-

List the needed fields based on the data collection goals.

-

Use the form editor to create each field.

-

Finalize the layout for clarity and ease of use.

-

Save and distribute your form.

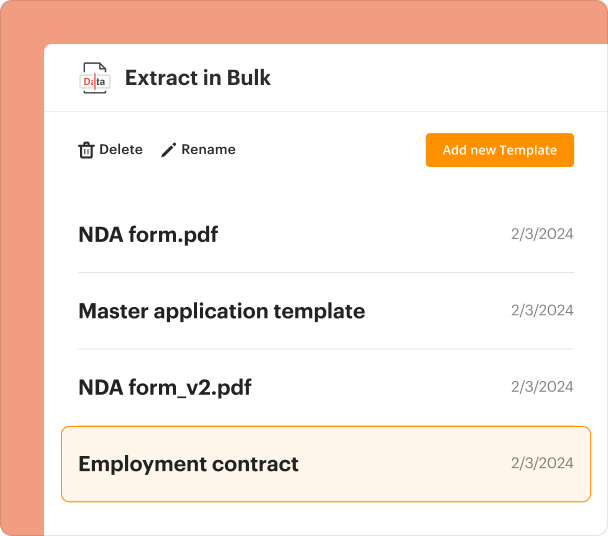

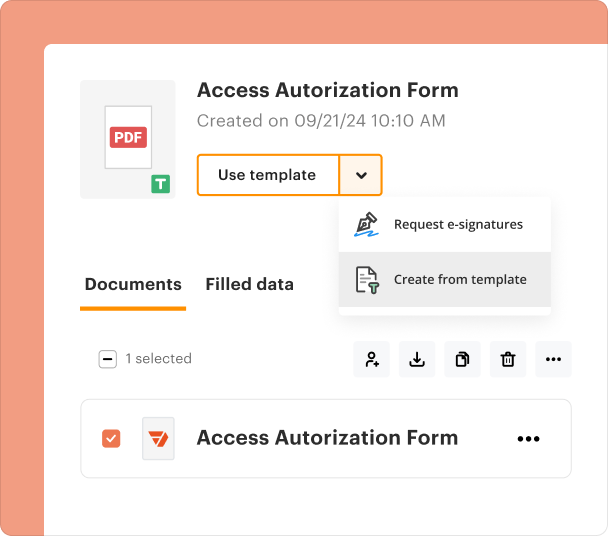

How to manage and update PDF templates effectively?

Managing and regularly updating your PDF templates is vital for ensuring accuracy and compliance. pdfFiller allows users to easily edit existing templates, minimizing the need to recreate documents from scratch. This adaptability helps teams remain agile in their operations and client communications.

-

Access your template library within pdfFiller.

-

Select the template needing updates.

-

Make necessary changes using the editing tools.

-

Save changes and notify team members of updates.

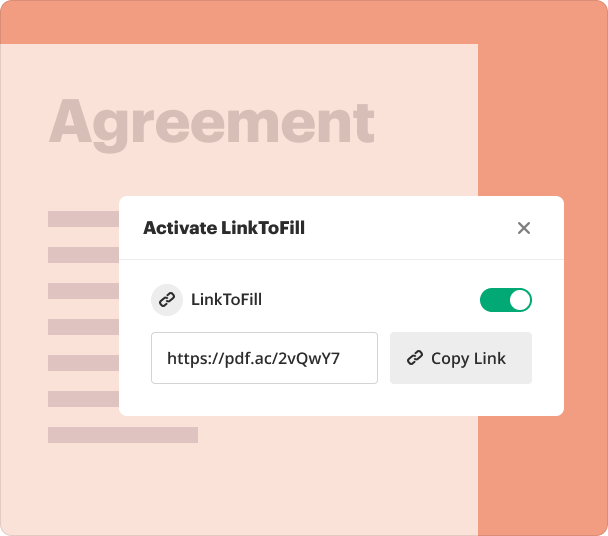

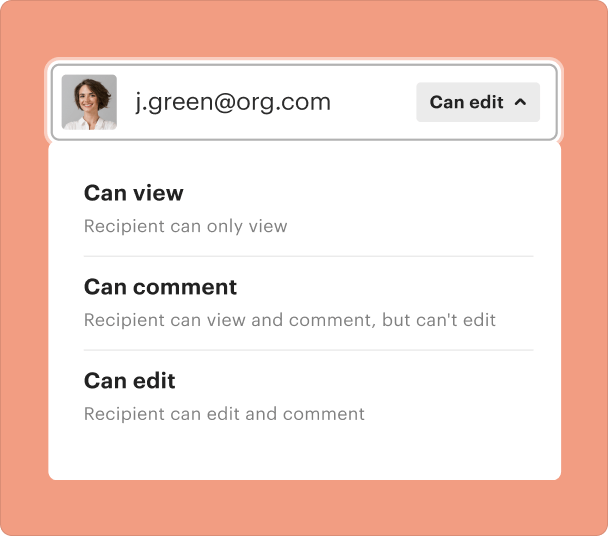

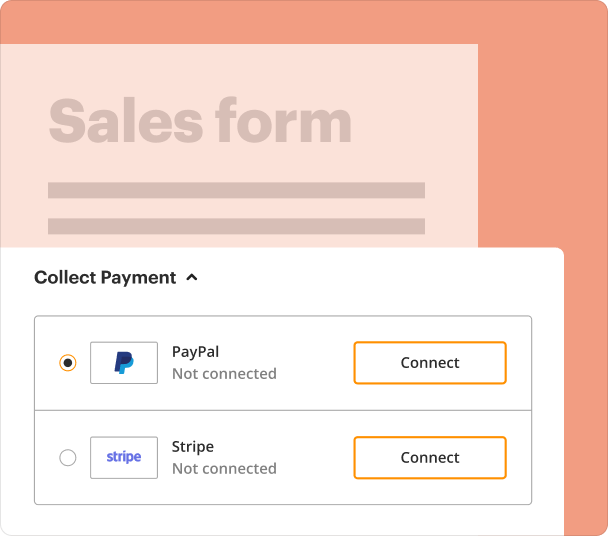

How to share forms and track interactions?

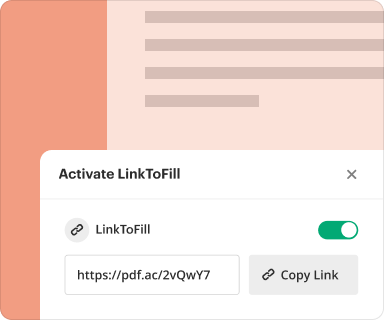

Sharing forms and monitoring responses can greatly enhance workflow efficiency. pdfFiller allows credit monitoring companies to share their forms securely and track completion rates. This valuable feature provides insights into user engagement and identifies bottlenecks in the process.

-

Click on the 'Share' button within the form editor.

-

Choose the sharing method (link, email, website embed).

-

Set permissions for each recipient.

-

Monitor submission statuses through the dashboard.

How to export the submitted data securely?

Exporting collected data from the forms is crucial for data analysis and reporting. pdfFiller provides options to securely download, print, or integrate submissions with external systems, ensuring flexibility in managing client data.

-

Access the 'Responses' section in the dashboard.

-

Select the submissions you need data from.

-

Choose the export format (CSV, XLSX, PDF).

-

Download or connect to external applications.

Where and why do credit monitoring companies use form creators?

Various credit monitoring companies leverage PDF form creators to optimize their document management systems. These tools increase efficiency in client onboarding, data collection, and compliance reporting. Additionally, the ability to create tailored forms allows companies to provide a better customer experience.

Conclusion

In summary, a pdf form creator for credit monitoring companies provides an efficient means of managing documentation and client interaction. With features that include form creation, data validation, and response tracking, pdfFiller enhances organizational workflows while ensuring data integrity. This streamlined approach is essential for any credit monitoring agency looking to implement best practices in their documentation processes.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms