Build PDF forms with pdfFiller’s Pdf Form Creator For Mortgage Loan Processors

How to Pdf Form Creator For Mortgage Loan Processors

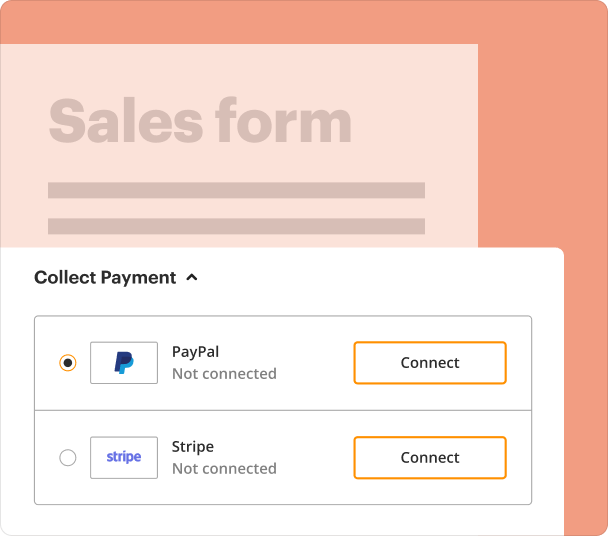

To create PDF forms for mortgage loan processing with pdfFiller, start by selecting a template or a blank document. Use the intuitive drag-and-drop interface to add interactive fields, set validation rules, and customize the layout as needed. Once the form is completed, you can share it directly through email or a unique link, track responses, and export data for analysis.

What is Pdf Form Creator For Mortgage Loan Processors?

Pdf Form Creator For Mortgage Loan Processors refers to tools designed to streamline the creation and management of PDF documents specifically tailored for mortgage loan processing. This solution integrates various functionalities such as dynamic field generation, data validation, and eSignature capabilities, facilitating a smooth workflow for lenders and borrowers.

How does Pdf Form Creator For Mortgage Loan Processors change document preparation?

This PDF form creator revolutionizes document preparation by automating repetitive tasks and providing a user-friendly interface. Mortgage loan processors save time by eliminating the need for paper forms, which can be prone to error and loss. Additionally, the ability to edit and update documents in real-time enhances collaboration among stakeholders.

Steps to add fields when you create a PDF form

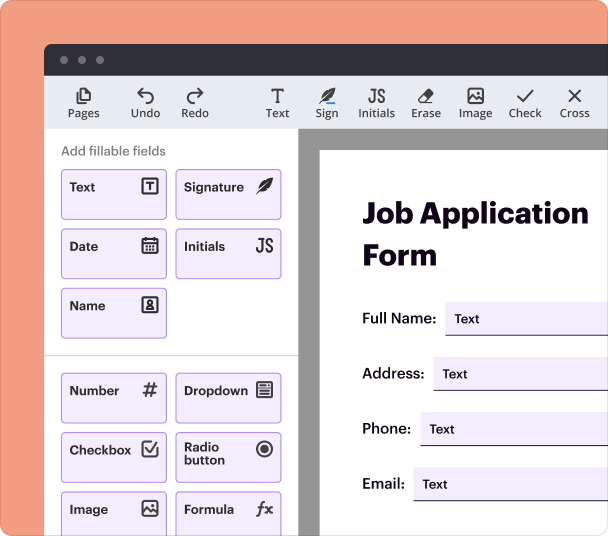

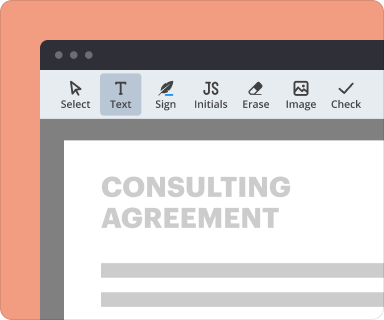

Adding fields to a PDF form is straightforward with pdfFiller. Follow these steps to enhance your forms:

-

Open your PDF document or select a pre-existing template.

-

Use the 'Add Field' tool to choose the type of fields needed (text boxes, checkboxes, etc.).

-

Drag and drop fields into your document where they are needed.

-

Customize each field with properties like title, description, and options.

-

Save your changes once you are satisfied with the layout.

Setting validation and data rules as you create a PDF form

To ensure the data collected through your PDF forms is accurate and useful, pdfFiller allows you to implement validation rules. Validation can range from mandatory fields to specific formatting requirements, ensuring that all necessary data is correctly captured.

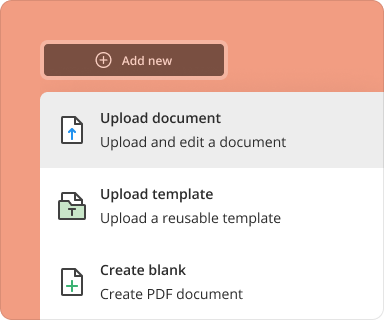

Going from blank page to finished form while you create a PDF form

Starting with a blank page can seem daunting, but pdfFiller makes this process seamless. Utilize pre-existing templates designed for mortgage documents or build from scratch. Customize form elements according to the specific requirements of your loan processing workflow.

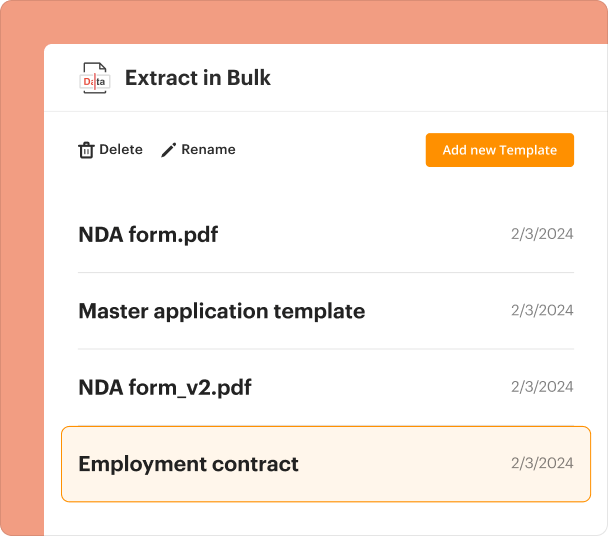

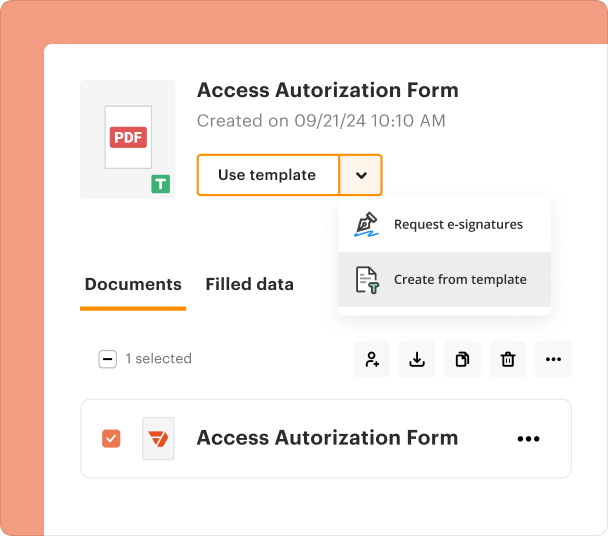

Organizing and revising templates when you create a PDF form

As your needs evolve, so should your templates. pdfFiller offers tools for easy organization and revision of your document templates. Create a library of templates categorized by type or purpose, and quickly update them when regulations change or when new information is required.

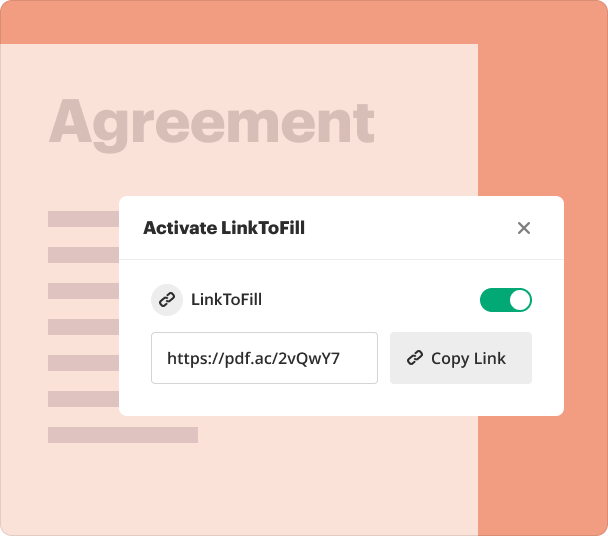

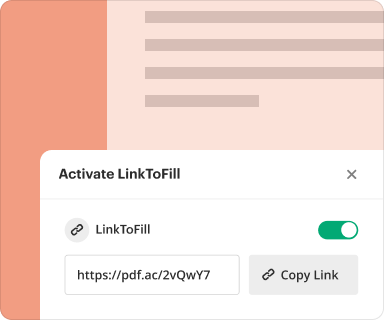

Sharing results and monitoring responses after you create a PDF form

Once you've created and distributed your PDF forms, tracking responses is essential. pdfFiller allows users to receive notifications when forms are completed, providing insights into how quickly and effectively your documents are being processed.

Exporting collected data once you create a PDF form

Upon completion of the forms, you may want to analyze the responses gathered. pdfFiller enables easy data export in various formats such as CSV or Excel, making it simple to transfer the information into your loan processing systems.

Where and why businesses create PDF forms

Businesses across numerous sectors utilize PDF forms for a variety of purposes, including customer onboarding, contract agreements, and internal documentation. Mortgage loan processors specifically benefit from standardized forms that can be quickly filled and shared, thus speeding up the approval process.

Conclusion

Utilizing pdfFiller’s Pdf Form Creator For Mortgage Loan Processors transforms the way documents are handled, providing a comprehensive, cloud-based solution for efficient form management. By integrating form creation, data validation, and eSigning into one platform, pdfFiller empowers mortgage professionals to streamline their operations, reduce errors, and enhance customer satisfaction.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

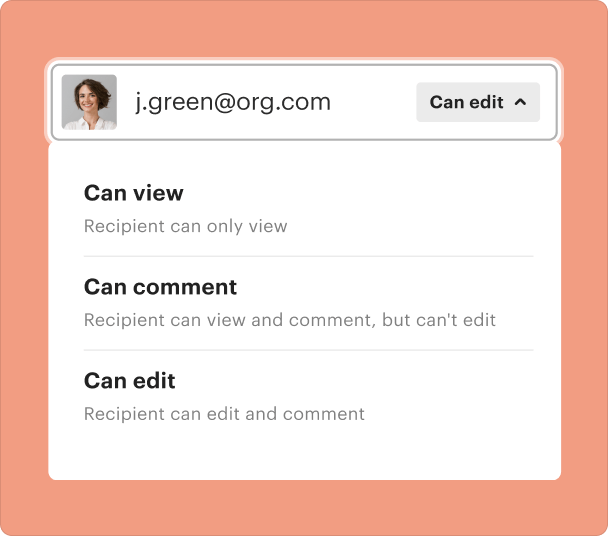

Share and collaborate

pdfFiller scores top ratings on review platforms