Build PDF forms with pdfFiller’s Pdf Form Creator For Mortgage Underwriters

How to create PDF form for mortgage underwriters

To effectively utilize pdfFiller’s Pdf Form Creator for Mortgage Underwriters, start by accessing the platform, then upload your PDF document or create a new form. Use the interactive features to add necessary fields, apply validation rules, and customize your template. Once complete, share the form for collaboration and track responses efficiently.

What is Pdf Form Creator For Mortgage Underwriters?

The Pdf Form Creator for Mortgage Underwriters is a powerful tool provided by pdfFiller that enables users to easily create and manage PDF forms tailored for the mortgage industry. This functionality allows underwriters to streamline document preparation, ensuring that necessary fields are filled out accurately and legally.

How does Pdf Form Creator For Mortgage Underwriters change document preparation?

With pdfFiller's Pdf Form Creator, document preparation is significantly more efficient. The platform empowers mortgage underwriters to create comprehensive forms that can be completed digitally, which reduces the likelihood of errors and ensures compliance with industry standards. This transformation leads to faster processing times and improved communication with clients.

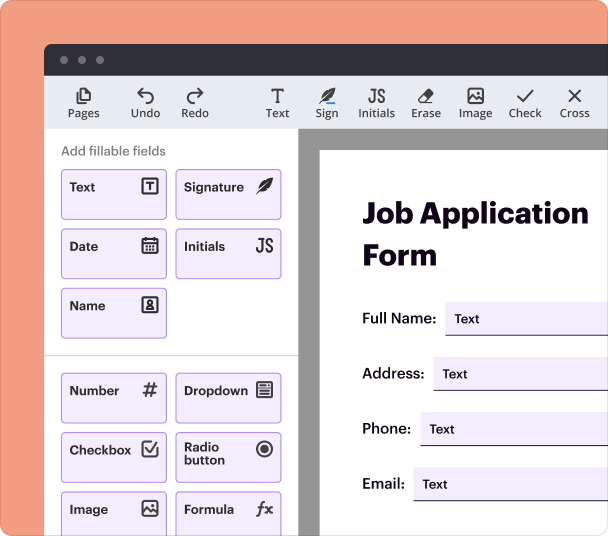

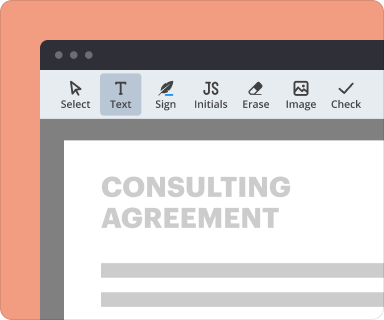

Steps to add fields when you create PDF forms

Adding interactive fields involves a simple process within the pdfFiller platform. To do this effectively, follow these steps:

-

Select the PDF document you want to edit.

-

Use the 'Add Fields' option to choose from various field types such as text, checkbox, dropdown, etc.

-

Drag and drop the fields to their desired locations on the document.

-

Adjust the properties of each field as required.

Setting validation and data rules as you create PDF forms

Setting validation rules enhances the accuracy of data input. As you create your PDF form, you can ensure that users fill out information correctly according to predefined criteria. This includes setting fields as mandatory, applying input masks for certain data types, and validating email or phone formats.

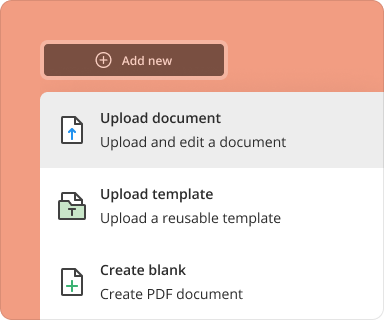

Going from blank page to finished form while creating PDF forms

Creating a complete PDF form from scratch can initially seem overwhelming. However, with pdfFiller's intuitive interface, you can start with a blank page and gradually build your form by adding text, images, and various field types. This flexibility allows you to tailor your form exactly as needed for each mortgage application.

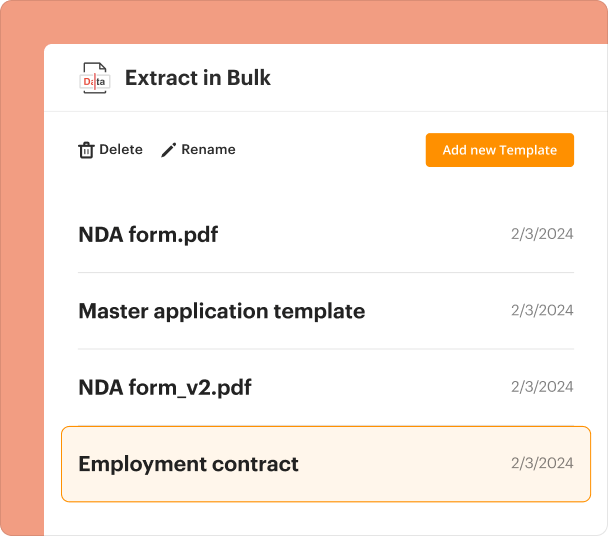

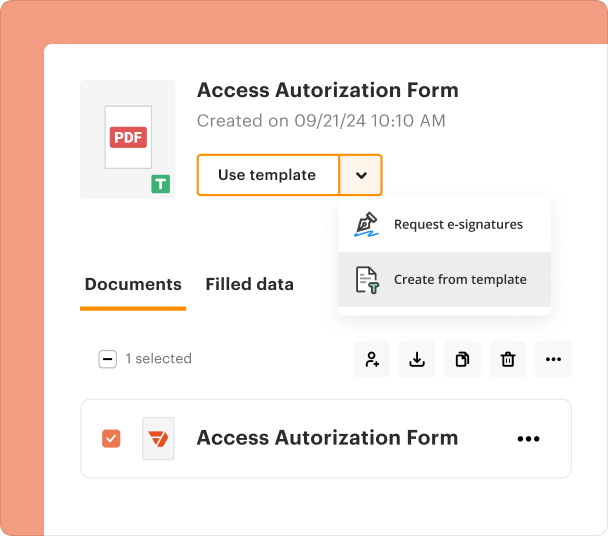

Organizing and revising templates when creating PDF forms

Once your templates are created, organization becomes vital for easy access and revision. pdfFiller allows you to categorize your templates, making it simple to update them as regulations change or as your business needs evolve. Regularly revising templates ensures that your forms are current, helping maintain compliance.

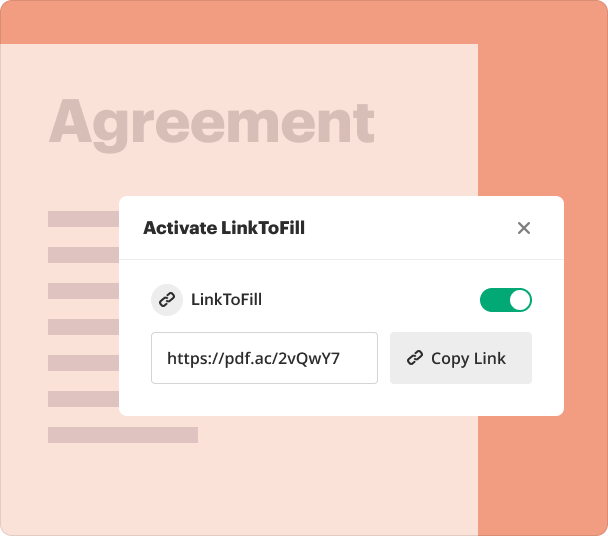

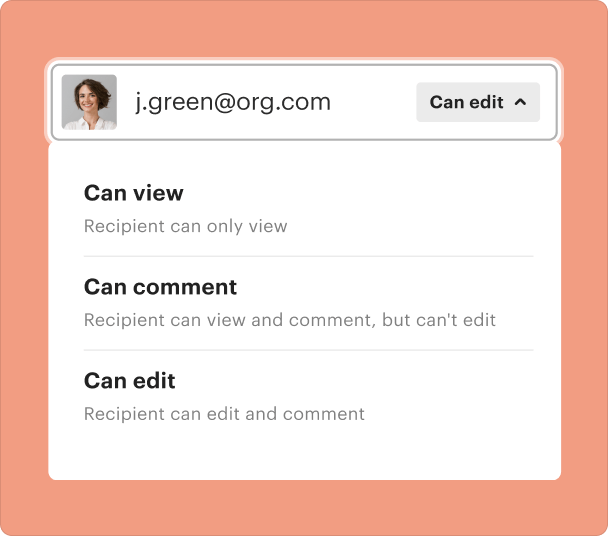

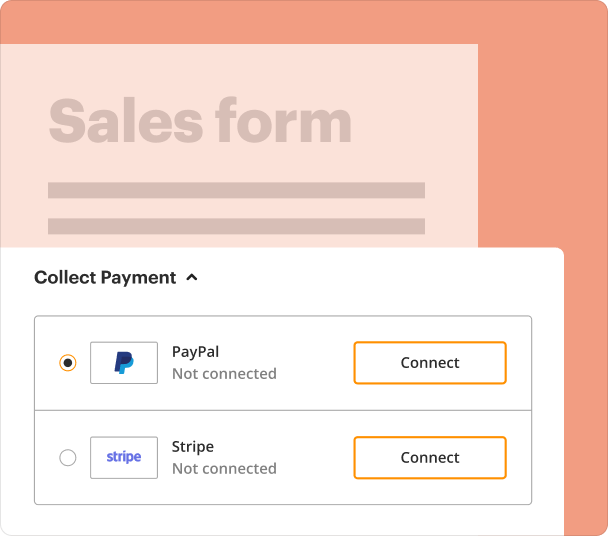

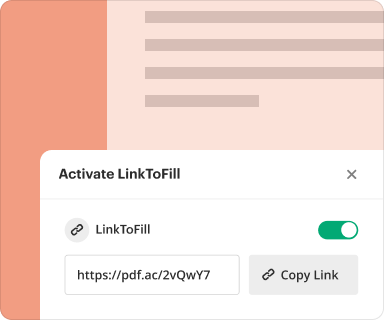

Sharing results and monitoring responses after creating PDF forms

After creating PDF forms, sharing them securely is essential. pdfFiller facilitates sharing through email or direct links, allowing tracking of who has opened or completed the form. This tracking capability is crucial for mortgage underwriters to ensure timely responses and manage workflow efficiently.

Exporting collected data once you create PDF forms

Once your forms are completed and submitted, exporting the collected data is simple. pdfFiller enables users to download responses in various formats, ensuring that important data is easily accessible for further processing in other applications or systems.

Where and why businesses use Pdf Form Creator For Mortgage Underwriters

Pdf Form Creator for Mortgage Underwriters is widely used in various industries, particularly within banking, real estate, and finance sectors. Its efficiency in creating detailed and compliant forms for document submission makes it a valuable tool for improving operational workflows, enhancing client interactions, and minimizing paperwork errors.

Conclusion

The Pdf Form Creator for Mortgage Underwriters stands as an essential tool for efficient document management in the mortgage sector. By leveraging its features for creating, editing, and sharing PDF forms, underwriters can streamline their workflows, enhance data accuracy, and improve client satisfaction. Embracing modern technology like pdfFiller is critical in an ever-evolving industry.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms