Build PDF forms with pdfFiller’s Pdf Form Creator For Payroll Accountants

How to create your PDF forms easily

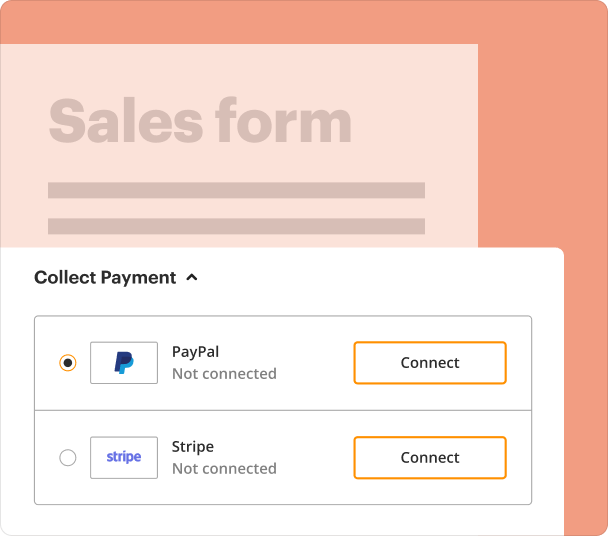

pdfFiller’s Pdf Form Creator For Payroll Accountants provides a user-friendly interface for creating interactive PDF forms in minutes. You can add fields, apply data rules, and manage submissions seamlessly, allowing you to streamline payroll documentation processes.

What is Pdf Form Creator For Payroll Accountants?

The Pdf Form Creator For Payroll Accountants is a robust tool designed for the specific needs of payroll professionals. It allows users to create, edit, and manage PDF forms that are essential for various payroll-related applications. This includes tax forms, direct deposit forms, and employment applications.

How does Pdf Form Creator For Payroll Accountants improve document preparation?

By utilizing pdfFiller, payroll accountants can significantly reduce the time spent on document preparation. The following advantages highlight this improvement:

-

Seamless editing capabilities, allowing for quick updates.

-

Interactive form features enhance user engagement.

-

Cloud-based access for collaboration across teams.

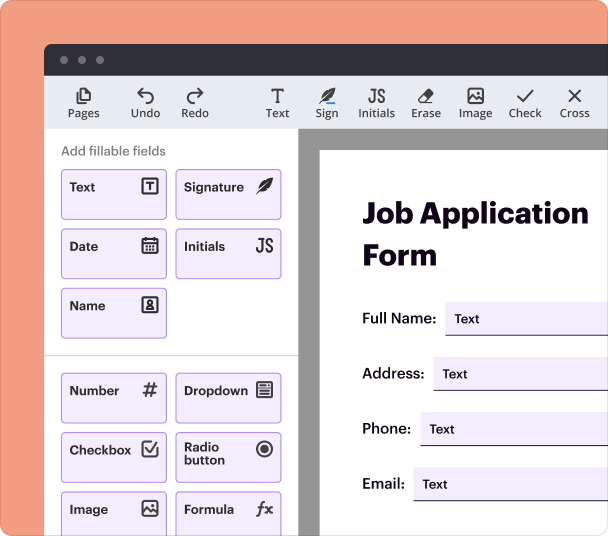

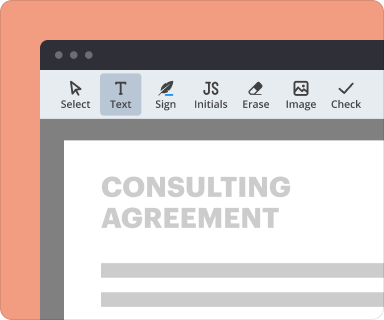

Steps to add fields when you create forms

Adding fields to your PDF form is straightforward. Here’s how to do it:

-

Open your PDF form in pdfFiller.

-

Select 'Add Field' from the toolbar.

-

Choose the type of field (text, checkbox, etc.).

-

Drag and drop the field to your desired location.

-

Customize field properties as needed.

Setting validation and data rules as you create forms

Setting data rules ensures the accuracy and quality of the information collected. Follow these steps to apply data validation:

-

Select a field and open the properties panel.

-

Define rules such as required fields or format restrictions.

-

Save changes to enforce these rules.

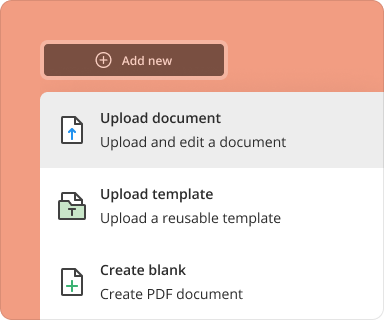

Going from blank page to finished form while using pdfFiller

Creating a complete form from scratch is a simple process. Here's how you can achieve this:

-

Start with a blank document or template.

-

Add necessary fields using the toolbar.

-

Apply data validation and rules.

-

Preview your form.

-

Save and publish your form.

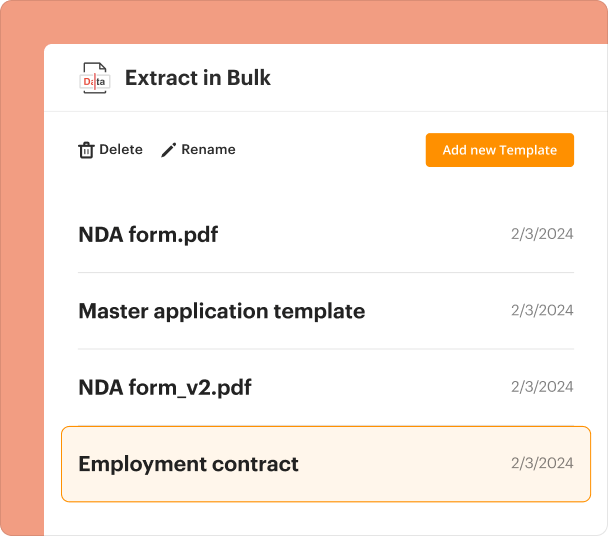

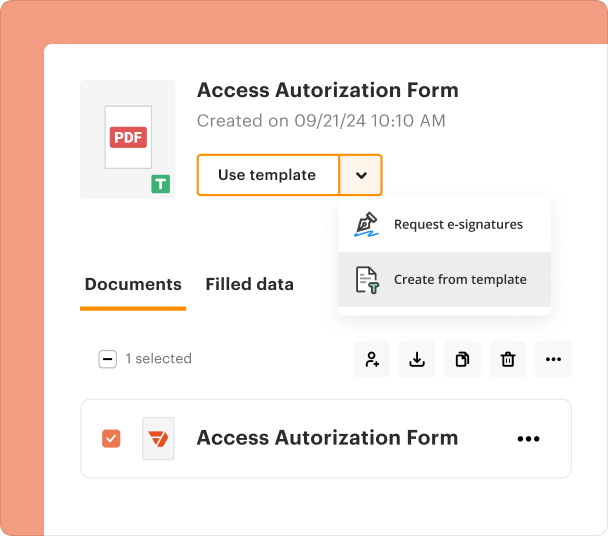

Organizing and revising templates when you create forms

Keeping your templates organized is crucial for efficiency. Follow these steps to manage your templates:

-

Navigate to the 'My Templates' section in pdfFiller.

-

Sort templates by categories (e.g., payroll, tax).

-

Edit, copy, or delete unnecessary templates.

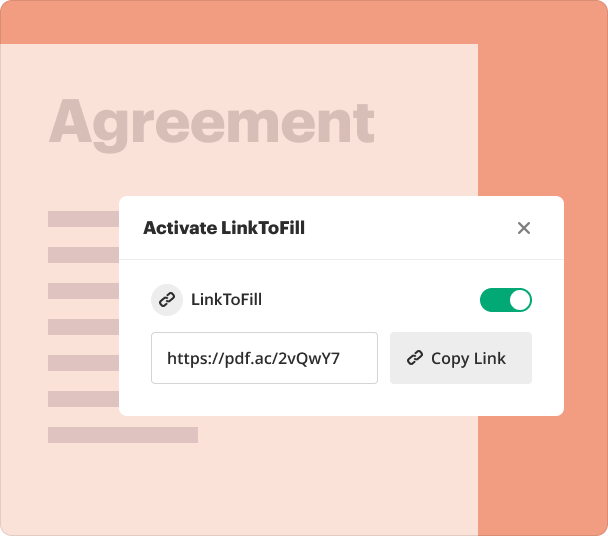

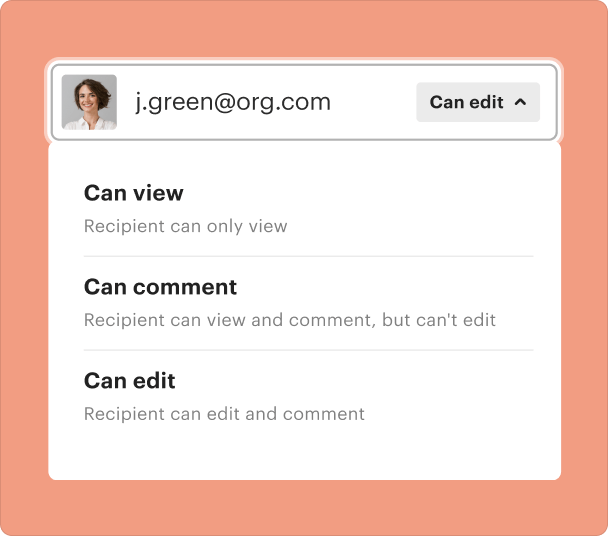

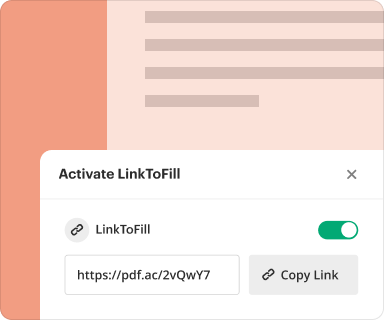

Sharing results and monitoring responses after you create forms

Once your forms are created, sharing results is easy. Here’s how to track responses:

-

Send forms via email or direct link to recipients.

-

Monitor response rates through the dashboard.

-

Receive notifications for completed submissions.

Exporting collected data once you create forms

Exporting the data collected from your forms is crucial for record-keeping. The process includes:

-

Select the form data you wish to export.

-

Choose your preferred export format (e.g., CSV, Excel).

-

Download the exported file and review it for accuracy.

Where and why businesses use Pdf Form Creator For Payroll Accountants

Pdf Form Creator For Payroll Accountants is used across various industries including finance, HR, and government for multiple purposes such as payroll processing, employee onboarding, and compliance documentation. Its flexibility and features address the specific needs of professionals in these fields.

Conclusion

In conclusion, pdfFiller’s Pdf Form Creator For Payroll Accountants is an invaluable tool for anyone involved in payroll management. With its intuitive interface and powerful functionalities, it enhances productivity and ensures accuracy in document handling. Begin transforming your payroll processes today with pdfFiller.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms