Build PDF forms with pdfFiller’s Pdf Form Creator For Tax Associates

How to build PDF forms using pdfFiller

Using pdfFiller's Pdf Form Creator for Tax Associates allows users to create effective and interactive PDF forms tailored specifically for tax-related purposes. This tool simplifies the document development process, enabling professionals to streamline client data collection and ensure compliance with tax regulations.

-

Access pdfFiller from any internet-enabled device.

-

Select or create a PDF form template.

-

Add interactive elements like text fields and checkboxes.

-

Apply validation rules for accurate data entry.

-

Share the finished form with clients and monitor responses.

What is Pdf Form Creator For Tax Associates?

Pdf Form Creator for Tax Associates is a specialized tool designed to assist tax professionals in creating, managing, and distributing PDF forms efficiently. It allows users to streamline tasks associated with tax documentation, ensuring they can gather and organize client information effectively.

How does Pdf Form Creator for Tax Associates improve document preparation?

The Pdf Form Creator simplifies the document preparation process by allowing tax associates to create customized PDF forms that cater specifically to their procedural needs. This tailored approach means that users can build forms that meet industry standards without needing extensive design knowledge.

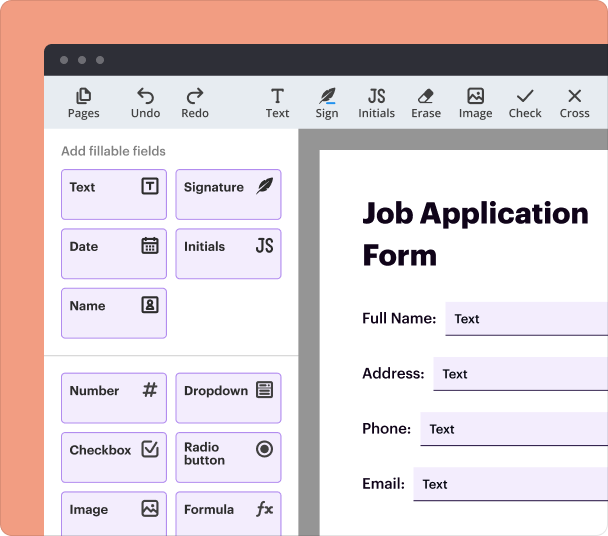

Steps to add interactive fields when you create PDF forms

Adding interactive fields in your forms is crucial for ensuring accurate data collection. Here’s how you can do it using pdfFiller:

-

Open your PDF form in pdfFiller.

-

Select the 'Add Fields' button to access various field options.

-

Drag and drop the desired fields (such as text, checkbox, or dropdown) onto the form.

-

Customize each field by setting properties like required status and formatting.

-

Click 'Save' to retain your changes.

Setting validation and data rules as you create PDF forms

Setting validation and data rules is essential to ensure the information collected through your forms is correct. pdfFiller allows users to define specific rules for each field, ensuring data integrity and compliance.

-

Choose the field you want to apply validation to.

-

Select 'Field Properties' to access validation options.

-

Set rules such as 'Must Fill,' format requirements, or restrict certain inputs.

-

Test the validations by previewing the form before sharing.

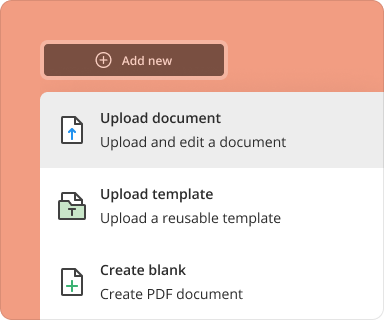

Going from a blank page to a finished form with pdfFiller

Creating a complete PDF form from scratch is made intuitive with pdfFiller. Users can leverage a drag-and-drop interface to design a form that aligns with their specific requirements.

-

Start with a blank PDF canvas or choose from existing templates.

-

Add necessary fields and sections as per the tax requirements.

-

Include instructional text or tooltips for clarity.

-

Save and test your form functionality before finalizing.

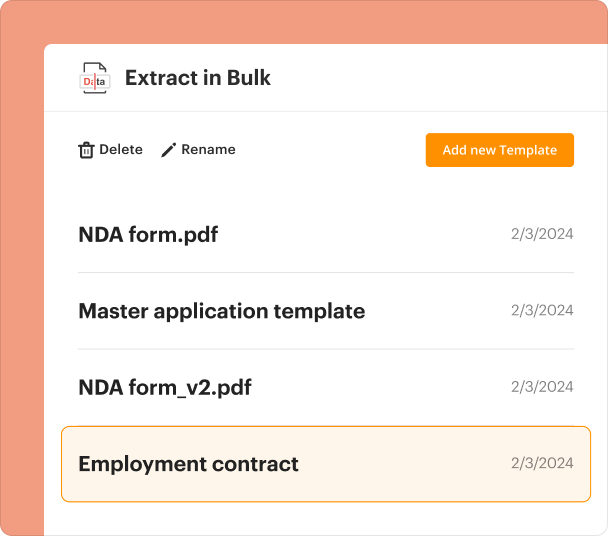

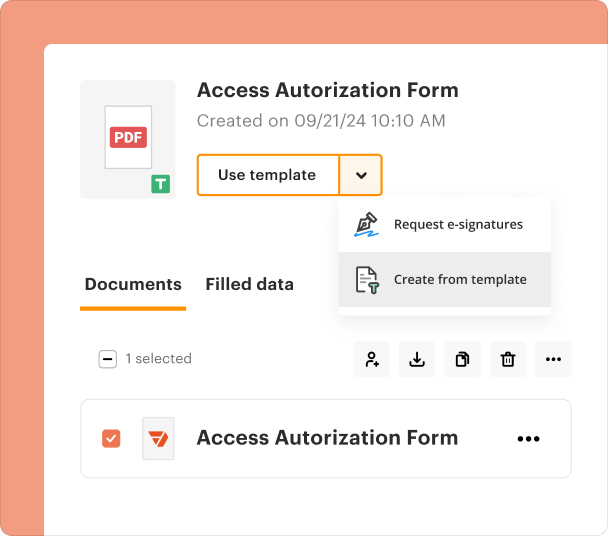

Organizing and revising templates when you create PDF forms

Managing template versions and revisions is vital for tax associates to maintain accuracy over time. pdfFiller provides a straightforward solution for organizing and updating forms.

-

Use the 'My Templates' section to sort forms based on usage or date.

-

Select a template to edit or duplicate for minor changes.

-

Revise the content, fields, or data rules as needed.

-

Save revisions with version control for future reference.

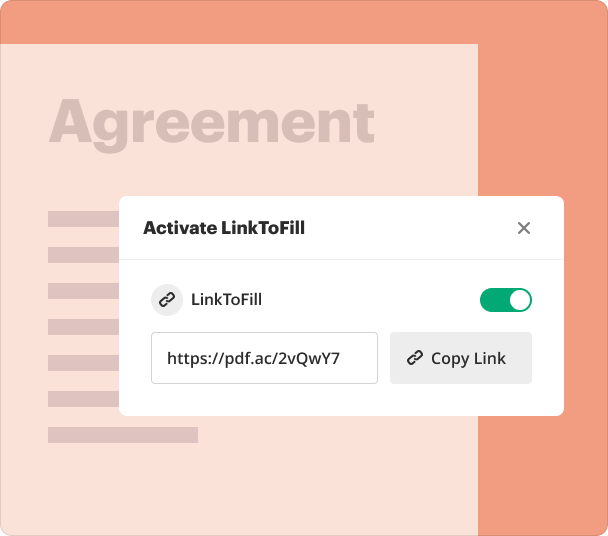

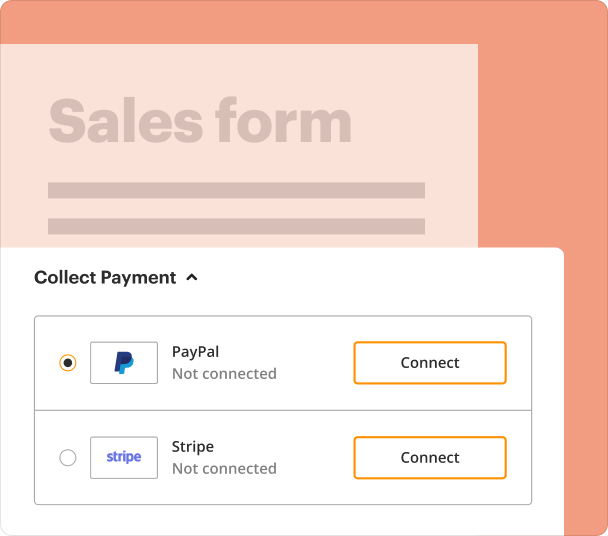

Sharing results and monitoring responses after you create PDF forms

After creating your form, efficient sharing and response tracking are essential. pdfFiller offers various options for distributing forms and monitoring submissions.

-

Utilize the 'Share' button to generate a shareable link or send directly via email.

-

Monitor responses through a centralized dashboard.

-

Receive notifications for completed submissions.

-

Access individual form responses for review and further action.

Exporting collected data once you create PDF forms

Exporting data gathered from your forms is critical for integrating information into accounting software or for reporting purposes. With pdfFiller, users can easily export submitted data.

-

Access the submission dashboard and select the form for data export.

-

Use the 'Export' feature to determine the file format (e.g., CSV, Excel).

-

Choose export options such as including timestamps or user data.

-

Initiate the export and save the file for your records.

Where and why businesses use Pdf Form Creator for Tax Associates

Businesses, particularly in finance and accounting, benefit from the Pdf Form Creator for Tax Associates by ensuring that they can produce high-quality, functional forms quickly. This tool is useful for client onboarding, tax returns, and processing forms required by regulatory bodies.

Conclusion

In conclusion, pdfFiller's Pdf Form Creator for Tax Associates offers a comprehensive solution for generating and managing PDF forms necessary for tax-related activities. From creating forms with interactive fields to monitoring responses and exporting data, pdfFiller streamlines the entire form creation process, making it an ideal choice for modern tax professionals.

How to create a PDF form

Who needs this?

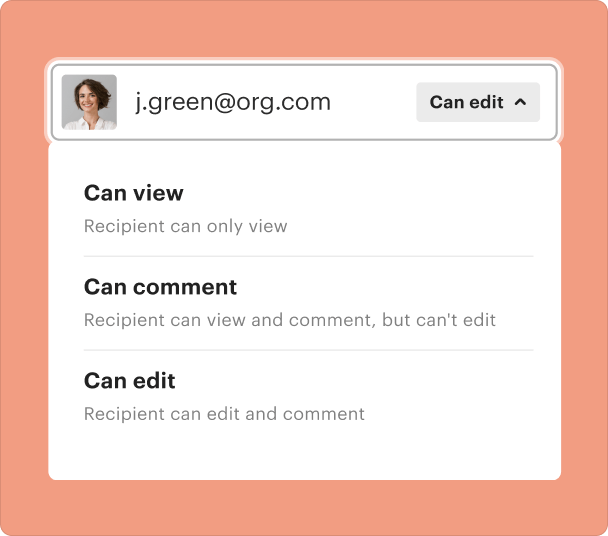

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms