Build PDF forms with pdfFiller’s Pdf Form Creator For Tax Consultants

How to Pdf Form Creator For Tax Consultants

Utilizing pdfFiller’s Pdf Form Creator enables tax consultants to easily create, edit, and manage interactive PDF forms, streamlining the document preparation process while saving time and ensuring accuracy.

What is a Pdf Form Creator For Tax Consultants?

A Pdf Form Creator specifically for tax consultants is a powerful tool that allows professionals to design and customize PDF forms tailored to their client's needs. These forms can include various interactive elements, making it easier to collect the required information efficiently.

How does Pdf Form Creator For Tax Consultants change document preparation?

Traditional document preparation can be tedious, often requiring physical document handling and multiple revisions. Using pdfFiller’s Pdf Form Creator, tax consultants can streamline this process by automating form creation, reducing errors, and enhancing collaboration.

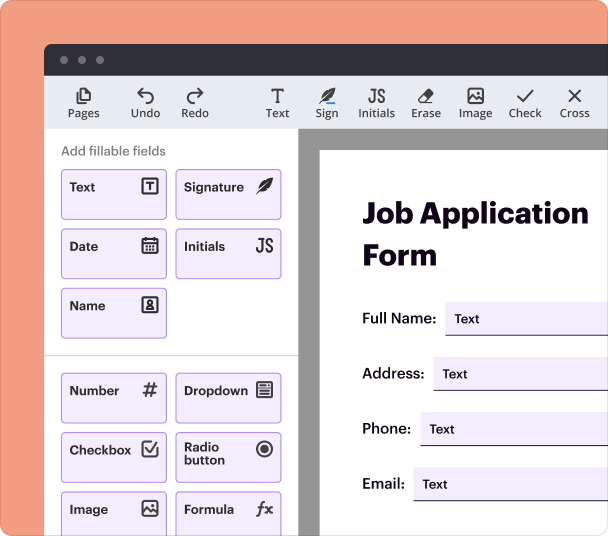

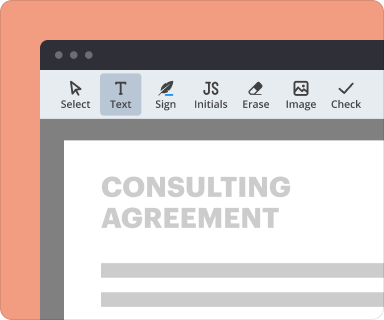

Steps to add fields when you create PDFs

Adding interactive fields to your PDF form is straightforward with pdfFiller. Here’s how to do it:

-

Open your document in pdfFiller.

-

Select the 'Add Fields' option from the toolbar.

-

Drag and drop field types such as text boxes, checkboxes, and dropdowns onto your form.

-

Customize field properties, including size and validation requirements.

-

Save your form and preview it to ensure all fields are correctly placed.

Setting validation and data rules as you create PDFs

Implementing data validation rules is essential for ensuring the integrity of the information collected. You can define mandatory fields, limit input types, and set character counts to keep your forms organized and professional.

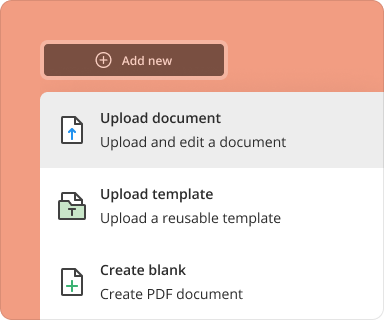

How to go from blank page to finished form

Creating a complete form from scratch using pdfFiller’s Pdf Form Creator involves the following steps:

-

Start with a blank PDF or use an existing template.

-

Add relevant fields according to the specific requirements of tax forms.

-

Incorporate text, images, or logos to personalize the form.

-

Utilize design elements to enhance usability, such as color-coding and section breaks.

-

Review the form and make adjustments before final saving.

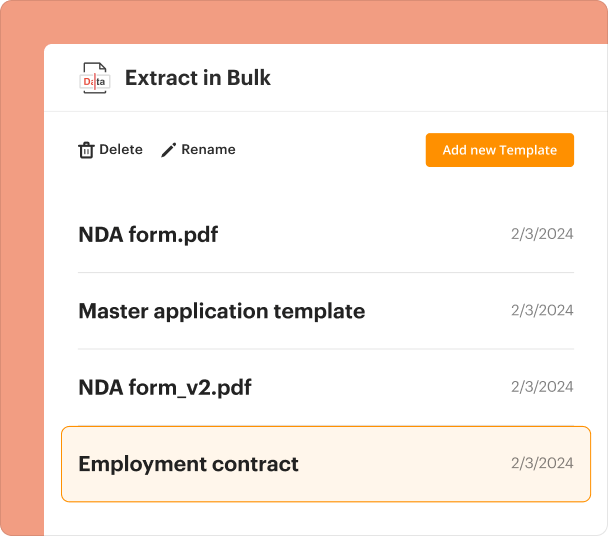

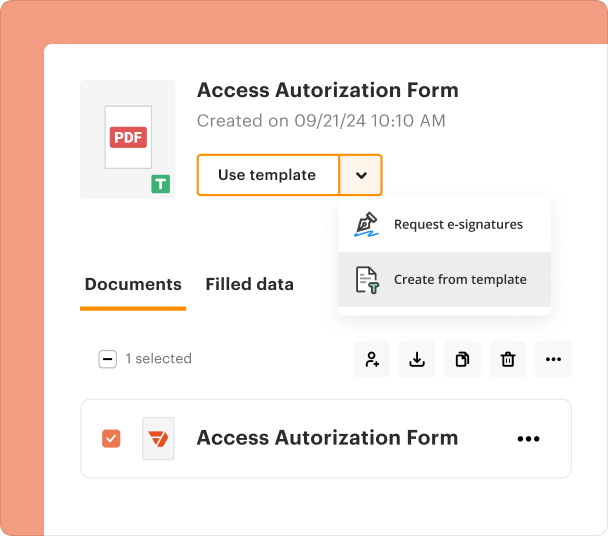

Organizing and revising templates when you create PDFs

Managing templates allows for easy updates and version control. You can categorize templates based on form type and usage frequency, making it efficient to access and revise them as required.

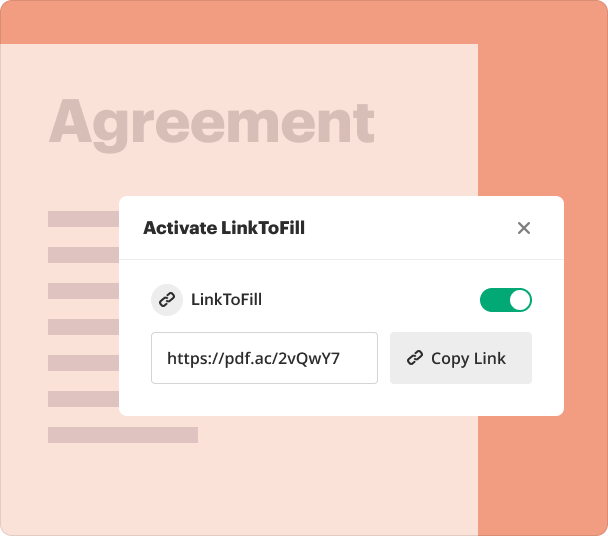

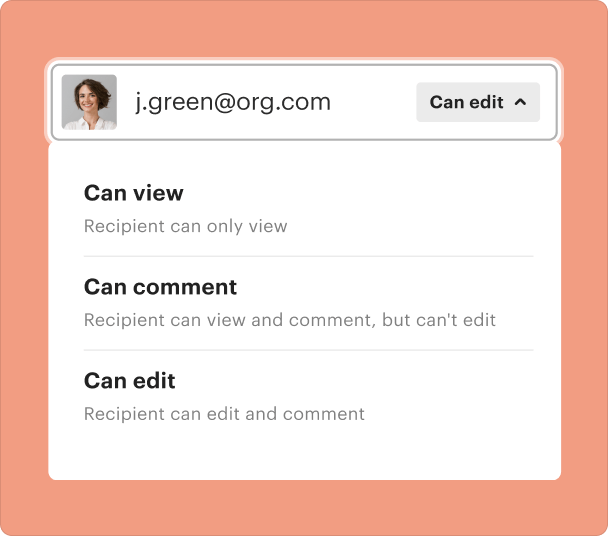

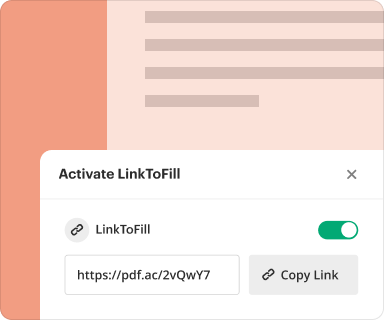

Sharing results and monitoring responses after you create PDFs

Collaboration is key in document management. After creating your PDF forms, you can share them with clients or colleagues for input and approval. pdfFiller allows tracking of changes and responses, making it easier to manage versions.

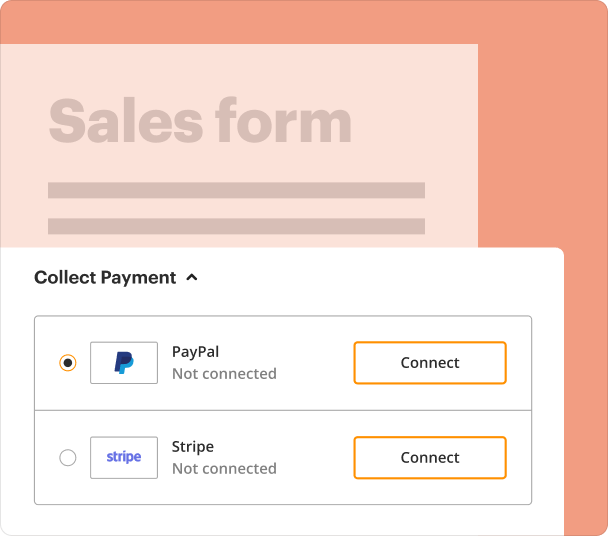

Exporting collected data once you create PDFs

One of the standout features of pdfFiller is its ability to export submitted data effortlessly. You can download responses in formats like CSV or Excel, which further facilitates analysis and reporting for tax consultation.

Where and why businesses use Pdf Form Creator For Tax Consultants

Various industries utilize Pdf Form Creator to streamline document processes, particularly in tax consulting firms. These solutions not only enhance productivity but also ensure compliance with regulatory requirements.

Conclusion

Utilizing pdfFiller’s Pdf Form Creator for tax consultants revolutionizes how documents are prepared and managed. By incorporating interactive fields and data validation, consultants can ensure accuracy while saving valuable time. This accessible, cloud-based solution stands out as a necessary tool in modern tax consultation.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms