Build PDF forms with pdfFiller’s Small Business Loan Application Form Creator

How to create a Small Business Loan Application Form using pdfFiller

To create a Small Business Loan Application Form using pdfFiller, first sign up for an account. After logging in, select the form creation option, and either upload an existing PDF template or build a new one. Customize your form by adding fields such as text boxes, checkboxes, and dropdowns. Finally, once your form is complete, share it with necessary stakeholders for completion.

What is a Small Business Loan Application Form Creator?

A Small Business Loan Application Form Creator is a tool that allows individuals and organizations to design, customize, and manage loan application forms in PDF format. This capability simplifies the process of gathering information from applicants while ensuring that the forms are organized, professional, and easy to use.

How does a Small Business Loan Application Form Creator improve document preparation?

Using a Small Business Loan Application Form Creator streamlines document preparation by providing an efficient way to design forms specifically tailored to gathering necessary loan details. This reduces errors and speeds up the processing time for applications. Moreover, it allows teams to maintain branding consistency across all documents.

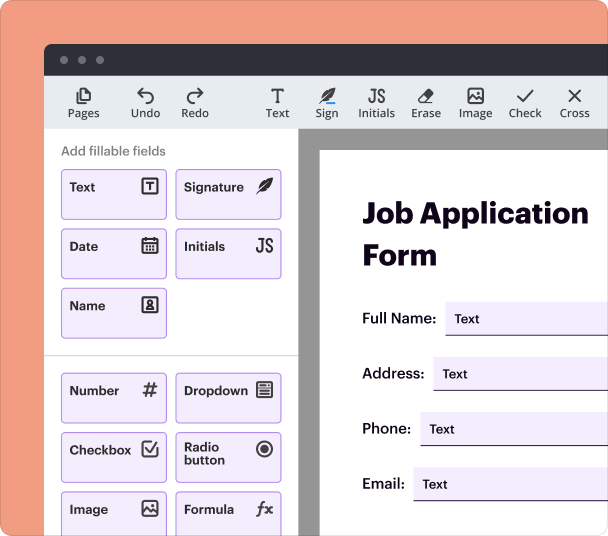

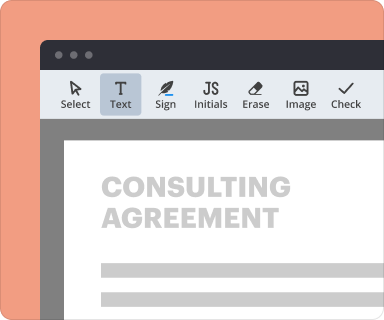

Steps to add fields when you create a Small Business Loan Application Form

To add fields to your loan application form, follow these steps:

-

Open the Small Business Loan Application Form in pdfFiller.

-

Select 'Fill' from the toolbar.

-

Drag and drop the required fields such as text input, radio buttons, or checkboxes onto your form.

-

Size and position the fields as needed.

-

Save your changes to the form.

Setting validation and data rules as you create a Small Business Loan Application Form

When designing your form, it's important to set validation rules to ensure the collected data is accurate and complete. This includes establishing required fields and defining specific data formats (e.g., numeric fields for loan amounts).

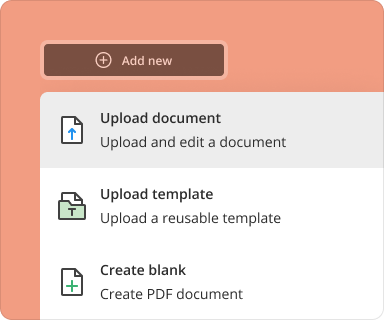

Going from a blank page to a finished form while you create a Small Business Loan Application Form

Creating a complete form from scratch involves several steps:

-

Select 'Create New Form' from the pdfFiller dashboard.

-

Choose the layout and format that best fits your needs.

-

Add fields for personal information, financial data, and any necessary disclosures.

-

Review and customize each field to fit your validation needs.

-

Finalize and save your form.

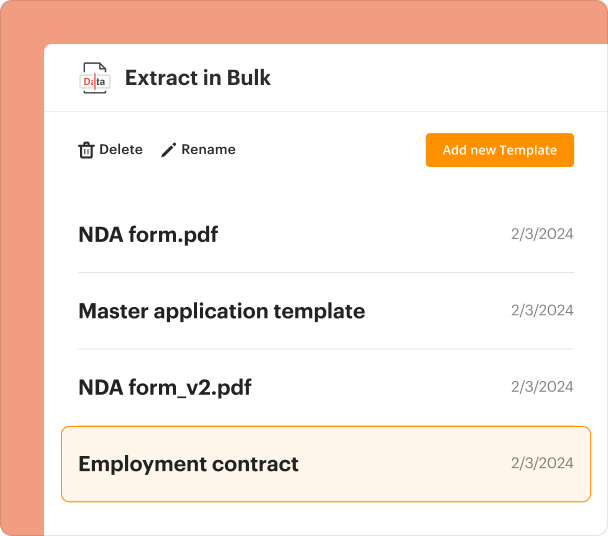

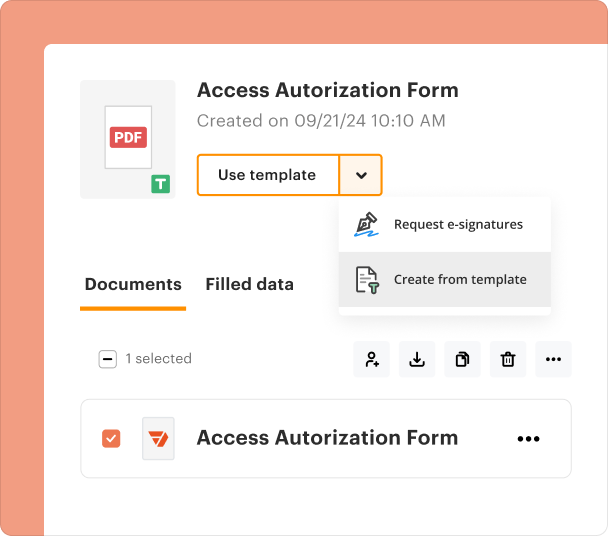

Organizing and revising templates when you create a Small Business Loan Application Form

Maintaining organized templates allows for efficient retrieval and updating. With pdfFiller, you can easily store and categorize your forms into folders. When a business requirement changes, templates can be revised seamlessly, ensuring up-to-date information is always reflected.

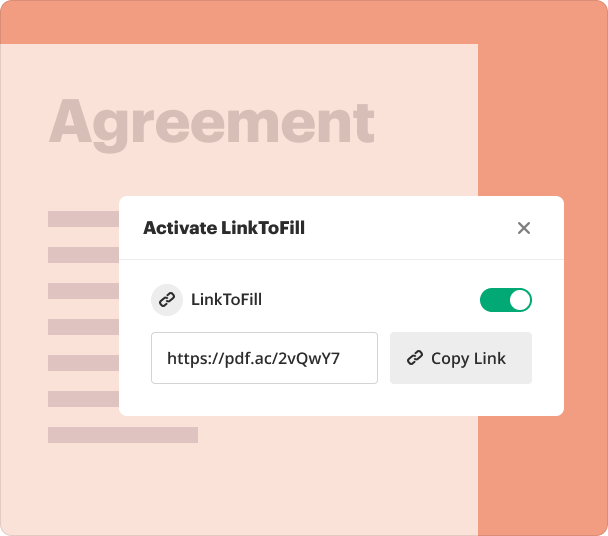

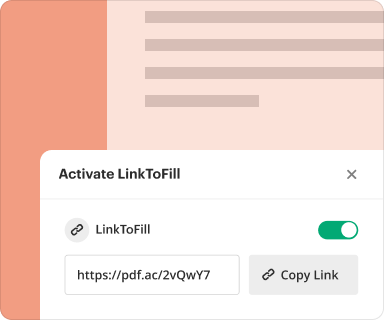

Sharing results and monitoring responses after you create a Small Business Loan Application Form

Once your form is shared with applicants, you can monitor responses in real time. pdfFiller provides tracking functionalities that allow you to see who has filled out the form and resend it to those who have not completed it yet.

Exporting collected data once you create a Small Business Loan Application Form

With pdfFiller, you can easily export the data collected from your loan application forms into various formats such as CSV or Excel. This enables seamless integration with other systems or reporting tools.

Where and why businesses use Small Business Loan Application Form Creators

Small Business Loan Application Form Creators are utilized across various industries such as finance, real estate, and startups. They automate the application process, reduce paperwork, and facilitate quicker decision-making for loan applications.

Conclusion

In conclusion, using a Small Business Loan Application Form Creator like pdfFiller not only enhances document efficiency but also ensures accuracy and organization in the loan application process. With its array of features, pdfFiller helps businesses simplify their paperwork through seamless PDF form management.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

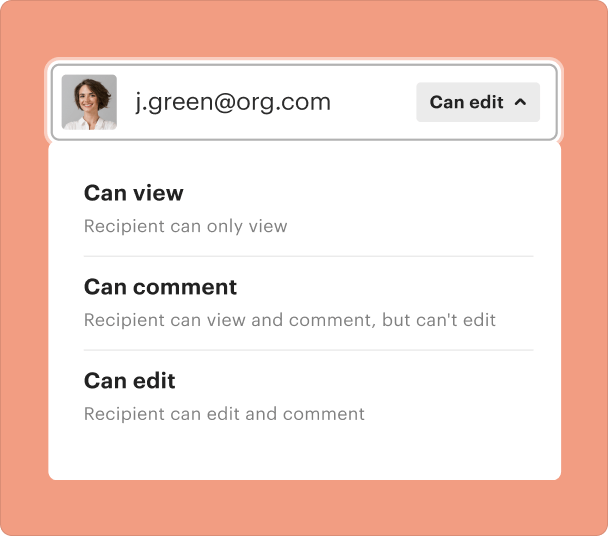

Share and collaborate

pdfFiller scores top ratings on review platforms