How to build a Tax Adjustment Request Form using pdfFiller

What does it mean to build a Tax Adjustment Request Form?

Building a Tax Adjustment Request Form involves creating a structured document that allows individuals or teams to request modifications to their tax accounts. This form is crucial for initiating communication with tax authorities about adjustments based on new information or circumstances that affect one's tax liability. Utilizing a PDF form builder, such as pdfFiller, simplifies this process by providing tools for customization and interactivity, leading to efficient data collection.

How does building a Tax Adjustment Request Form improve handling paperwork?

Using a Tax Adjustment Request Form Builder makes the paperwork process much more efficient and organized. Instead of navigating through endless paperwork, users can create standardized forms that ensure all necessary information is captured accurately. This not only saves time but also reduces the chances of errors that can occur with handwritten or manually created documents.

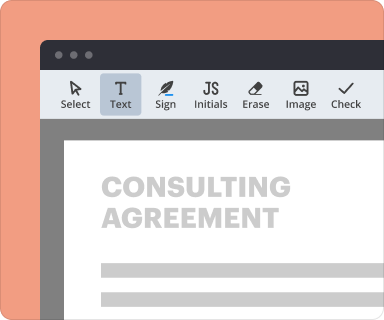

Steps to add fields when you build a Tax Adjustment Request Form

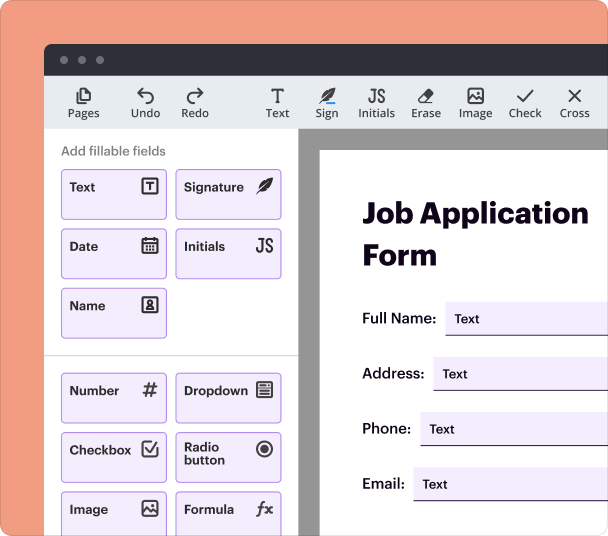

Adding fields to your form is a straightforward process with pdfFiller. You'll want to ensure that the form collects all necessary data for tax adjustments. Here’s how you can do it:

-

Log in to your pdfFiller account.

-

Select the 'Create New Form' option.

-

Use the drag-and-drop editor to add fields such as text boxes, checkboxes, and drop-down menus.

-

Label each field clearly for user understanding.

-

Save your form as a template for future use.

Setting validation and data rules as you build a Tax Adjustment Request Form

Establishing validation rules ensures that the data collected is accurate and meets any regulatory requirements. pdfFiller supports various validation features, helping you maintain data integrity. Here's how to apply these rules:

-

Choose a field to apply validation on.

-

Select a validation type, such as 'required', 'number', or 'email'.

-

Customize error messages to guide users on corrections.

-

Test the form to ensure validations work as intended.

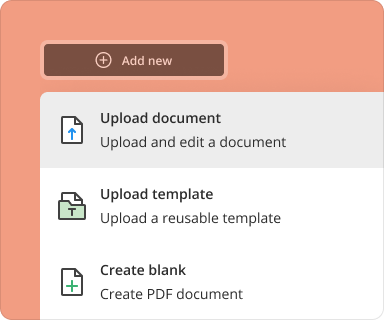

Going from blank page to finished form while you build a Tax Adjustment Request Form

Creating a comprehensive Tax Adjustment Request Form involves structuring your document effectively. With pdfFiller, you can easily transition from a blank page to a filled-out, interactive form, ensuring it meets all necessary requirements.

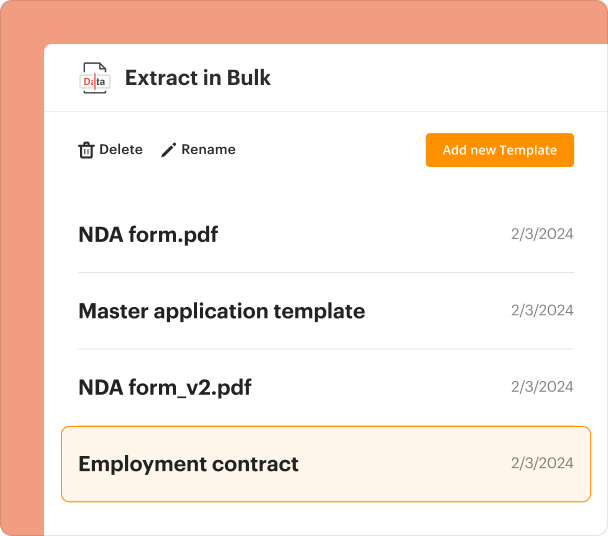

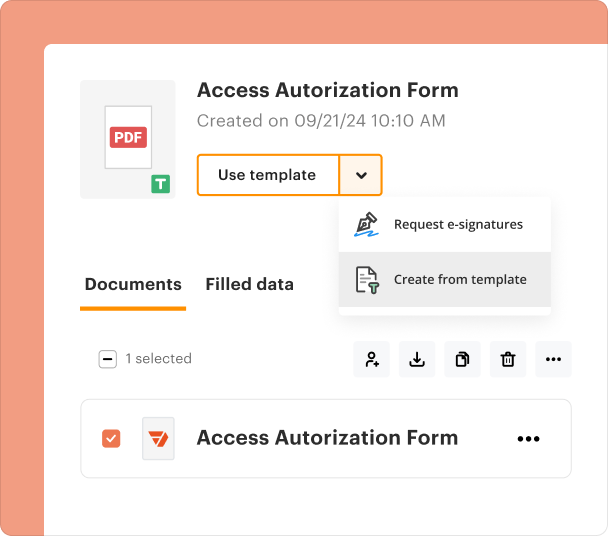

Organizing and revising templates when you build a Tax Adjustment Request Form

Once your form is created, maintaining an organized template library is important for quick access and updates. pdfFiller provides seamless management tools:

-

Label your forms for easy identification.

-

Categorize templates based on type or usage.

-

Regularly review and update forms based on changes in tax regulations.

Sharing results and monitoring responses after you build a Tax Adjustment Request Form

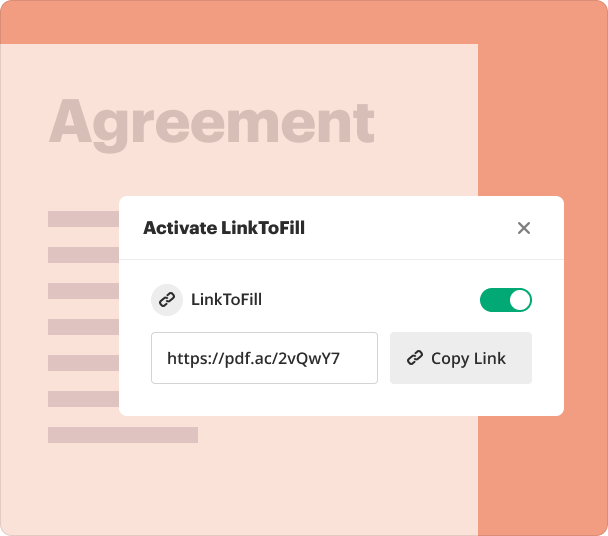

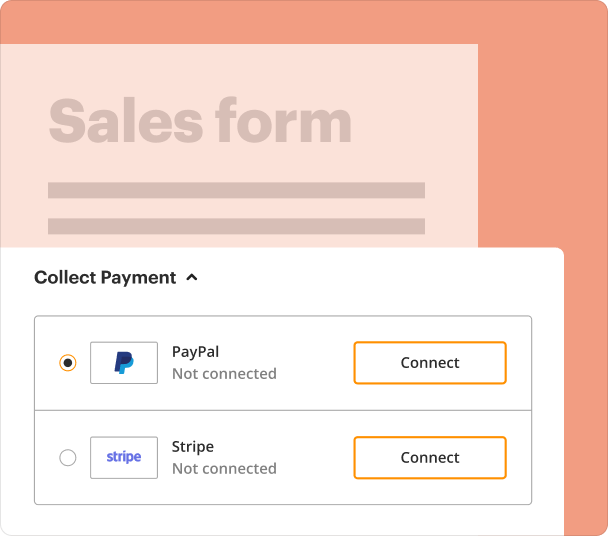

After creating and disseminating your Tax Adjustment Request Form, it's crucial to monitor responses and track submissions. pdfFiller comes with built-in sharing and tracking functionalities, which significantly enhance your workflow.

-

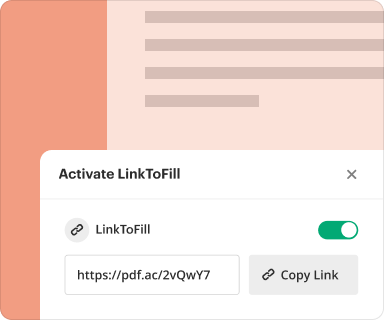

Generate a shareable link or send via email directly from the platform.

-

Track who has received the form and when it was opened.

-

Set alerts for form submissions to respond promptly.

Exporting collected data once you build a Tax Adjustment Request Form

Once your form is filled out, exporting the submitted data for further processing is essential. pdfFiller makes this easy with several export options.

-

Export data as Excel for detailed analysis.

-

Choose PDF format to keep it consistent with your forms.

-

Utilize API integration for direct data flow into your existing systems.

Where and why businesses build a Tax Adjustment Request Form

Tax adjustment forms are critical across various industries, including finance, law, and real estate. These businesses use such forms to formalize requests for any discrepancies in tax assessments, thus ensuring compliance and financial accuracy.

Conclusion

Building a Tax Adjustment Request Form using pdfFiller simplifies the document creation process, allowing users to capture essential data effectively and ensure compliance. With its interactive features and streamlined functionalities, pdfFiller positions itself as a powerful tool for anyone looking to manage tax-related paperwork efficiently.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

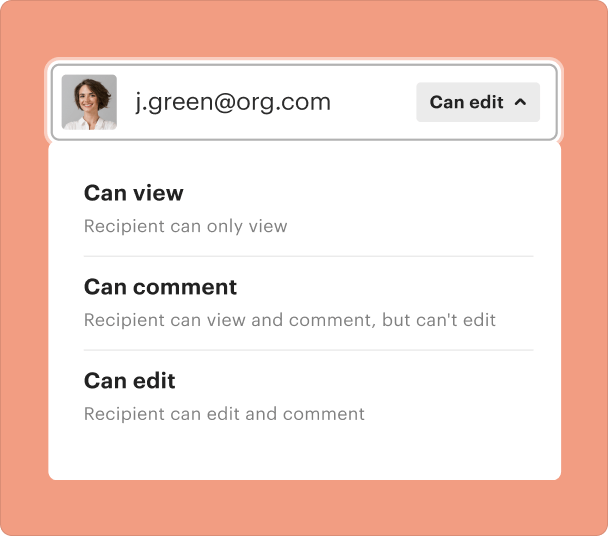

Share and collaborate

pdfFiller scores top ratings on review platforms

I like how easy it is to create forms and to fill out PDF forms. I also like the mobile app.

What do you dislike?

It's a bit slow, and sometimes crashes, requiring you to start over

Recommendations to others considering the product:

Definitely get and use the mobile app

What problems are you solving with the product? What benefits have you realized?

It makes it very easy to fill in forms that clients send me.