Build PDF forms with pdfFiller’s Tax Attorney Job Application Form Creator

What is the Tax Attorney Job Application Form Creator?

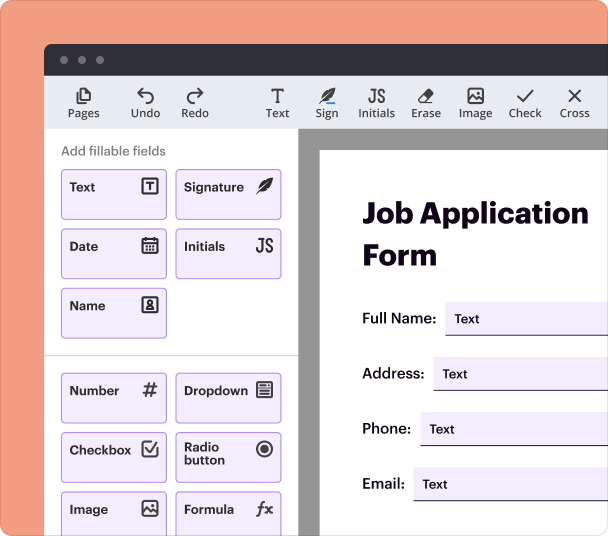

The Tax Attorney Job Application Form Creator is a specialized tool within pdfFiller that allows users to design, create, and manage PDF forms catered specifically for tax attorney job applications. This feature streamlines the process of preparing application documents, enabling users to add interactive fields, apply data validation, and customize templates as per their unique requirements.

-

User-friendly interface for easy navigation and form creation.

-

Interactive fields such as text boxes, checkboxes, and dropdowns.

-

Data validation features to ensure accurate entries.

-

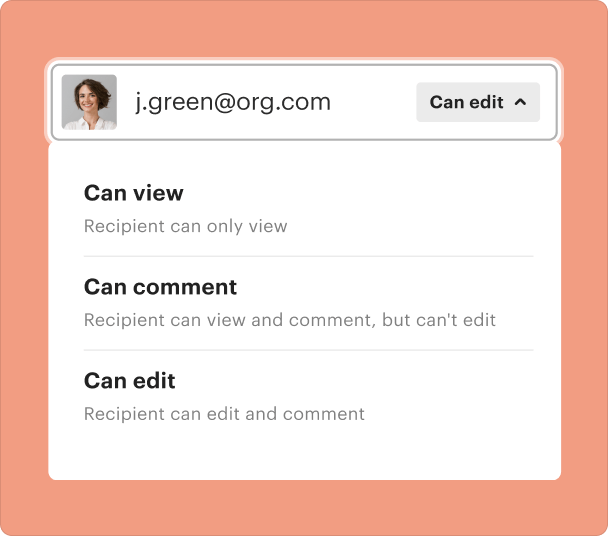

Cloud-based access allowing collaboration from anywhere.

-

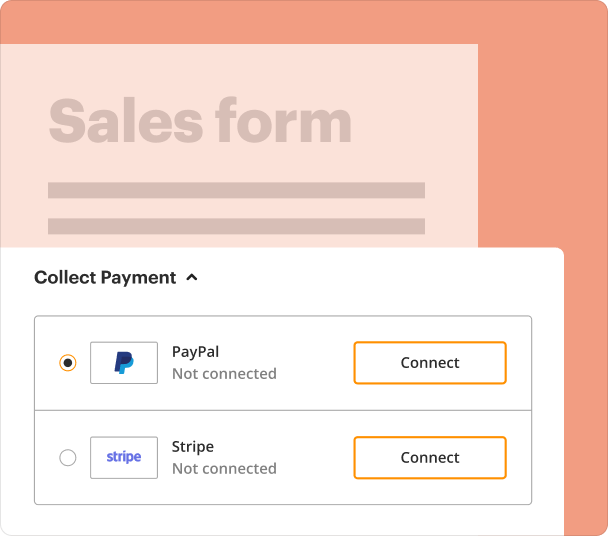

Integration with eSignature capabilities for streamlined approvals.

How does the Tax Attorney Job Application Form Creator change document preparation?

Traditionally, preparing job application forms for tax attorneys can be time-consuming and often requires multiple revisions and back-and-forth communications. The Tax Attorney Job Application Form Creator revolutionizes this process by providing an integrated platform where users can create, modify, and share their forms easily. This not only saves time but also enhances the accuracy of the information collected.

-

Minimizes manual errors through the use of interactive fields.

-

Streamlines collaboration, allowing teams to work in real-time.

-

Facilitates quick feedback and revisions to the document.

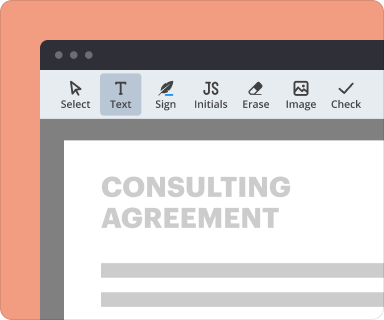

Steps to add interactive fields when you create a form

To enhance user interaction with your forms, it’s essential to incorporate interactive fields. Here’s how you can effectively add these fields in the Tax Attorney Job Application Form Creator.

-

Select the 'Add Field' option from the toolbar.

-

Choose from available field types: text box, checkbox, radio button, etc.

-

Drag and drop the selected field onto the form.

-

Resize and position the field as necessary.

-

Configure field properties, such as required status and validations.

Setting validation and data rules as you create a form

Implementing data validation rules ensures that proper information is collected, reducing errors significantly. The Tax Attorney Job Application Form Creator enables you to define these rules during the form creation process.

-

Select the target field where validation is needed.

-

Access the properties menu and find validation options.

-

Choose the type of validation, such as numeric, email format, or required fields.

-

Save the settings to activate validation rules.

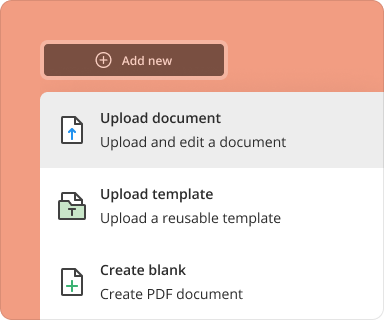

Creating a complete form from scratch using the tool

Building a complete PDF form tailored for tax attorney job applications can be accomplished in a few straightforward steps with the Tax Attorney Job Application Form Creator.

-

Open the pdfFiller platform and select 'Create Form.'

-

Choose 'Blank Document' or an existing template as a starting point.

-

Add titles, sections, and specify required fields.

-

Incorporate any specific tax-related questions or requirements.

-

Review and finalize the form before saving it as a PDF.

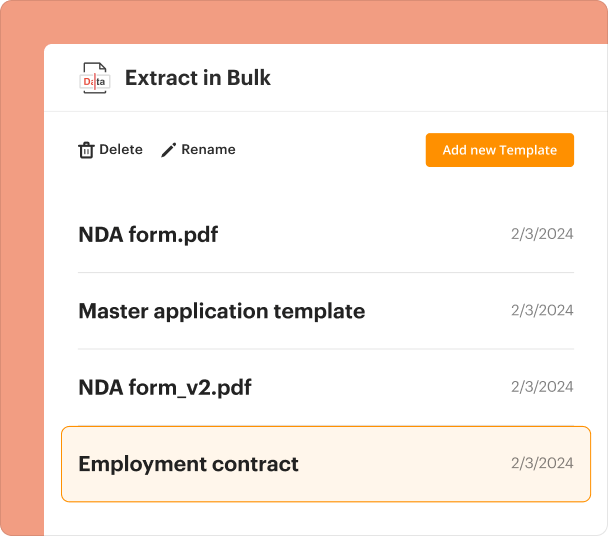

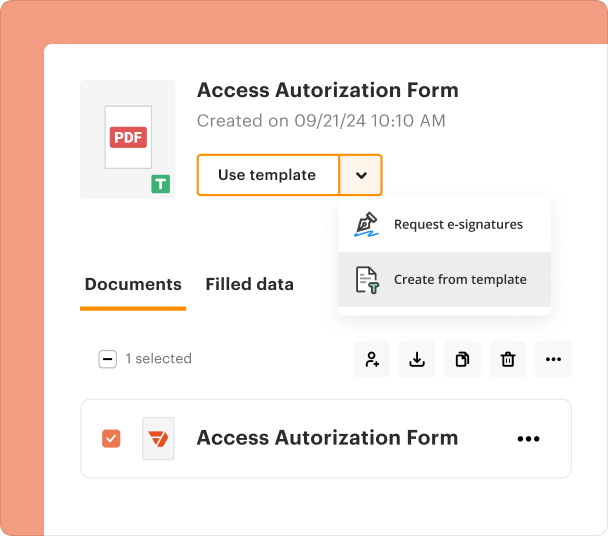

Organizing and revising templates when you create forms

After creating forms, effective management is key to ensure relevance and accuracy. The Tax Attorney Job Application Form Creator offers features to help organize and revise your templates efficiently.

-

Categorize forms based on different job positions or application types.

-

Use version control to keep track of changes made to templates.

-

Set reminders for periodic reviews and updates of templates.

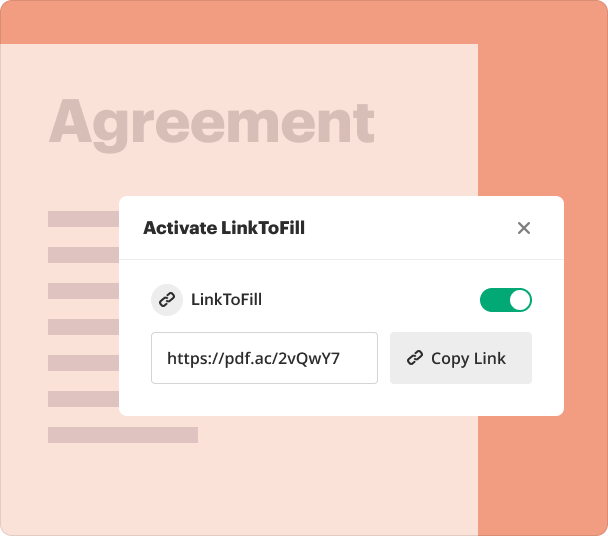

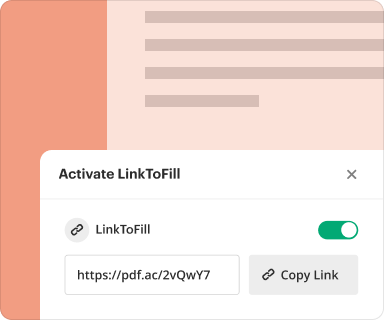

Sharing results and monitoring responses after creating a form

Once your forms are created and finalized, the next step is sharing them with potential applicants and monitoring response rates. pdfFiller enables easy sharing and tracking processes.

-

Generate a secure link for the form to distribute via email or on your website.

-

Monitor submissions in real-time through the pdfFiller dashboard.

-

Download responses in various formats, including CSV for analysis.

Exporting collected data once you finish your form

After collecting responses through your tax attorney job application form, exporting this data allows for easier evaluation and decision-making. The pdfFiller platform provides multiple options for data export.

-

Select 'Export' from the form management panel.

-

Choose the desired file format: PDF, Excel, or CSV.

-

Specify the destination for the exported file and confirm the action.

Where and why businesses use the Tax Attorney Job Application Form

Businesses across various sectors, including legal firms and tax consulting services, utilize the Tax Attorney Job Application Form Creator to streamline their hiring processes. This tool is pivotal in ensuring that applications are uniform and data is collected efficiently.

-

Facilitates standardized applications for consistency in evaluation.

-

Enhances data accuracy through built-in validation rules.

-

Saves administrative time, allowing focus on candidate assessment.

Conclusion

The Tax Attorney Job Application Form Creator available through pdfFiller is an invaluable resource for organizations seeking to streamline their application processes. By leveraging its capabilities, businesses can enhance accuracy, save time, and manage their documentation more effectively.

How to create a PDF form

Who needs this?

The all-in-one PDF form creator, editor, and eSignature solution

Handle all your docs in one place

Keep data secure

Share and collaborate

pdfFiller scores top ratings on review platforms