Lic maturity Forms and Templates

Lic Maturity Form: Fill out, eSign, share the document with ease

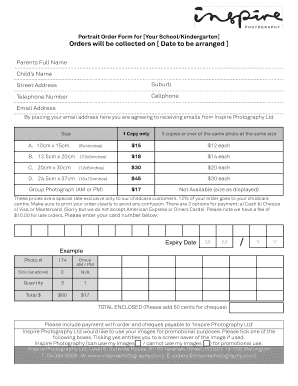

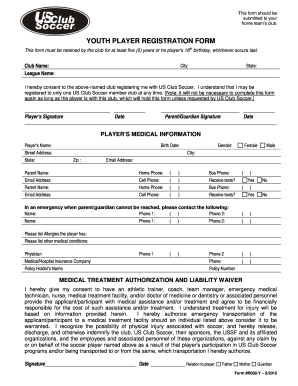

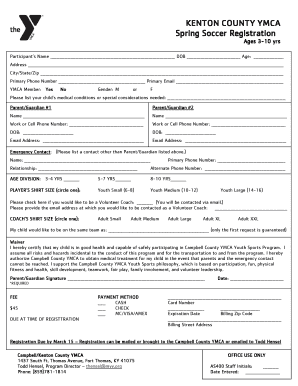

If filling out the forms like Lic Maturity Form is something perform regularly, then pdfFiller is the quickest, most straightforward way. Our solution enables you to access pre-drafted fillable forms, create ones from the ground up, or make the required edits to your existing paperwork.

Additionally, you can easily eSign and quickly share the completed document with others or safely store it for future use. pdfFiller is one of the number of editors that combines convenience and excellent performance robust enough to support various formats. Let’s review what to do with our PDF form editor.

How to get the most out of pdfFiller when editing Lic Maturity Form

Firstly: You need to create an account with pdfFiller or sign in to your existing one. If you've never used our editor before, don't worry - it's effortless to onboard. Once you have successfully logged in to pdfFiller, you can begin editing Lic Maturity Form or use our extensive catalog of forms.

pdfFiller supplies clients with advanced tools to compose documents or alter existing ones online, all from the convenience of just one application that works across desktop and mobile phone. Give it a go today and see for yourself!