Pag-ibig Contribution Table

What is Pag-ibig contribution table?

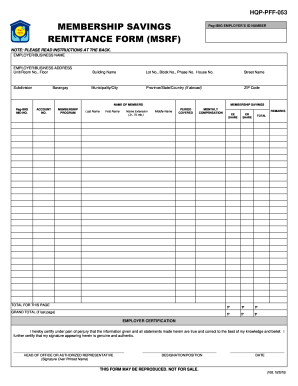

The Pag-ibig contribution table is a chart that outlines the monthly contributions required by members of the Pag-ibig Fund. This table helps individuals understand how much they need to contribute based on their monthly income.

What are the types of Pag-ibig contribution table?

There are two main types of Pag-ibig contribution tables: for employees and for self-employed individuals. Employees have a different set of contribution rates compared to those who are self-employed.

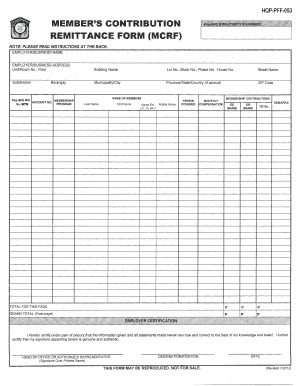

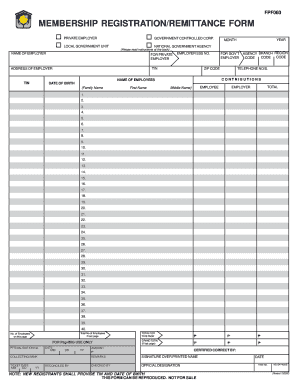

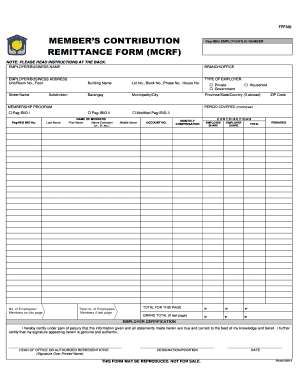

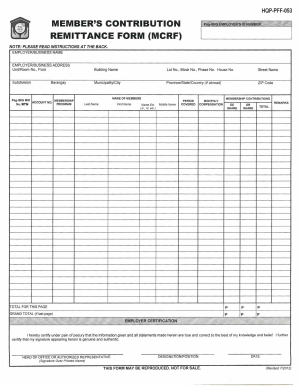

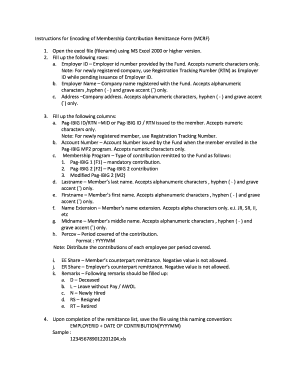

How to complete Pag-ibig contribution table

Completing the Pag-ibig contribution table is a simple process that involves calculating your monthly income and determining the corresponding contribution based on the official table. Make sure to accurately input all required information to ensure compliance with Pag-ibig regulations.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.