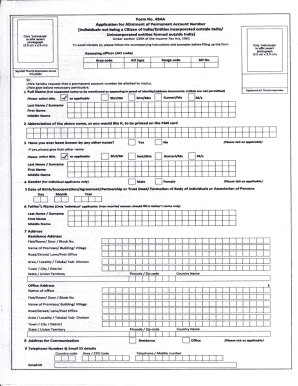

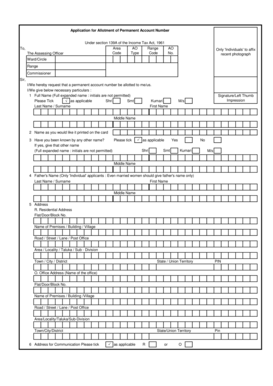

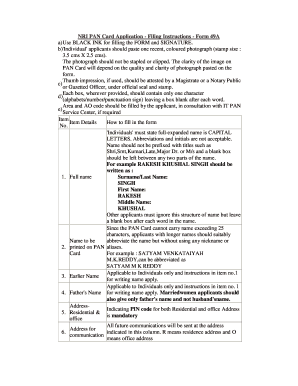

Pan Card Form

What is Pan Card Form?

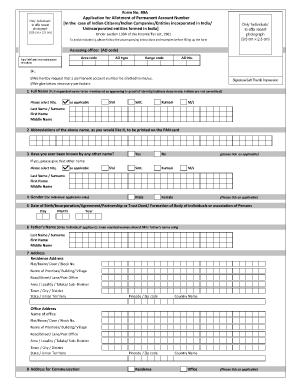

Pan Card Form is a document that is used to apply for a Permanent Account Number (PAN) card in India. It is a unique alphanumeric code that is assigned to individuals, corporations, and other entities for the purpose of tax identification.

What are the types of Pan Card Form?

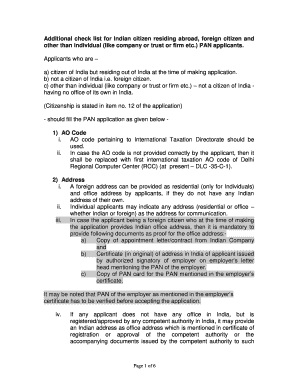

There are primarily two types of Pan Card Forms: 1. Form 49A: This form is used by Indian citizens, Indian companies, and entities incorporated in India. 2. Form 49AA: This form is used by individuals and entities who are not citizens of India, but wish to apply for a PAN card.

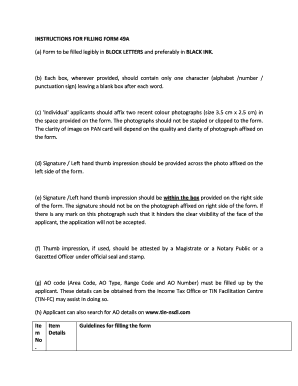

How to complete Pan Card Form

To complete the Pan Card Form, follow these steps: 1. Download the required form from the official website of the Income Tax Department of India or use pdfFiller for a hassle-free experience. 2. Fill in all the necessary details accurately, such as personal information, contact details, and income details. 3. Attach the required documents, such as proof of identity, proof of address, and proof of date of birth. 4. Review the form carefully to ensure all information is correct. 5. Sign the form and submit it either online or by mail to the designated PAN Service Centers.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.