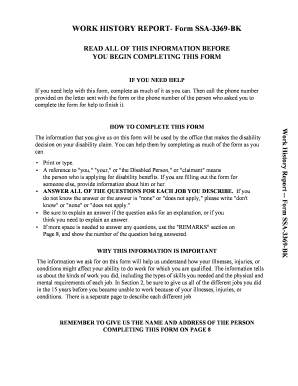

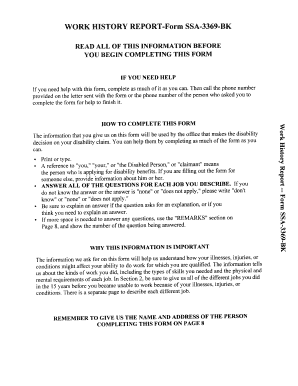

Ssa Work History Report

What is SSA Work History Report?

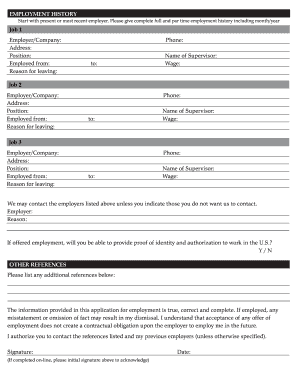

The SSA Work History Report is a document that provides a detailed overview of an individual's work history. This report is often required when applying for Social Security disability benefits or other related programs. It contains information about the individual's past employers, job titles, dates of employment, and earnings.

What are the types of SSA Work History Report?

There are two main types of SSA Work History Report:

Self-reported Work History Report: This report is filled out by the individual themselves, providing details of their own work history.

Employer-provided Work History Report: This report is completed by the individual's past employers, providing accurate and verified information about their employment history.

How to complete SSA Work History Report

To complete the SSA Work History Report, follow these steps:

01

Gather all the necessary information, such as your previous employers' names, job titles, and dates of employment.

02

If required, contact your past employers to obtain any missing or incorrect information.

03

Fill out the report accurately and truthfully, providing as much detail as possible.

04

Check the report for any errors or missing information before submitting it.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out ssa work history report

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Why is Social Security asking for my work history?

Your work history plays a major role in the Social Security's formula for calculating your work credits and Social Security SSDI benefits amount. Part of their calculation of your work credits is based on the number of actual years you have worked and their medical records proving a disability.

Does Social Security track work history?

From your first job to your last, your employer verifies your Social Security number with us to help reduce fraud and allow us to keep track of your work history to ensure you get the benefits you deserve.

What is a SSA work history report?

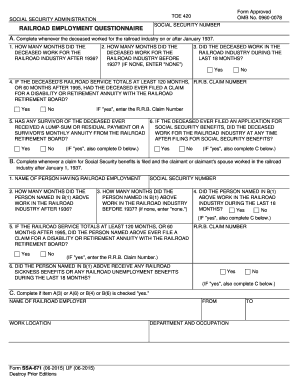

Social Security uses the Work Activity Report form to learn more about the work activity of a disability applicant or beneficiary. If you are applying for disability benefits, the information you provide will help us decide if you can receive benefits.

Does your Social Security show work history?

' the answer is yes, you can. SSA can provide a statement of your employment history by completing a Request for Social Security Earnings Information form and paying a fee.

How do I get my work history report from Social Security?

Yearly earnings totals are free to the public if you do not require certification. To obtain FREE yearly totals of earnings, visit our website at www.ssa.gov/myaccount. Section 205 of the Social Security Act, as amended, allows us to collect this information.

Can you get Social Security without work history?

The only people who can legally collect benefits without paying into Social Security are family members of workers who have done so. Nonworking spouses, ex-spouses, offspring or parents may be eligible for spousal, survivor or children's benefits based on the qualifying worker's earnings record.