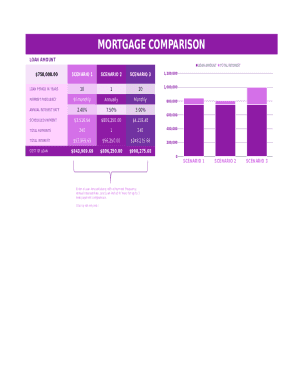

What is Mortgage Comparison Sheet?

A Mortgage Comparison Sheet is a tool used by individuals to compare different mortgage options available to them. It typically includes details about interest rates, loan terms, fees, and other relevant information to help borrowers make an informed decision when choosing a mortgage.

What are the types of Mortgage Comparison Sheet?

There are several types of Mortgage Comparison Sheets that borrowers can use to evaluate their options. Some common types include:

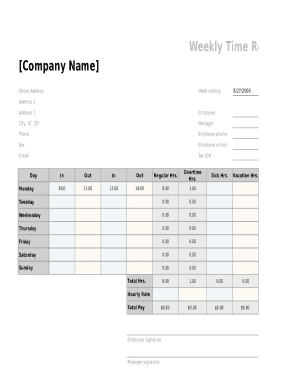

How to complete Mortgage Comparison Sheet

Completing a Mortgage Comparison Sheet is a simple process that can help you make the right choice for your home loan. Here are some steps to guide you through the process:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.