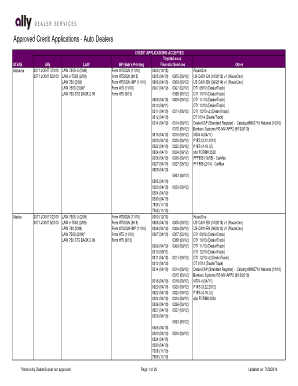

Auto Credit Application Template

What is an auto credit application template?

An auto credit application template is a pre-designed document that allows individuals or businesses to apply for automotive credit. It serves as a standardized form that collects information necessary for credit evaluation, such as personal details, employment history, and financial information.

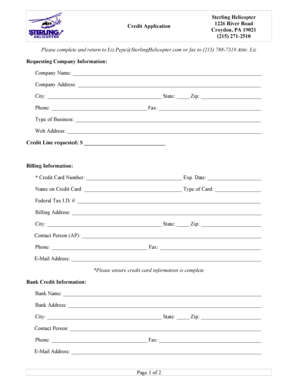

What are the types of auto credit application templates?

There are various types of auto credit application templates available that cater to different needs and requirements. Some common types include: 1. Individual Auto Credit Application Templates: These templates are designed for individuals who are seeking credit for purchasing a car. 2. Business Auto Credit Application Templates: These templates are intended for businesses or organizations that require credit for purchasing vehicles for their commercial operations. 3. Joint Auto Credit Application Templates: These templates are useful when multiple individuals or partners want to apply for automotive credit together. 4. Specialty Auto Credit Application Templates: Some lenders or dealerships offer specialized templates tailored to specific purposes, such as bad credit auto financing or leasing options.

How to complete an auto credit application template?

Completing an auto credit application template is a straightforward process. Here are the steps to follow: 1. Gather the necessary information: You will need personal details, employment information, financial records, and any other relevant documentation. 2. Open the auto credit application template: Use a reliable PDF editor like pdfFiller to access the template. 3. Fill in the personal information: Enter your name, contact details, social security number, and other required personal details. 4. Provide employment details: Input your employment history, including current and previous employers, job titles, duration of employment, and income information. 5. Fill in financial information: Include details about your assets, liabilities, debts, and monthly expenses. 6. Review and submit: Carefully review the completed application for accuracy and make any necessary corrections. Once you are satisfied, submit the application to the relevant party.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.