Personal Credit Application Form

What is personal credit application form?

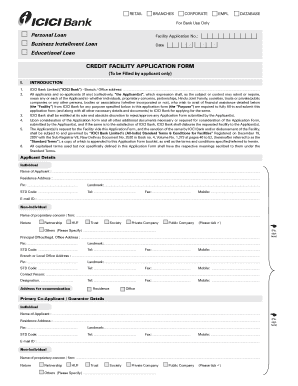

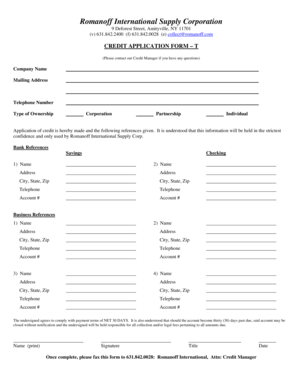

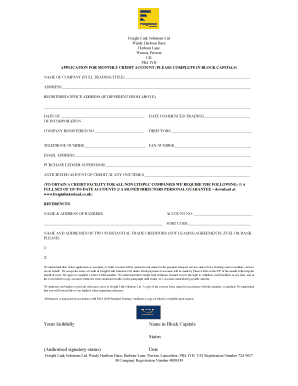

A personal credit application form is a document that individuals use to apply for credit from a bank or financial institution. It gathers all the necessary information about the applicant, including their personal details, financial information, employment details, and references. This form helps the lender assess the creditworthiness of the applicant and make an informed decision about granting credit.

What are the types of personal credit application form?

There are several types of personal credit application forms that cater to different types of credit offerings. Some common types include: 1. Credit Card Application Form: Used for applying for a credit card. 2. Personal Loan Application Form: Used for applying for a personal loan. 3. Mortgage Application Form: Used for applying for a mortgage loan. 4. Line of Credit Application Form: Used for applying for a line of credit. 5. Auto Loan Application Form: Used for applying for an auto loan. Each type of form collects specific information relevant to the type of credit being applied for.

How to complete personal credit application form

Completing a personal credit application form requires careful attention to detail and providing accurate information. Here are the steps to complete a personal credit application form: 1. Personal Information: Fill in your name, contact information, social security number, and other required personal details. 2. Financial Information: Provide details about your income, assets, debts, and expenses. 3. Employment Information: Fill in your employment history, current job details, and income sources. 4. References: Provide references who can vouch for your character and financial stability. 5. Review and Submit: Double-check all the information entered before submitting the form.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.