What is a donation receipt pdf?

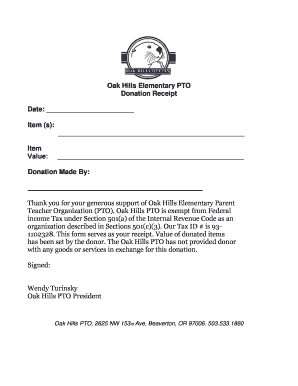

A donation receipt pdf is an electronic document that serves as a proof of donation for both the donor and the recipient. It includes important details such as the donation amount, date, and recipient's information. This document is typically used by individuals and organizations to claim tax deductions, track donations, and maintain financial records.

What are the types of donation receipt pdf?

There are various types of donation receipt pdf that cater to different needs and situations. Some common types include:

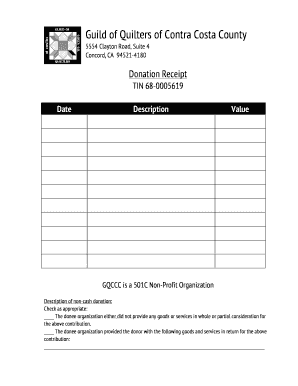

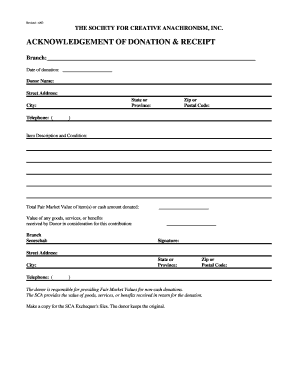

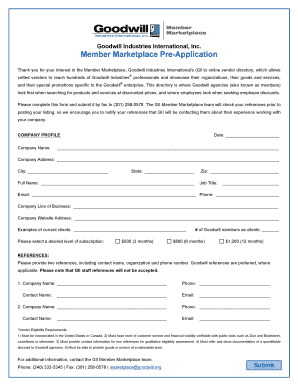

Standard donation receipt pdf: This type includes the basic information required for a donation receipt, such as the donor's name, donation amount, and date.

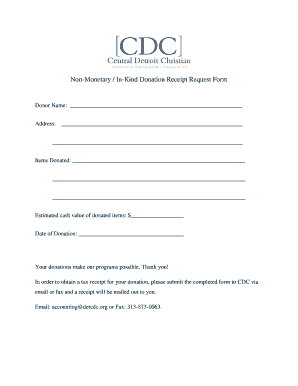

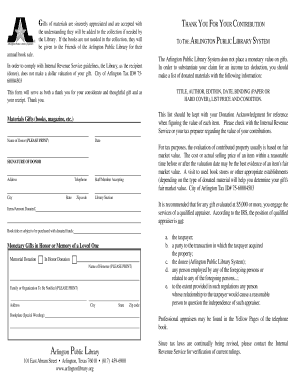

In-kind donation receipt pdf: Used for non-cash donations, it includes details about the donated item, its value, and a description of the item.

Vehicle donation receipt pdf: Specifically designed for donations of vehicles, this type includes information about the vehicle, its condition, and the fair market value.

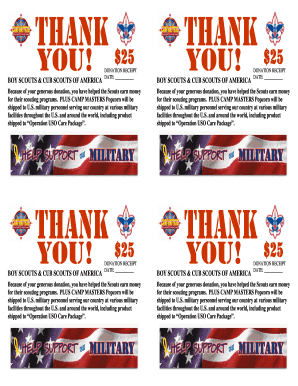

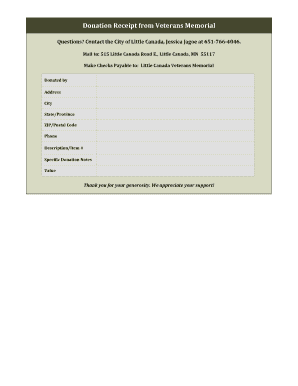

Event donation receipt pdf: Used for donations received at fundraising events, it includes details about the event, donation amount, and any benefits provided to the donor.

Recurring donation receipt pdf: Used for recurring donations, this type includes information about the frequency of the donation and the total amount donated over a specific period.

How to complete a donation receipt pdf?

Completing a donation receipt pdf is a simple process. Follow these steps:

01

Open the donation receipt pdf in a PDF editor like pdfFiller.

02

Fill in the donor's information, such as name, address, and contact details.

03

Enter the donation details, including the amount, donation date, and any specific instructions or restrictions.

04

Include the recipient's information, such as the organization's name, address, and contact details.

05

Review the completed donation receipt pdf for accuracy and make any necessary corrections.

06

Save the document and share it with the donor.

07

Optional: Print a physical copy of the donation receipt for your records or the donor's convenience.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.