Donation Receipt Format In Excel

What is donation receipt format in excel?

The donation receipt format in excel is a document that is used to acknowledge the donation made by an individual or organization. It contains important information such as the donor's name, contact details, the amount or value of the donation, and the date it was received. This format is commonly used to provide a record of the donation for both the donor and the recipient organization. By using excel, you can easily create and customize donation receipts to meet your specific needs.

What are the types of donation receipt format in excel?

There are several types of donation receipt formats that can be created in excel. Some common formats include: 1. Basic Donation Receipt: This format includes the essential details such as donor information, donation amount, and date received. 2. Detailed Donation Receipt: This format provides more comprehensive information, including the purpose of the donation, any restrictions or special instructions, and an acknowledgment statement. 3. Tax Deductible Donation Receipt: This format is specifically designed for donations that qualify for tax deductions. It includes additional information required by tax authorities, such as the organization's tax-exempt status and the donor's tax identification number. By choosing the appropriate format, you can ensure that your donation receipts are accurate, professional, and meet the specific requirements of your organization.

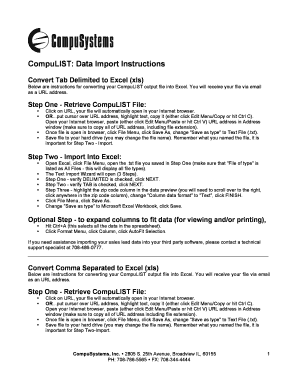

How to complete donation receipt format in excel

Completing a donation receipt format in excel is a simple process. Here are the steps to follow: 1. Open Excel: Launch Microsoft Excel on your computer. 2. Create a New Spreadsheet: Click on 'File' and select 'New' to create a new Excel spreadsheet. 3. Set Up the Receipt Format: Customize the columns and headers of your receipt template to include the necessary donor and donation information. 4. Enter Donor Details: Fill in the donor's name, contact details, and any other required information. 5. Record Donation Information: Enter the donation amount, date received, and any additional details as needed. 6. Save and Share: Save the completed receipt as an excel file and share it with the donor or recipient organization. By following these steps, you can easily complete a donation receipt format in excel and ensure that all necessary information is included.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.