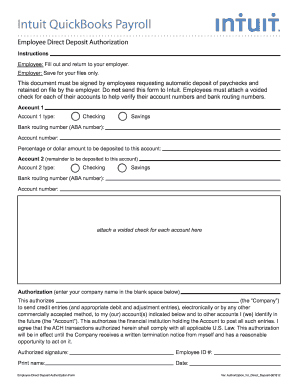

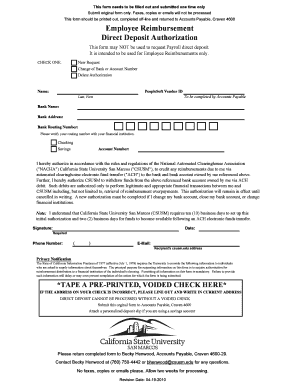

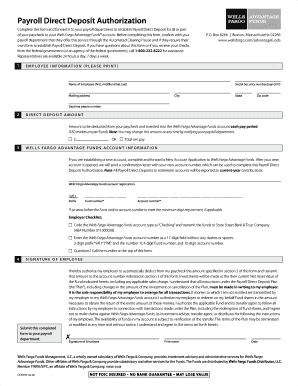

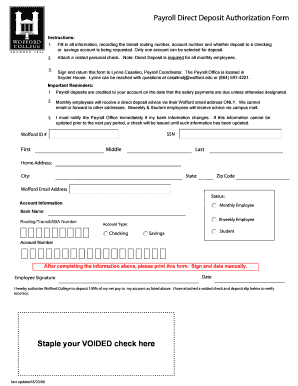

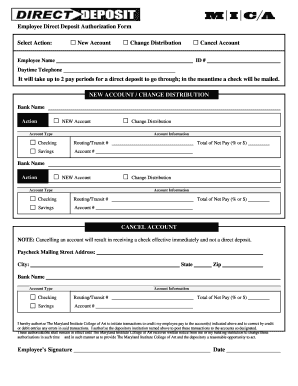

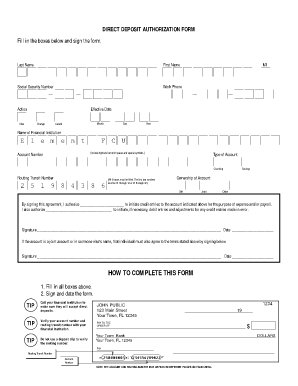

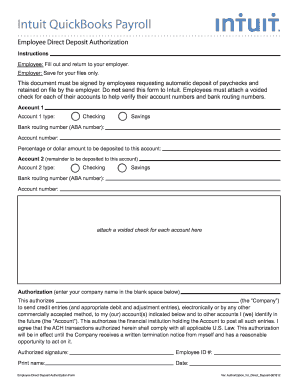

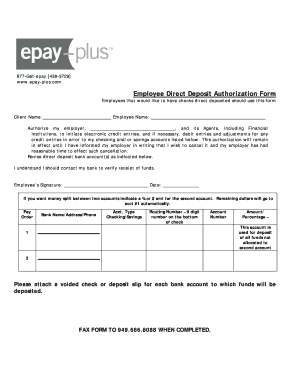

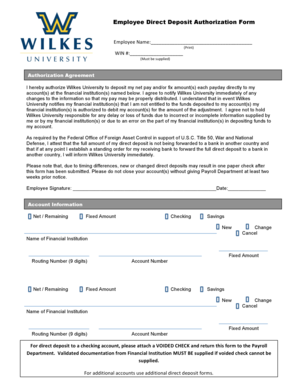

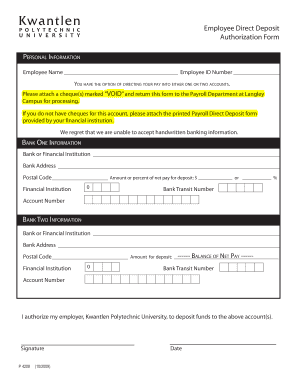

Employee Direct Deposit Authorization Form

What is Employee Direct Deposit Authorization Form?

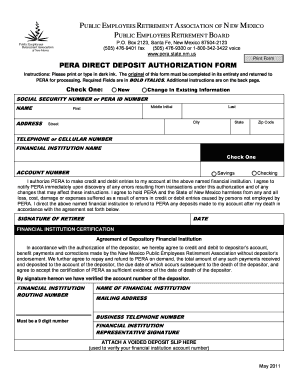

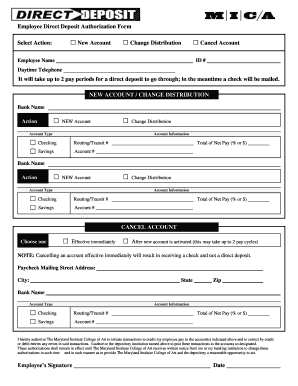

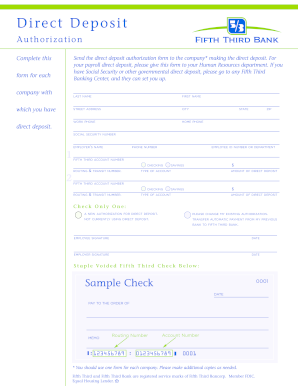

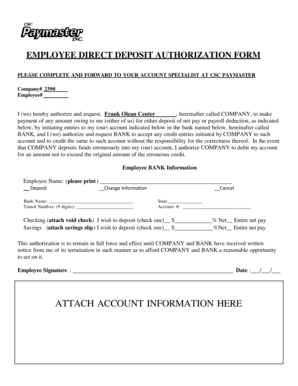

The Employee Direct Deposit Authorization Form is a document that allows employers to electronically deposit employees' paychecks directly into their bank accounts. This form is a convenient and secure way for employees to receive their wages without having to physically deposit a check at a bank.

What are the types of Employee Direct Deposit Authorization Form?

There are two main types of Employee Direct Deposit Authorization Forms: standard and customized. Standard forms are pre-made templates provided by employers that employees can fill out with their banking information. Customized forms are tailored to meet specific requirements or preferences of the employer or employee.

How to complete Employee Direct Deposit Authorization Form

Completing an Employee Direct Deposit Authorization Form is a simple process that requires basic information about the employee's bank account. Here are the steps to complete the form:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.