Get the free EMPLOYEE SELF-SERVICE TAX WITHHOLDING PROCEDURES

Show details

EMPLOYEE SELF-SERVICE TAX WITHHOLDING PROCEDURES STEP 1: To access Employee Self Service, login to Lawson by entering your District User ID and Password. STEP 2: Click on the down arrow next to Employee

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign

Edit your employee self-service tax withholding form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your employee self-service tax withholding form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing employee self-service tax withholding online

In order to make advantage of the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit employee self-service tax withholding. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out employee self-service tax withholding

How to fill out employee self-service tax withholding:

01

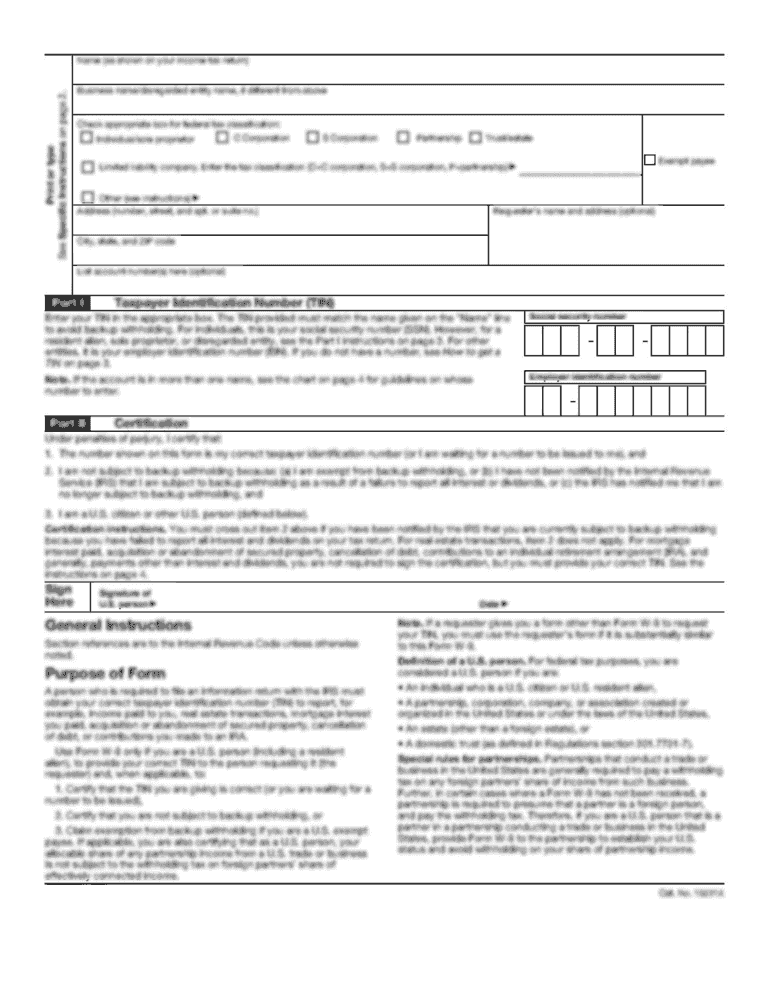

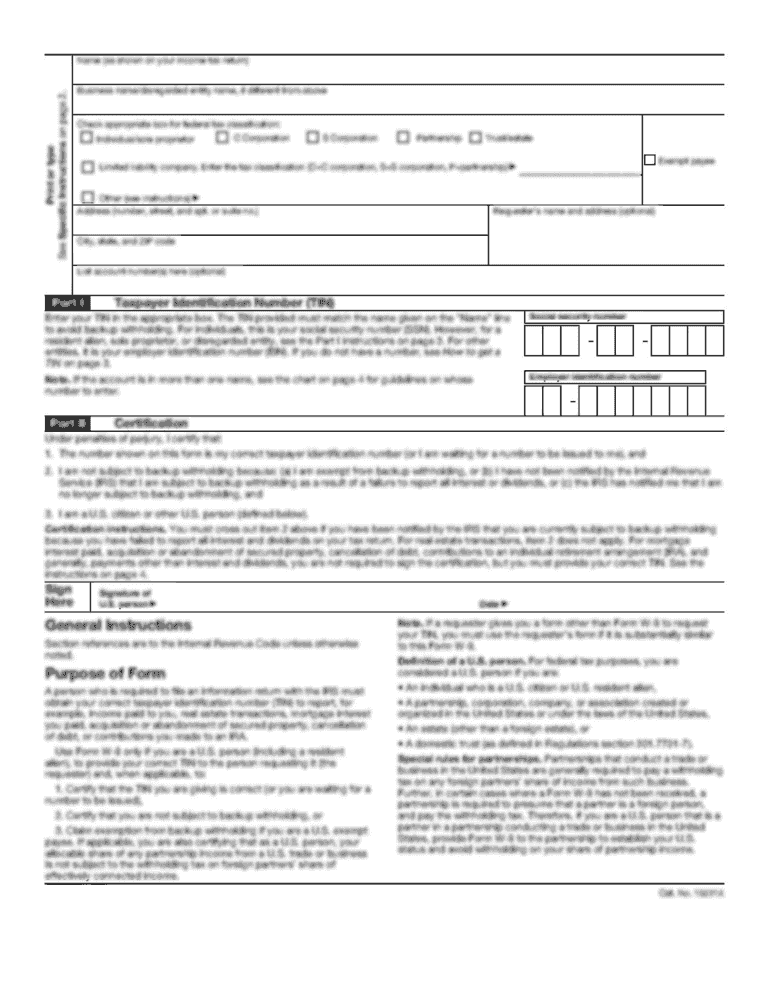

Obtain the necessary tax forms: Before filling out employee self-service tax withholding, you need to acquire the appropriate tax forms. This typically includes Form W-4, which is the Employee's Withholding Certificate.

02

Provide personal information: Begin by entering your personal information accurately on the tax form. This includes your full name, Social Security number, address, and filing status. Double-check the information to ensure its accuracy.

03

Determine your withholding allowances: The next step involves indicating the number of withholding allowances you are claiming. This determines how much income tax will be withheld from your paychecks. The more allowances you claim, the less tax will be deducted. The IRS provides worksheets and calculators to help you determine the appropriate number of allowances based on your circumstances.

04

Consider additional withholding: If you want to have additional income tax withheld from each paycheck, you can choose to enter an additional amount on the tax form. This can be useful if you anticipate owing additional taxes or prefer to receive a larger tax refund.

05

Complete any other sections: The tax form may include other sections that require your attention, such as questions related to exempt status or nonresident alien status. Read and complete these sections if applicable to your situation.

Who needs employee self-service tax withholding?

01

Employees: Employee self-service tax withholding is required for individuals who are employed and receive wages or salary. This includes full-time, part-time, and seasonal employees.

02

Employers: Employers also play a crucial role in ensuring compliance with tax withholding requirements. They are responsible for accurately withholding the appropriate amount of income tax from employees' paychecks and reporting it to the IRS.

03

Self-employed individuals: While self-employed individuals are not specifically eligible for employee self-service tax withholding, they are responsible for making quarterly estimated tax payments to cover their federal income tax liability.

04

Individuals with multiple jobs: If you have multiple jobs, you may need to adjust your withholding to avoid underpayment or overpayment of taxes. Employee self-service tax withholding allows you to make adjustments and ensure the correct amount of tax is withheld from each paycheck.

05

Individuals with changing financial situations: It is important to review and update your employee self-service tax withholding whenever your financial circumstances change. This includes getting married, having a child, buying a home, or experiencing other significant life events that may impact your tax liability.

Fill form : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is employee self-service tax withholding?

Employee self-service tax withholding is the process of employers withholding a portion of an employee's wages to pay their federal, state, and local income taxes.

Who is required to file employee self-service tax withholding?

Employers are required to file employee self-service tax withholding for employees who earn wages subject to income tax.

How to fill out employee self-service tax withholding?

Employers must gather information from employees such as their Social Security number, filing status, and any deductions or credits they may qualify for.

What is the purpose of employee self-service tax withholding?

The purpose of employee self-service tax withholding is to ensure that employees have paid enough taxes throughout the year to avoid owing a large amount at tax time.

What information must be reported on employee self-service tax withholding?

Employers must report the amount of wages subject to income tax, the amount of tax withheld from each employee, and any additional information required by the tax authorities.

When is the deadline to file employee self-service tax withholding in 2023?

The deadline to file employee self-service tax withholding in 2023 is typically January 31.

What is the penalty for the late filing of employee self-service tax withholding?

The penalty for the late filing of employee self-service tax withholding varies depending on the amount of tax owed and the length of the delay.

How do I make changes in employee self-service tax withholding?

pdfFiller not only lets you change the content of your files, but you can also change the number and order of pages. Upload your employee self-service tax withholding to the editor and make any changes in a few clicks. The editor lets you black out, type, and erase text in PDFs. You can also add images, sticky notes, and text boxes, as well as many other things.

How do I make edits in employee self-service tax withholding without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your employee self-service tax withholding, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

How do I fill out employee self-service tax withholding on an Android device?

On Android, use the pdfFiller mobile app to finish your employee self-service tax withholding. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

Fill out your employee self-service tax withholding online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not the form you were looking for?

Keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.