Finance

What is Finance?

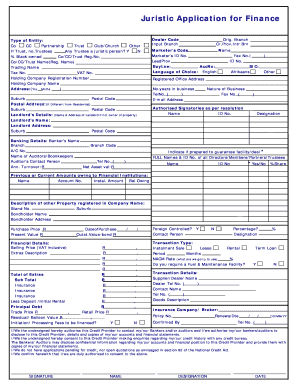

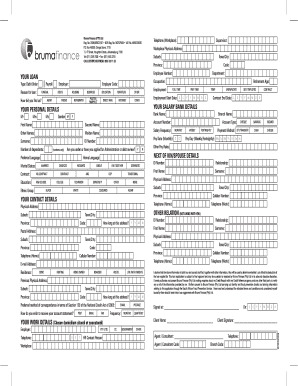

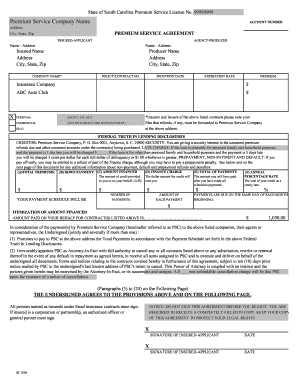

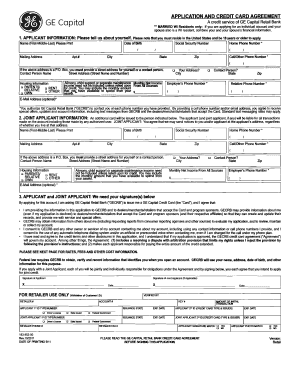

Finance refers to the management of money and other financial assets. It involves activities such as investing, borrowing, lending, budgeting, and analyzing financial data. Finance plays a crucial role in businesses, governments, and individuals' financial decisions and helps ensure the efficient allocation and utilization of resources.

What are the types of Finance?

Finance can be broadly categorized into three main types: personal finance, corporate finance, and public finance. 1. Personal Finance: This type of finance focuses on managing individual or household finances. It includes budgeting, saving, investing, retirement planning, and managing debt. 2. Corporate Finance: Corporate finance involves managing the financial activities of companies or organizations. It includes financial planning, investment decisions, capital structure management, and analyzing financial risks and returns. 3. Public Finance: Public finance deals with the management of finances at the government level. It involves taxation, budgeting, public expenditure, and managing public debt.

How to complete Finance

Completing finance-related tasks requires a systematic approach and attention to detail. Here are some steps to help you complete finance tasks effectively:

By following these steps and using the right tools, such as pdfFiller, you can efficiently manage your finances and achieve your financial goals. pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.