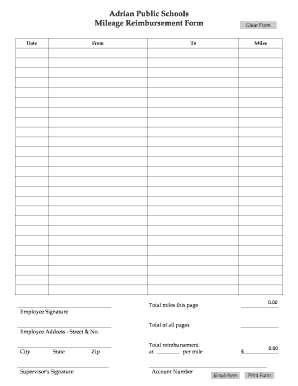

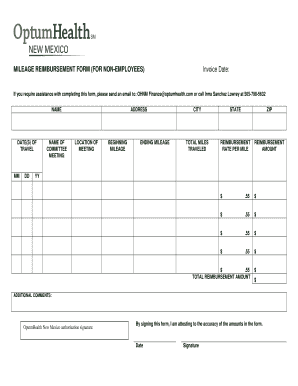

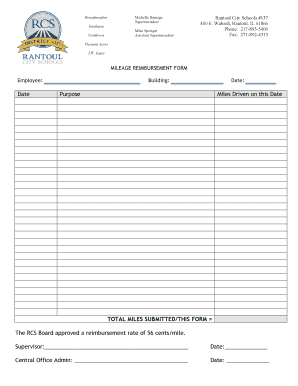

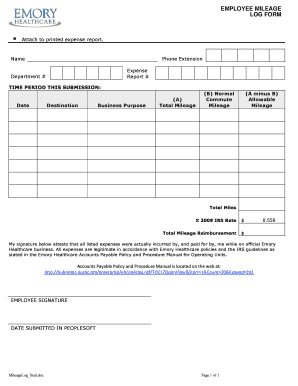

What is Employee Mileage Reimbursement Form?

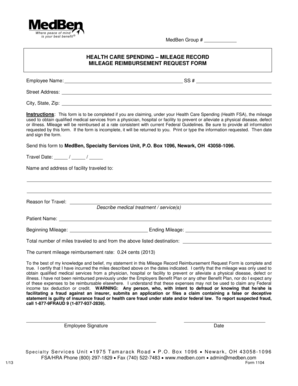

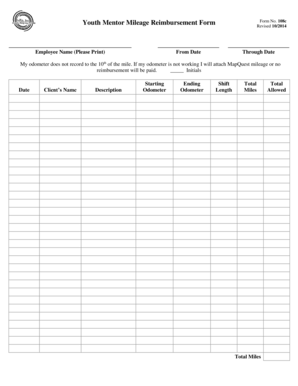

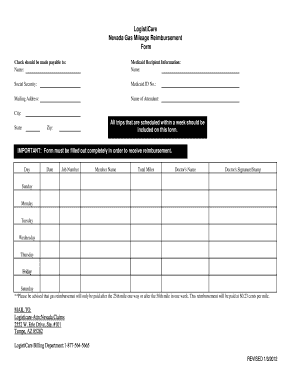

An Employee Mileage Reimbursement Form is a document used by employees to request reimbursement for mileage expenses incurred during business-related travel. It allows employees to record the distance traveled, the purpose of the trip, and any additional relevant information. By submitting this form, employees can ensure they receive the appropriate reimbursement for their travel expenses.

What are the types of Employee Mileage Reimbursement Form?

There are various types of Employee Mileage Reimbursement Forms available depending on the organization's requirements. Some common types include:

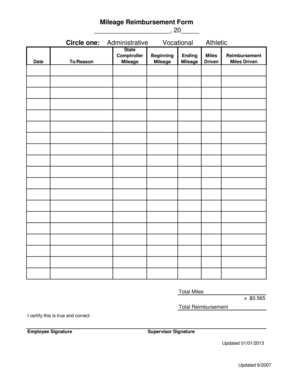

Standard Employee Mileage Reimbursement Form: This form is used by employees to request reimbursement for business-related travel using their personal vehicles.

Company Vehicle Mileage Reimbursement Form: This form is used when employees use company vehicles for business travel and need to be reimbursed for the mileage.

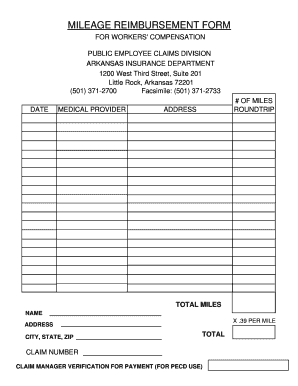

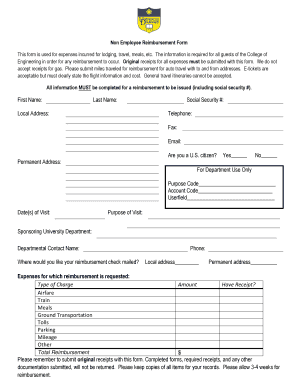

Special Circumstances Mileage Reimbursement Form: This form is used when employees incur mileage expenses for unique circumstances such as attending conferences or client visits.

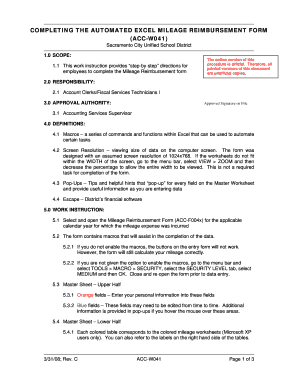

How to complete Employee Mileage Reimbursement Form

Completing an Employee Mileage Reimbursement Form is a simple process. Here are the steps you need to follow:

01

Enter your personal information, including your name, employee ID, and contact details.

02

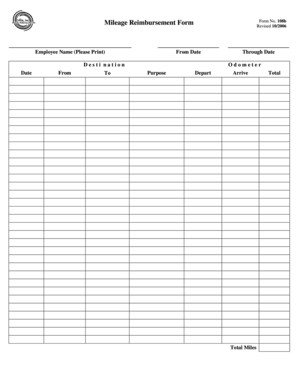

Specify the purpose of the trip and provide relevant details like the date of travel, destination, and the reason for the trip.

03

Record the starting and ending mileage of your vehicle.

04

Calculate the total distance traveled for the business-related trip.

05

Include any additional expenses incurred during the trip, such as tolls or parking fees.

06

Attach supporting documents such as gas receipts or toll receipts if required.

07

Submit the completed form to the appropriate department for review and processing.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.