Mileage Reimbursement Form Irs

What is mileage reimbursement form irs?

A mileage reimbursement form IRS is a document used by individuals or employees to report mileage expenses for tax purposes. This form is specifically designed by the IRS to provide a standardized way of calculating and claiming reimbursement for business-related mileage.

What are the types of mileage reimbursement form irs?

There are mainly two types of mileage reimbursement forms offered by the IRS:

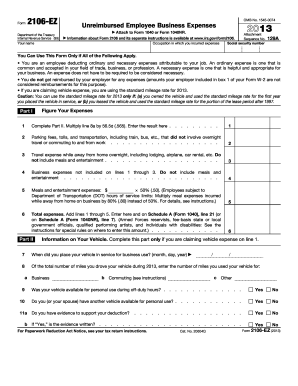

Form Employee Business Expenses

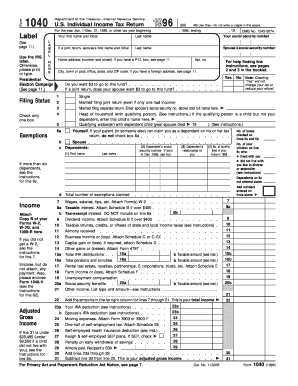

Form 1040 Schedule C: Profit or Loss from Business

How to complete mileage reimbursement form irs

Completing a mileage reimbursement form IRS involves a few simple steps:

01

Gather necessary information such as starting and ending odometer readings, dates of travel, and purpose of the trip.

02

Calculate the total number of miles traveled for business purposes.

03

Use the appropriate IRS form (Form 2106 or Form 1040 Schedule C) based on your employment status.

04

Enter the required information accurately on the form, including personal details, trip details, and the total mileage.

05

Submit the completed form to the IRS along with any additional supporting documents, if required.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out mileage reimbursement form irs

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Is it better to claim mileage or gas on taxes?

Turns out, the actual car expense method would give you a far greater deduction. If you use the standard mileage method, you could have written off $2,725. But if you deducted your actual car expenses, that number goes all the way up to $3,380. That's an extra $655 in tax write-offs from your car.

Where do I enter mileage on my tax return?

Self-employed individuals will report their mileage on the Schedule C form. In addition to providing the number of miles driven during the tax year, you'll also need to answer a few questions about the vehicle, including when it was placed into service for business.

How do I claim mileage on a 1099?

The standard mileage rate method deducts the IRS set rate per business mile driven. In 2021, the IRS set the rate at $0.56 per business mile. however, the rate changes every year. The actual expense method is used to claim deductions for all car operation expenses, including gas, repairs and insurance.

How do I fill out a mileage form?

0:52 2:26 How to Fill out the Medical Mileage Form in Workers Comp - YouTube YouTube Start of suggested clip End of suggested clip Make sure to include the city where they are located for the round-trip miles you will enter theMoreMake sure to include the city where they are located for the round-trip miles you will enter the total number of miles traveled by recording your vehicle's odometer reading at the start.

How do I fill out mileage reimbursement?

0:52 2:26 How to Fill out the Medical Mileage Form in Workers Comp - YouTube YouTube Start of suggested clip End of suggested clip Make sure to include the city where they are located for the round-trip miles you will enter theMoreMake sure to include the city where they are located for the round-trip miles you will enter the total number of miles traveled by recording your vehicle's odometer reading at the start.

What information do I need to claim mileage on my taxes?

You can calculate your driving deduction by adding up your actual expenses or by multiplying the miles you drive by the IRS's standard mileage rate. The per-mile rate for the first half of 2022 is 58.5 cents per mile and for the second half of 2022 it's 62.5 cents per mile.

Related templates