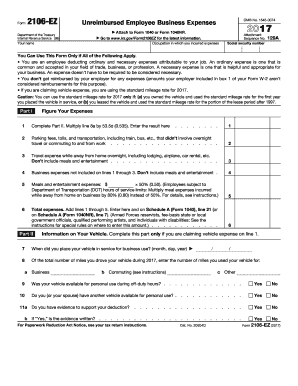

IRS 2106-EZ 2013 free printable template

Instructions and Help about IRS 2106-EZ

How to edit IRS 2106-EZ

How to fill out IRS 2106-EZ

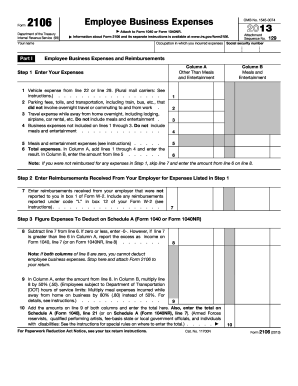

About IRS 2106-EZ 2013 previous version

What is IRS 2106-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

Due date

What payments and purchases are reported?

How many copies of the form should I complete?

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2106-EZ

What should I do if I realize I've made a mistake on my already submitted 2013 IRS Form 2106?

If you discover an error on your filed 2013 IRS Form 2106, you can file an amended return using Form 1040X. This allows you to correct inaccuracies. Ensure you explain the changes clearly and keep all original documentation for your records.

How can I verify if my 2013 IRS Form 2106 was received and is being processed?

To verify the status of your 2013 IRS Form 2106, you can check your IRS account online or call the IRS helpline. Have your social security number and filing details ready for a quicker process.

What kind of e-signatures are acceptable when submitting the 2013 IRS Form 2106 electronically?

When electronically filing your 2013 IRS Form 2106, you can typically use a self-select PIN as your e-signature. Make sure to follow IRS guidelines for e-filing to ensure compliance.

What actions should I take if my e-filed 2013 IRS Form 2106 is rejected?

If your e-filed 2013 IRS Form 2106 is rejected, review the rejection notice carefully to identify the error. Make the necessary corrections and resubmit the form as soon as possible to avoid delays.

How long should I keep records related to my 2013 IRS Form 2106 for tax purposes?

You should retain records for your 2013 IRS Form 2106 for at least three years from the date you filed the return. Keeping records longer might be necessary if your situation is more complex or if you are subject to audit.