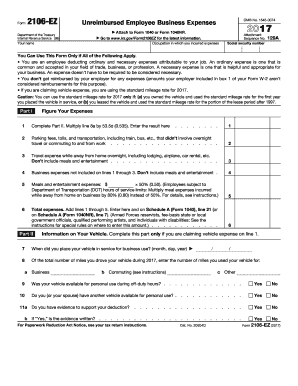

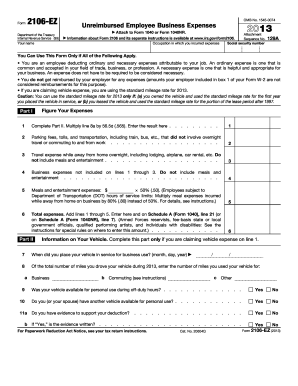

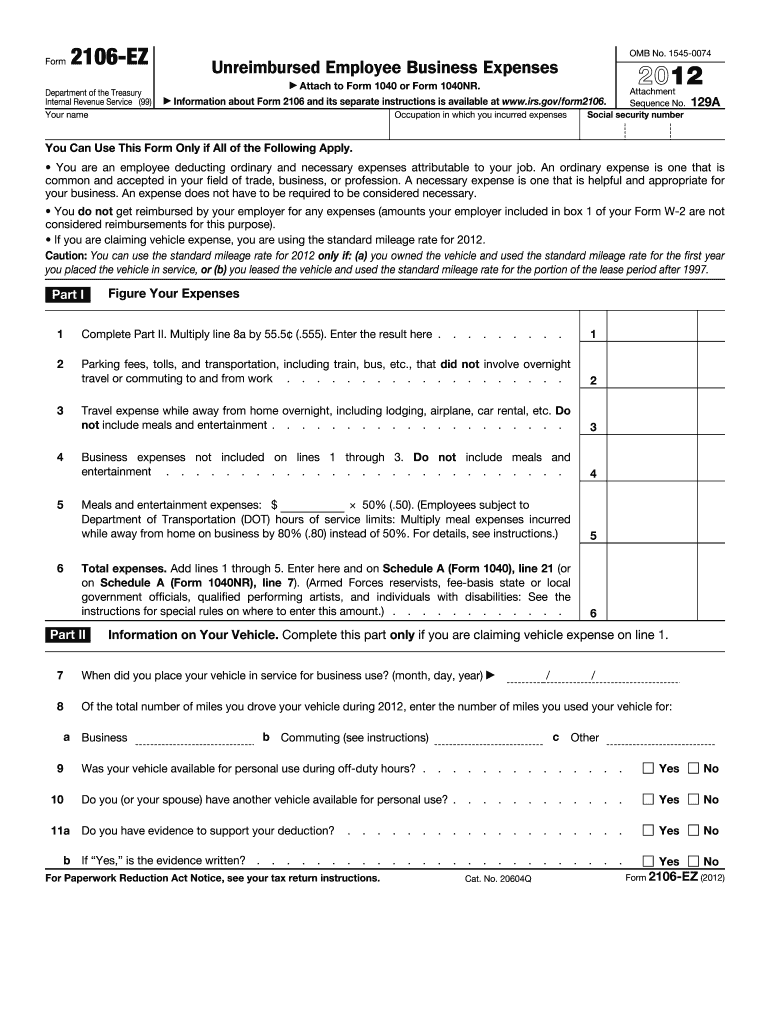

IRS 2106-EZ 2012 free printable template

Instructions and Help about IRS 2106-EZ

How to edit IRS 2106-EZ

How to fill out IRS 2106-EZ

About IRS 2106-EZ 2012 previous version

What is IRS 2106-EZ?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

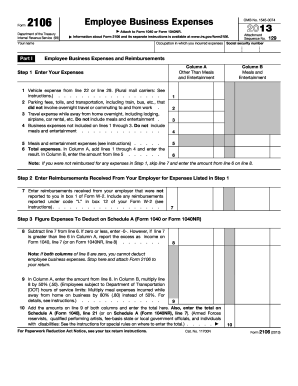

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

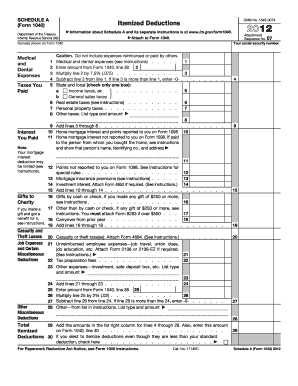

Is the form accompanied by other forms?

Where do I send the form?

FAQ about IRS 2106-EZ

What should I do if I realize I made an error after submitting my 2012 form 2106 ez?

If you discover an error after submitting your 2012 form 2106 ez, you can file an amended return using Form 1040X. Ensure you correct the mistake and include a copy of the revised 2012 form 2106 ez for clarity. Keep a record of all communications and submissions for your records.

How can I verify the status of my submitted 2012 form 2106 ez?

To verify the status of your submitted 2012 form 2106 ez, check the IRS online tool for tracking your form or call the IRS customer service. Be prepared with your Social Security number and details from your submission to assist in locating your information.

What are common issues that lead to rejection of the e-file for the 2012 form 2106 ez?

Common e-file rejection codes for the 2012 form 2106 ez include mismatches in personal identification information, missing or incorrect entries in required fields, and failure to follow electronic submission protocols. Review the specific error code provided to understand the necessary corrections.

How long should I retain records related to my 2012 form 2106 ez?

It is advisable to retain records related to your 2012 form 2106 ez for at least three years from the date you filed the form or the due date, whichever is later. This includes all supporting documentation, as you may need these for future reference or in case of an audit.