What is excel budget planner?

An excel budget planner is a tool used to track and manage personal or business expenses. It is designed to help individuals or organizations create a budget plan, allocate funds to different categories, and monitor their financial activities. With an excel budget planner, users can easily enter income and expenses, calculate totals, and analyze their spending habits.

What are the types of excel budget planner?

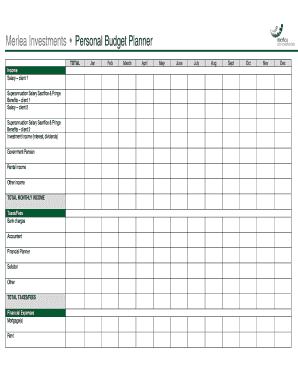

There are several types of excel budget planners available depending on the specific needs of the user. Some common types include:

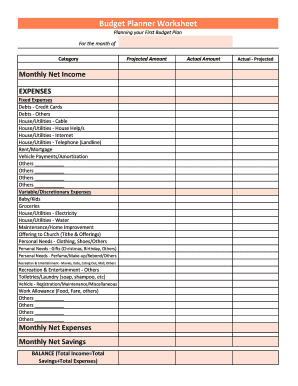

Basic Budget Planner: This type of budget planner provides a simple format for tracking income and expenses.

Monthly Budget Planner: As the name suggests, this planner focuses on monthly budgeting and can provide a detailed overview of income and expenses for each month.

Yearly Budget Planner: This planner helps users plan their budget for the entire year, allowing them to set financial goals and monitor their progress.

Business Budget Planner: Specifically designed for businesses, this type of budget planner enables users to track income, expenses, and cash flow related to their business operations.

Debt Repayment Planner: This planner helps individuals track their payment progress for different types of debts, such as credit cards or loans.

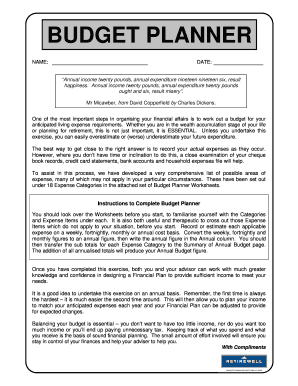

How to complete excel budget planner

Completing an excel budget planner is a straightforward process. Here are the steps to follow:

01

Open the excel budget planner template on your computer.

02

Enter your income information in the designated cells. This can include salary, freelance earnings, or other sources of income.

03

Next, enter your expenses in their relevant categories. These can include rent/mortgage, utilities, groceries, transportation, etc.

04

Ensure that you accurately enter all income and expenses to get an accurate representation of your budget.

05

Review the totals and analyze your spending patterns. Identify areas where you can cut back or make adjustments to achieve your financial goals.

06

Make updates to the budget planner as needed, especially when there are changes in income or expenses.

07

Regularly track and monitor your budget to stay on top of your financial health.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.