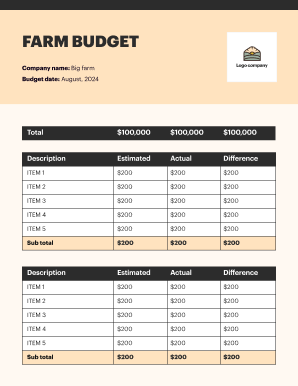

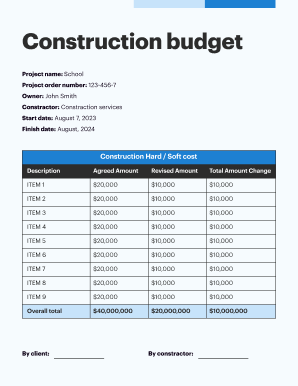

Budget Template

The function of budget sheets

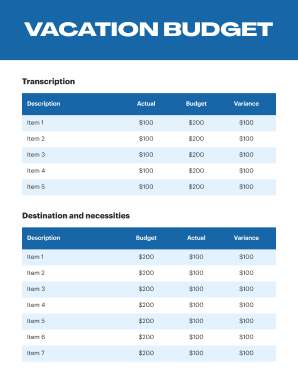

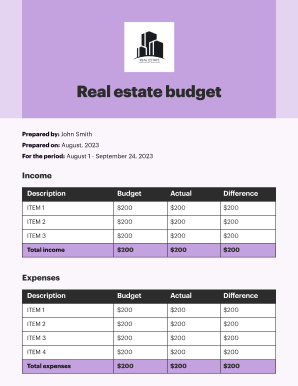

A budget is a kind of instrument which allows to distribute your funds properly avoiding debts. It is necessary for everyone whether you are a student, a young family or a business person. With this document you can easily plan further expenses without great losses. For example, you can know how much to spend for vacation or for household goods and definitely be aware of a purpose for which funds will be spent.

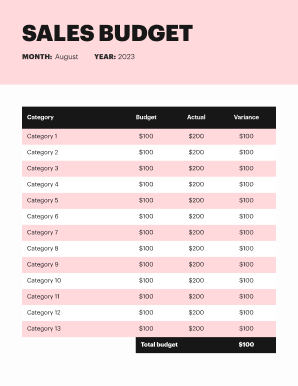

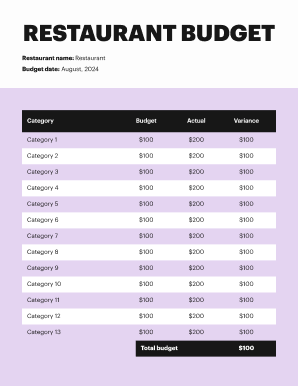

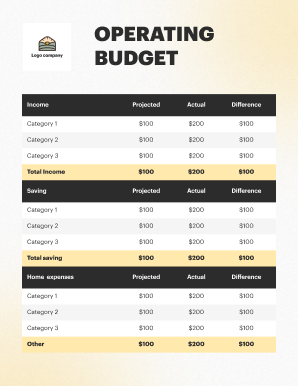

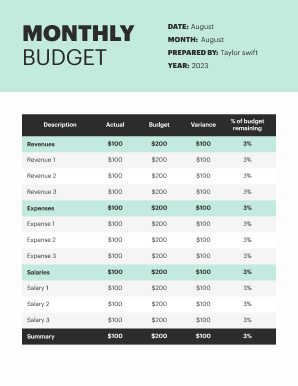

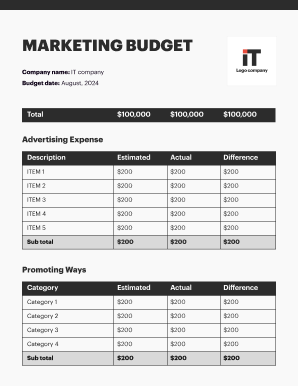

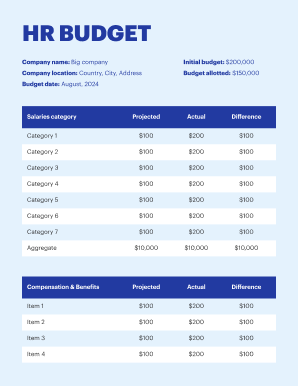

A budget is a kind of a plan explaining how to spend your money. According to such plan, you can control your income and expenditures. A budget sheet can be presented in different forms depending on details a person wants to include. For example, first you enter data about your salary, and then try to list almost all expenses for a certain period. If expenses exceed an income in some way, it means a person has to cut down on them. A person should define a purpose of a budget in order to prepare it in a proper way.

Here are few tips for preparing a budget sheet:

During a month or a year a person may put changes into a budget spreadsheet, so it could show a positive result. Remember that you can download budget templates on your personal computer or mobile, fill in online or print and fill in manually.