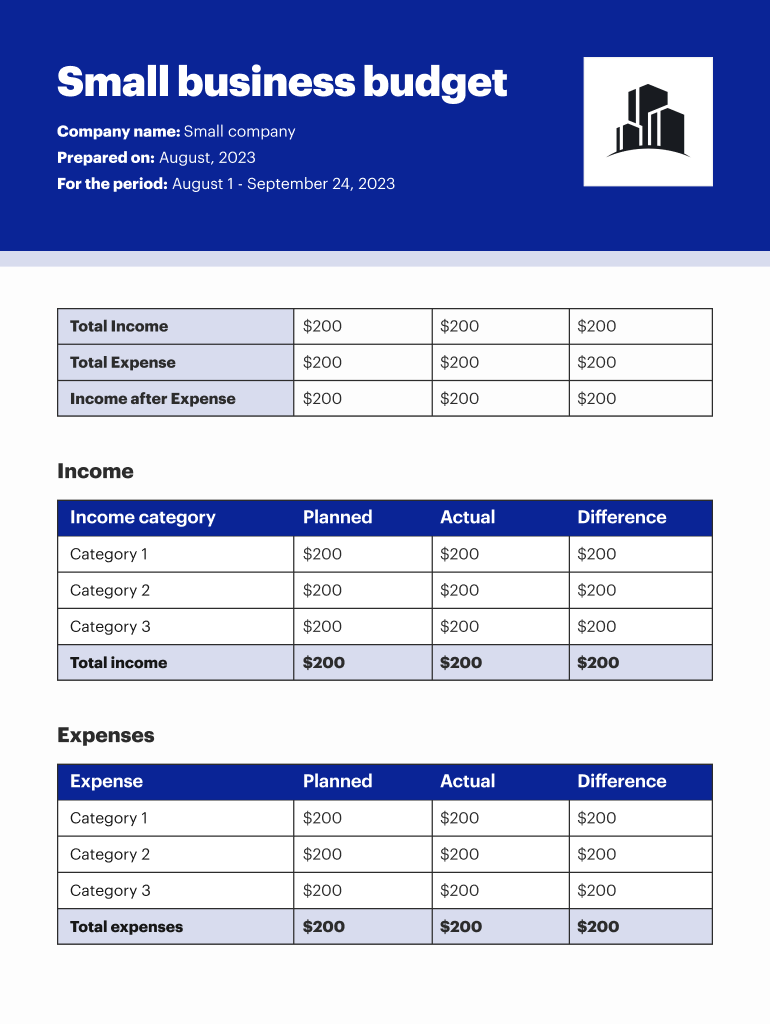

Get the free small business budget template

Get, Create, Make and Sign

How to edit small business budget template online

How to fill out small business budget template

How to fill out small business budget

Who needs small business budget?

Instructions and Help about small business budget template

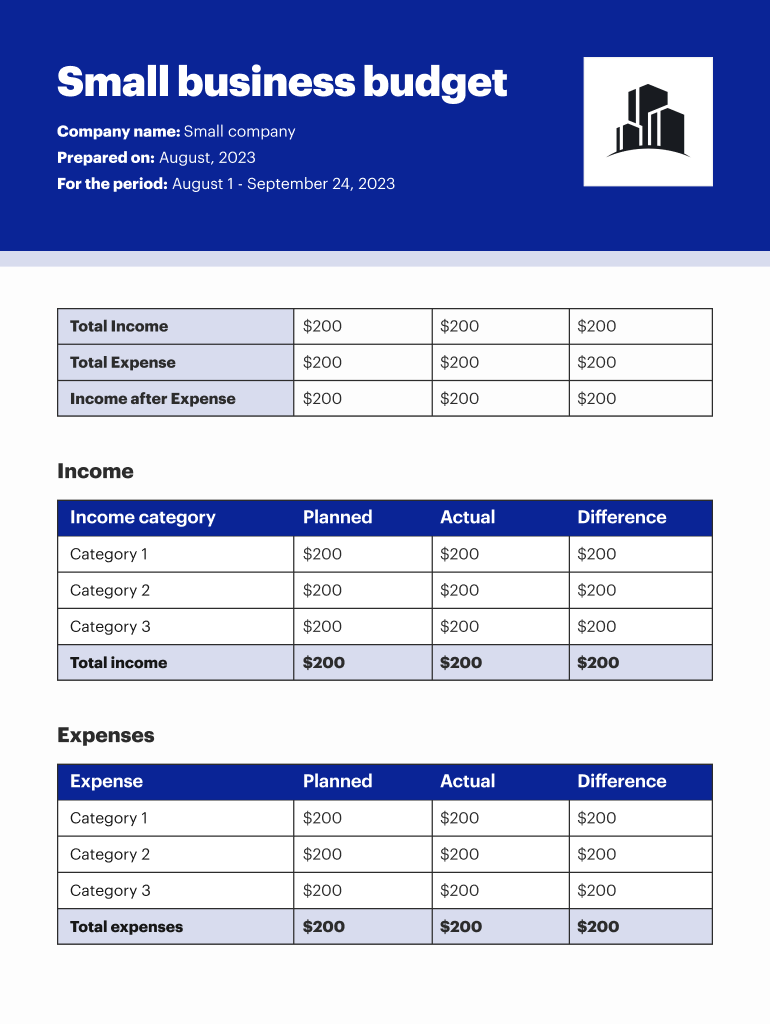

You can't manage a small business without a budget it's impossible i have clients that make six figures or seven figures per year in sales but have nothing left to pay themselves for example this is the p l of one of my clients they were making over a half million dollars in sales per year but was operating at a steep operating loss within six months we created a budget held her accountable for it and flipped that operating loss completely around as a result they just had their highest profit margin ever i'm on a mission to help you do the exact same hi my name is sherman with life accounting a full service accounting firm that helps small businesses grow and manage their finances today i'm going to simplify small business budgeting and help you get started by the end of this episode i promise you will have a clear understanding of where to start with your budget and how to get started in the process as a licensed cpa and founder of multiple companies i'm going to show you how we create budgets for businesses we own and for our client if you can do me...

Fill form : Try Risk Free

People Also Ask about small business budget template

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your small business budget template online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.