Fidelity Investments Deposit Slip

What is Fidelity Investments Deposit Slip?

A Fidelity Investments Deposit Slip is a form that allows Fidelity Investments customers to deposit funds into their accounts. It is a convenient way to transfer money and securely add funds to your Fidelity Investments account.

What are the types of Fidelity Investments Deposit Slip?

There are three main types of Fidelity Investments Deposit Slips:

Regular Deposit Slip: This type of deposit slip is used for depositing funds into a regular Fidelity Investments account.

Retirement Deposit Slip: This type of deposit slip is used for depositing funds into a Fidelity Investments retirement account, such as an IRA or 401(k).

Business Deposit Slip: This type of deposit slip is used for depositing funds into a Fidelity Investments business account, such as a corporate or partnership account.

How to complete Fidelity Investments Deposit Slip

Completing a Fidelity Investments Deposit Slip is a simple process. Here are the steps:

01

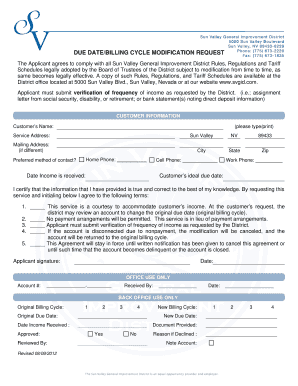

Start by filling out your personal information, including your name, address, and account number.

02

Indicate the type of account you are depositing funds into. Choose either Regular, Retirement, or Business, depending on the type of account you have.

03

Enter the amount of money you are depositing into your account.

04

If you have multiple checks to deposit, include the individual check amounts and total them up.

05

Sign and date the deposit slip.

06

Detach the deposit slip and keep a copy for your records.

07

Submit the deposit slip along with your funds to Fidelity Investments.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out Fidelity Investments Deposit Slip

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I fund my Fidelity account with check?

Depositing checks into your Fidelity account is simple! Use the camera on your mobile device to deposit a check or mail it directly to Fidelity to fund your account. Fidelity account is quick and easy. - Learn more about other check deposit options in our cash management section.

Where do I mail my Fidelity rollover check?

Have a check sent to you Mobile check depositUse your iPhone®, iPad®, or AndroidTM to scan and deposit checks with our Fidelity Mobile® check deposit.Bring to a Fidelity Investor CenterFind an Investor CenterRegular mailFidelity Investments, attn: Direct Rollovers PO Box 770001 Cincinnati, OH 45277-00371 more row

How do I make a check payable to my Fidelity IRA?

Important: The check should be made payable to Fidelity Management Trust Company (or FMTC), FBO [your name]. Be sure to include your IRA account number on the check.

Can you write a check from Fidelity Investments?

Acceptable Check Types Personal checks. Checks payable to one or more Fidelity account owners (second party checks, see endorsement requirements below) Cashier's or bank checks. Certified checks.

Does Fidelity take personal checks?

Fidelity will accept the following types of checks: Personal checks. Checks payable to one or more Fidelity account owners (second-party checks. see endorsement requirements below) Cashier's or bank checks.

How do I deposit money into my Fidelity IRA?

Depositing money into an account Send money to or from a bank account with an electronic funds transfer (EFT). Wire money from a bank or third party account.* Deposit a check via mobile upload or mail a paper check. Transfer money from one Fidelity account to another.

Related templates