Revocable Living Trust Agreement

What is revocable living trust agreement?

A revocable living trust agreement is a legal document that allows an individual, known as the grantor, to transfer their assets into a trust during their lifetime. This trust can be changed or revoked by the grantor at any time, providing flexibility and control over their assets. By creating a revocable living trust agreement, the grantor can avoid the probate process, maintain privacy, and ensure a smooth transition of their assets to their beneficiaries upon their death.

What are the types of revocable living trust agreement?

There are various types of revocable living trust agreements to cater to different needs and circumstances. Some common types include: 1. Individual Trust: This type of trust is created by a single individual and includes only their assets. 2. Joint Trust: Spouses or partners can establish a joint trust to combine their assets and benefit from joint management and tax advantages. 3. Testamentary Trust: This trust becomes effective after the grantor's death and is often included in a will. 4. Special Needs Trust: Designed to provide for individuals with disabilities while preserving their eligibility for government benefits.

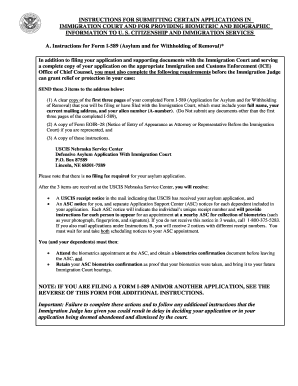

How to complete revocable living trust agreement

Completing a revocable living trust agreement may seem daunting, but with the right tools and guidance, it can be a straightforward process. Here are the steps to follow: 1. Gather information: Collect all the necessary details about your assets, beneficiaries, and trustees. 2. Choose a template: Utilize a trusted online platform like pdfFiller that offers unlimited fillable templates for revocable living trust agreements. 3. Customize the agreement: Input the collected information into the template, making sure to accurately represent your wishes. 4. Review and edit: Carefully go through the document to ensure all information is correct and make any necessary edits. 5. Share and sign: Share the document with the involved parties for review and signature. pdfFiller allows for easy online collaboration and electronic signatures.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.