What is Payroll Register Template?

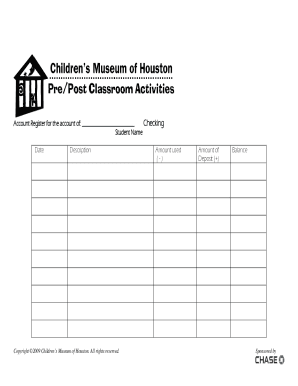

A Payroll Register Template is a document used to track and record employee payroll information. It includes details such as employee names, contact information, work hours, salary or wage rates, deductions, and net pay. This template helps businesses maintain accurate records of their payroll expenses and ensure timely payment to employees.

What are the types of Payroll Register Template?

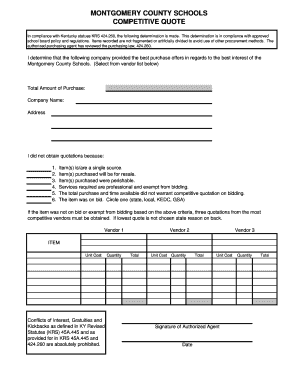

Payroll Register Templates can vary based on the specific needs and requirements of businesses. Some common types of Payroll Register Templates include:

Basic Payroll Register Template: This template includes essential fields to record employee information, hours worked, wages, and deductions.

Advanced Payroll Register Template: This template offers additional features such as overtime calculations, bonuses, and benefits.

Hourly Payroll Register Template: Specifically designed for businesses with hourly employees, this template tracks the hours worked and calculates wages accordingly.

Salary Payroll Register Template: Ideal for businesses with salaried employees, this template focuses on recording salary information and applicable deductions.

Department-wise Payroll Register Template: This template allows businesses to organize payroll data by department, making it easier to analyze and manage employee costs.

How to complete Payroll Register Template

Completing a Payroll Register Template is a straightforward process. Here's a step-by-step guide to help you:

01

Download a Payroll Register Template that suits your business needs. You can find a variety of templates online or use a specialized software like pdfFiller.

02

Enter the necessary details about each employee, such as their name, contact information, and employment status.

03

Record the hours worked by each employee, specifying regular hours, overtime, and any other applicable categories.

04

Input the wage or salary rates for each employee, considering factors like hourly rates, fixed salaries, or any special rates for overtime.

05

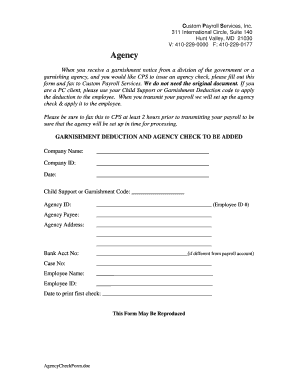

Include deductions, such as taxes, insurance premiums, retirement contributions, and any other applicable deductions.

06

Calculate the net pay for each employee by subtracting the deductions from the gross wages or salary.

07

Review and double-check the information entered to ensure accuracy.

08

Save and update the Payroll Register Template regularly to keep track of ongoing payroll information.

09

Consider using software tools like pdfFiller to automate calculations and generate reports for better payroll management.

With pdfFiller, completing and managing Payroll Register Templates becomes even more efficient. Its user-friendly interface and powerful features allow you to easily create, edit, and share documents online. Additionally, pdfFiller offers unlimited fillable templates and robust editing tools, making it the ultimate PDF editor for all your document needs.