What is payroll ledger template?

A payroll ledger template is a digital document that is used to record and track employee payroll information. It includes details such as employee names, salaries, deductions, and tax information. The template provides a structured format for organizing payroll data and simplifies the process of calculating and managing employee payments.

What are the types of payroll ledger template?

There are several types of payroll ledger templates available to cater to different business needs. Some common types include:

Basic Payroll Ledger Template: This template provides a simple layout for recording employee payroll details.

Salary Slip Payroll Ledger Template: This template includes additional sections for generating salary slips that can be issued to employees.

Hourly Payroll Ledger Template: Designed for businesses that pay employees based on hourly rates, this template allows for easy calculation of wages.

Deductions Payroll Ledger Template: This template includes sections for deducting taxes, insurance premiums, and other deductions from employee wages.

Vacation and Sick Leave Payroll Ledger Template: This template includes sections for tracking vacation and sick leave balances and calculating payments accordingly.

How to complete payroll ledger template

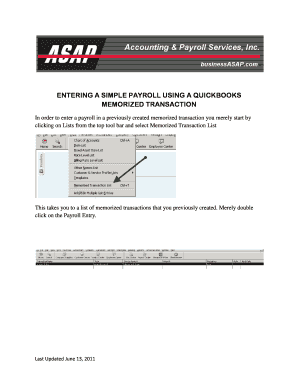

Completing a payroll ledger template is a straightforward process. Here are the steps to follow:

01

Open the payroll ledger template in a PDF editor like pdfFiller.

02

Enter the necessary details in the designated sections. This includes employee names, salaries, deductions, and tax information.

03

Verify the accuracy of the entered information.

04

Save the completed payroll ledger template.

05

Share the payroll ledger template with relevant stakeholders, such as the finance department or HR team.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.