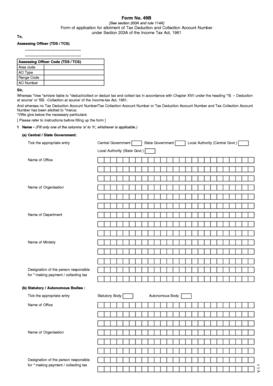

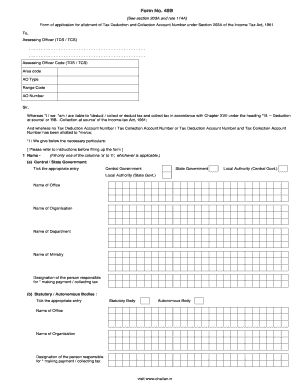

Form 49b

What is form 49b?

Form 49b is a document used by the Income Tax Department in India. It is an application for obtaining a Tax Deduction and Collection Account Number (TAN). TAN is a unique 10-digit alphanumeric code that is mandatory for all entities who are required to deduct or collect tax on behalf of the government.

What are the types of form 49b?

There are two types of form 49b:

Form 49b for obtaining fresh TAN

Form 49b for changes or corrections to existing TAN

How to complete form 49b

To complete form 49b, follow these steps:

01

Visit the official Income Tax Department website and download form 49b.

02

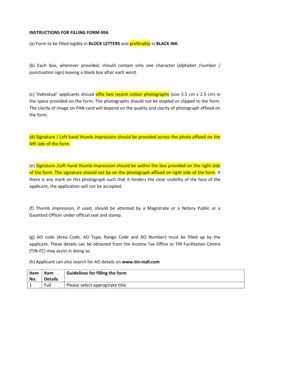

Fill in the required details such as applicant's name, communication address, and status.

03

Attach the necessary documents as mentioned in the form instructions.

04

Sign the form and submit it to the designated TIN facilitation center.

05

Once submitted, you will receive a unique acknowledgment number for future reference.

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor users need to get their documents done.

Video Tutorial How to Fill Out form 49b

Thousands of positive reviews can’t be wrong

Read more or give pdfFiller a try to experience the benefits for yourself

Questions & answers

Can I download Tan allotment letter?

Visit www.incometaxindiaefiling.gov.in Click on 'Know Your TAN' Select 'Name' or 'TAN' under the 'TAN Search' option. Select 'Category of Deductor' Select 'State'

How can I register my tan online?

TAN/TDS > TAN Registration Step – I. Visit www.tdscpc.gov.in and click on Register as Tax Deductor or Go to https://www.tdscpc.gov.in/app/dedregs1.xhtml to register. Step – II. Fill out the requisite details and your Login Credentials and click on Create Account. Step – III. Step – IV.

How do I register my tan in Portal?

Registration Step 1: Go to the e-Filing portal homepage, click Register. Step 2: Click Others and select the Category as Tax Deductor and Collector. Step 3: Enter the TAN of the Organization and click Validate. Step 5: Enter the details of the person making payments or collecting tax and click Continue.

What is tan certificate?

Tax Deduction Account Number or Tax Collection Account Number is a 10 -digit alpha-numeric number issued by the Income-tax Department. TAN is to be obtained by all persons who are responsible for deducting tax at source (TDS) or who are required to collect tax at source (TCS).

How do I register for first time traces?

Steps to Register as a Deductor on the TRACES Portal Visit the TRACES portal. Go to the TRACES website. Enter required details. Important Note. KYC Verification. Enter CIN details. Under Part 2, enter unique PAN-Amount Combination for Challan. Example of Unique PAN Amount combination: Authentication code.

How can I get tan allotment date?

Q- How can I know my tan allotment date? Applicants can know his TAN allotment date from a TAN allotment letter which has been received from income tax department or from an enquiry from customer care of income tax department.

Related templates