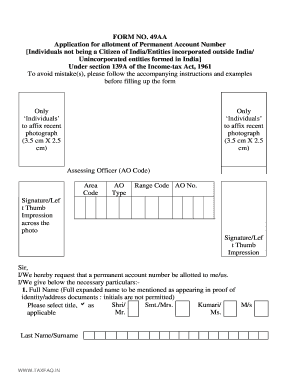

Form 49aa

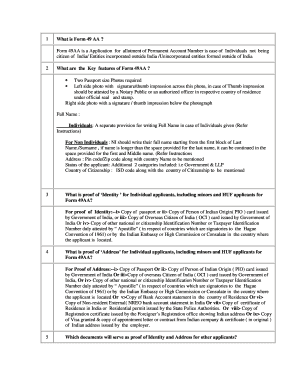

What is form 49aa?

Form 49aa is a unique identification number that is required for non-residents and foreign citizens who wish to carry out financial transactions in India. This form is used to apply for an Indian Tax Identification Number (TIN) or Permanent Account Number (PAN). It is an essential document for individuals who want to invest or conduct business in India. Form 49aa collects personal and financial information about the applicant, including their name, address, and passport details.

What are the types of form 49aa?

There are two types of form 49aa: individual and non-individual. The individual form is for single applicants who are not representing any organization or business entity. This form is suitable for individuals who want to obtain a TIN or PAN for personal use. On the other hand, the non-individual form is for organizations, companies, or associations that require a TIN or PAN. This includes partnerships, corporations, trusts, or any other non-individual entities.

How to complete form 49aa?

Completing form 49aa is a straightforward process. Here is a step-by-step guide to help you:

pdfFiller empowers users to create, edit, and share documents online. Offering unlimited fillable templates and powerful editing tools, pdfFiller is the only PDF editor you need to get your documents done.